Does Strong 2025 Earnings and Buybacks Change The Bull Case For Oceaneering International (OII)?

- In the fourth quarter and full year ended December 31, 2025, Oceaneering International reported sales of US$668.57 million and US$2.78 billion, respectively, with quarterly net income rising to US$177.65 million and full-year net income reaching US$353.76 million, alongside higher diluted EPS from continuing operations versus the prior year.

- An interesting aspect of these results is that Oceaneering expanded profit significantly even as fourth-quarter revenue declined year over year, underscoring the impact of operational execution, cost control, and a business mix that supported stronger earnings and free cash flow.

- We’ll now examine how this earnings jump and management’s 2026 guidance, including planned share repurchases, reshape Oceaneering International’s investment narrative.

Invest in the nuclear renaissance through our list of 85 elite nuclear energy infrastructure plays powering the global AI revolution.

Oceaneering International Investment Narrative Recap

To own Oceaneering International, you need to believe that its shift toward higher‑margin technologies and services, especially in areas like ADTech and robotics, can gradually reduce reliance on cyclical offshore oil and gas. The latest results, with a sharp jump in net income and free cash flow despite softer quarterly revenue, support that near term, but the key catalyst remains ADTech’s execution in 2026, while the biggest current risk is a slowdown in deepwater spending that could pressure backlog and utilization.

The most relevant recent announcement is management’s 2026 outlook, which calls for net income of US$178 million to US$203 million and consolidated EBITDA of US$390 million to US$440 million, coupled with ongoing share repurchases. Against the strong 2025 earnings beat, this guidance frames expectations for how much of the current profitability uplift is sustainable, and how far ADTech and higher‑margin product lines can offset any softness in traditional offshore activity.

But even with these stronger 2025 numbers, investors should also be aware that...

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's narrative projects $3.1 billion revenue and $185.9 million earnings by 2028. This requires 4.2% yearly revenue growth and a $16.3 million earnings decrease from $202.2 million today.

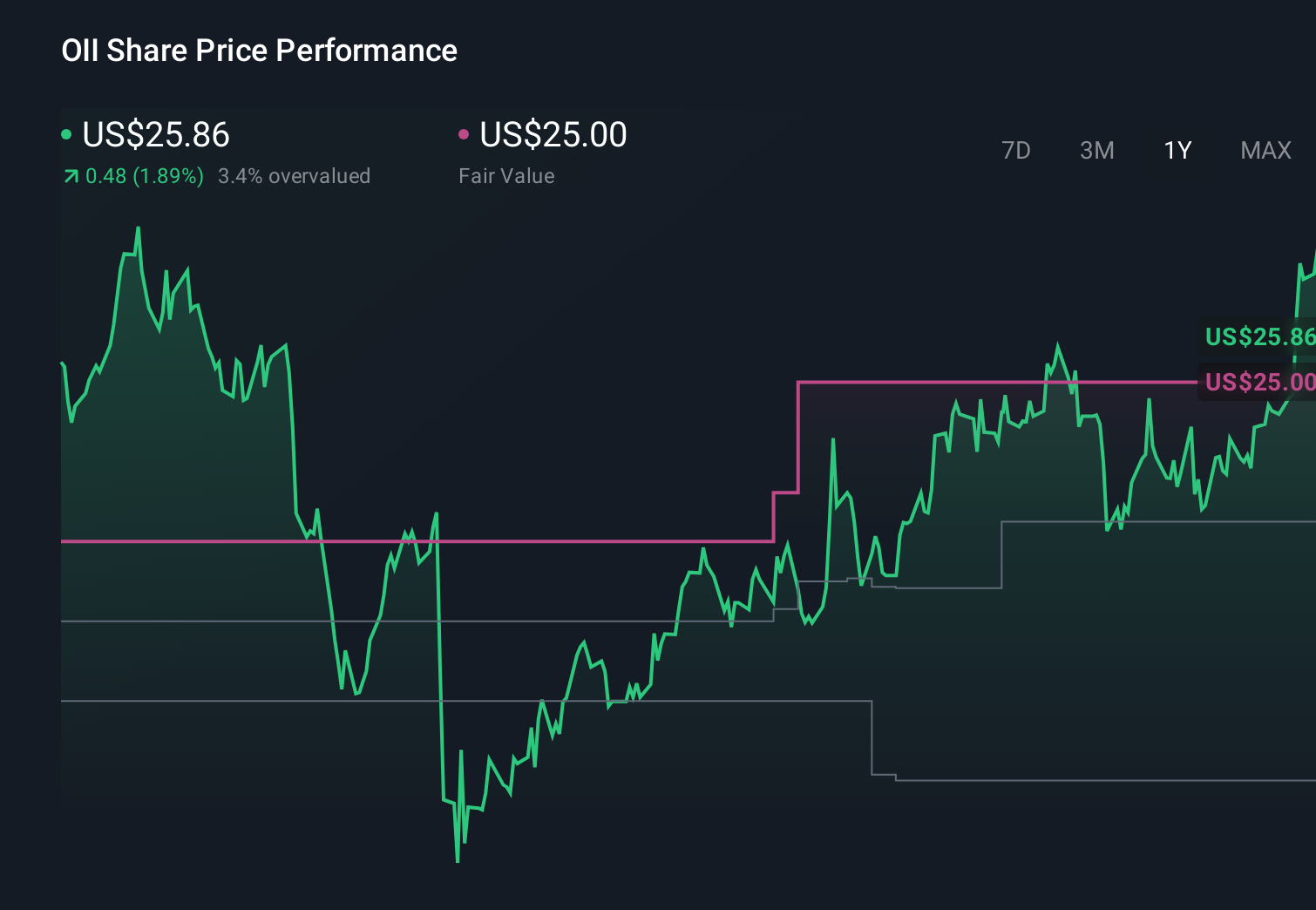

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 32% downside to its current price.

Exploring Other Perspectives

Some of the lowest‑estimate analysts painted a much harsher picture, assuming earnings could fall toward about US$186 million on roughly US$3.1 billion of revenue, so it is worth asking how this new profitability surge and Oceaneering’s dependence on deepwater oil and gas might shift those more pessimistic views over time.

Explore 4 other fair value estimates on Oceaneering International - why the stock might be worth as much as 13% more than the current price!

The Verdict Is Yours

Disagree with existing narratives? Extraordinary investment returns rarely come from following the herd, so go with your instincts.

- A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal