Did Brink’s Operations Veteran Appointment to Lead North America Just Shift Brink's (BCO) Investment Narrative?

- The Brink’s Company has appointed Adrian Button as executive vice president and president of Brink’s North America, effective February 16, 2026, adding him to the executive leadership team reporting to CEO Mark Eubanks.

- With more than 30 years of global operational leadership at GE, NCR, and Carrier overseeing multibillion-dollar businesses and large-scale supply chains, Button’s background directly aligns with Brink’s focus on operational efficiency and service quality in North America.

- Next, we’ll examine how bringing in an operations-focused leader with extensive supply chain experience could influence Brink’s existing investment narrative.

Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

Brink's Investment Narrative Recap

To own Brink’s, you need to believe its mix of secure logistics, ATM services, and digital retail solutions can keep generating resilient cash flows despite gradual shifts toward digital payments. The appointment of Adrian Button to lead Brink’s North America looks incremental rather than transformational for the near term, with the key catalyst still centered on execution in AMS and DRS, and the biggest risk remaining a faster structural move away from cash usage.

Among recent announcements, the continued regular quarterly dividend of US$0.255 per share stands out as most relevant, because it underscores Brink’s ongoing capital returns while it invests in operations, technology, and productivity. For investors, the balance between returning cash to shareholders and funding modernization is closely tied to whether AMS and DRS can offset long term pressures on legacy Cash in Transit and traditional cash management activities.

Yet, investors should be aware that if the shift to cashless payments accelerates faster than expected, Brink’s exposure to cash dependent services...

Read the full narrative on Brink's (it's free!)

Brink's narrative projects $6.0 billion revenue and $755.1 million earnings by 2028. This requires 5.5% yearly revenue growth and roughly a $593 million earnings increase from $161.7 million today.

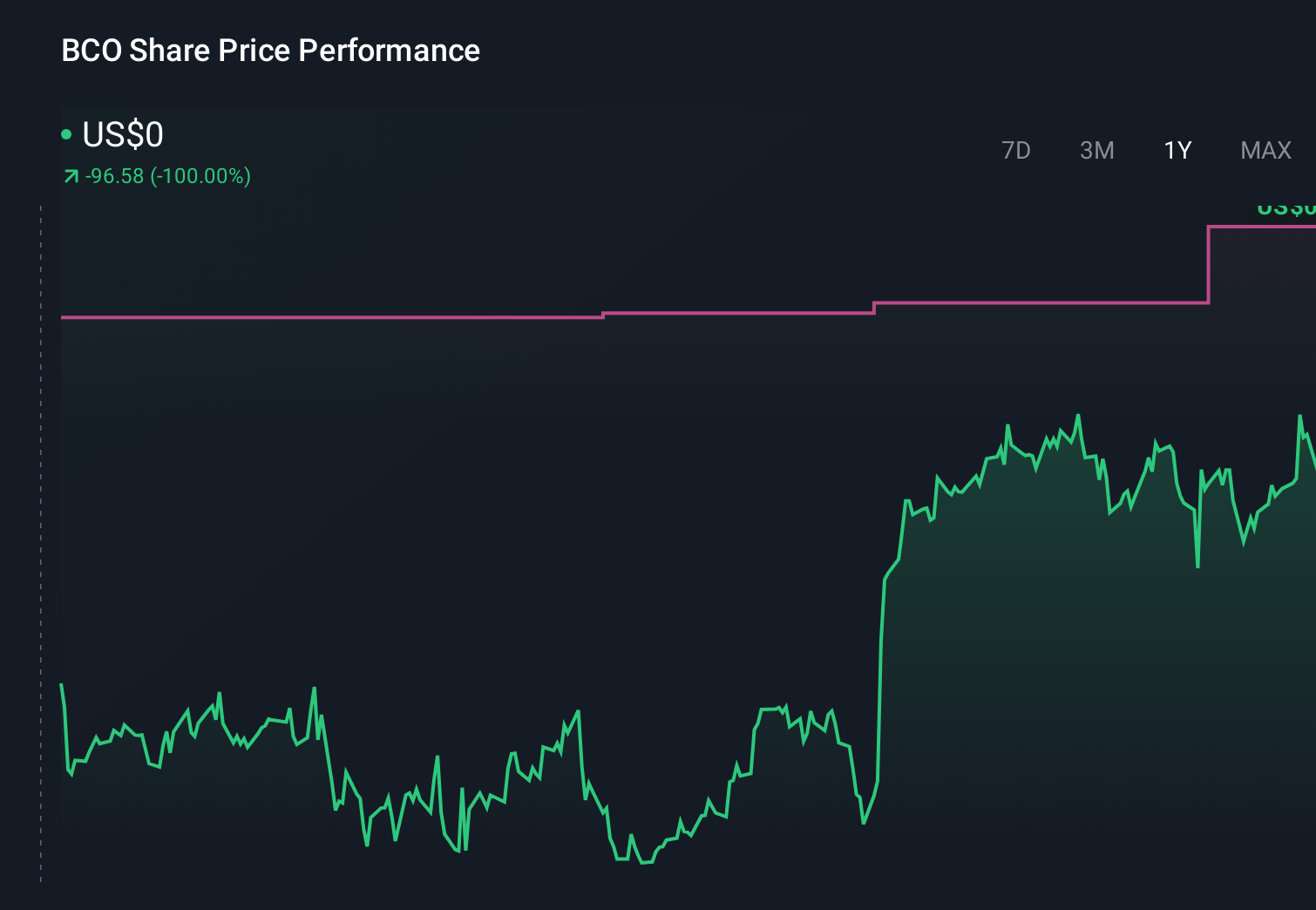

Uncover how Brink's forecasts yield a $133.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently estimate Brink’s fair value between US$58.27 and US$321.60, reflecting very different return expectations. You should weigh those views against the company’s reliance on AMS and DRS growth to support margins and offset long term pressure on traditional cash handling businesses.

Explore 5 other fair value estimates on Brink's - why the stock might be worth over 2x more than the current price!

Form Your Own Verdict

Don't just follow the ticker - dig into the data and build a conviction that's truly your own.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Invest in the nuclear renaissance through our list of 85 elite nuclear energy infrastructure plays powering the global AI revolution.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal