A Look At Sun Country Airlines (SNCY) Valuation After Mixed 2025 Earnings Results

Sun Country Airlines Holdings (SNCY) has drawn fresh attention after releasing fourth quarter and full year 2025 results, with higher revenue figures alongside softer quarterly profitability shaping how investors are reassessing the stock.

See our latest analysis for Sun Country Airlines Holdings.

Those earnings, together with the recent update on the completed US$10m share buyback, have come alongside a 30 day share price return of 19.62% and a 90 day share price return of 86.37%. The 1 year total shareholder return of 16.88% suggests momentum has recently been stronger in the short term than over the longer run.

If this latest move in Sun Country’s share price has you thinking about what else is moving, it could be a good time to broaden your search with our 23 top founder-led companies.

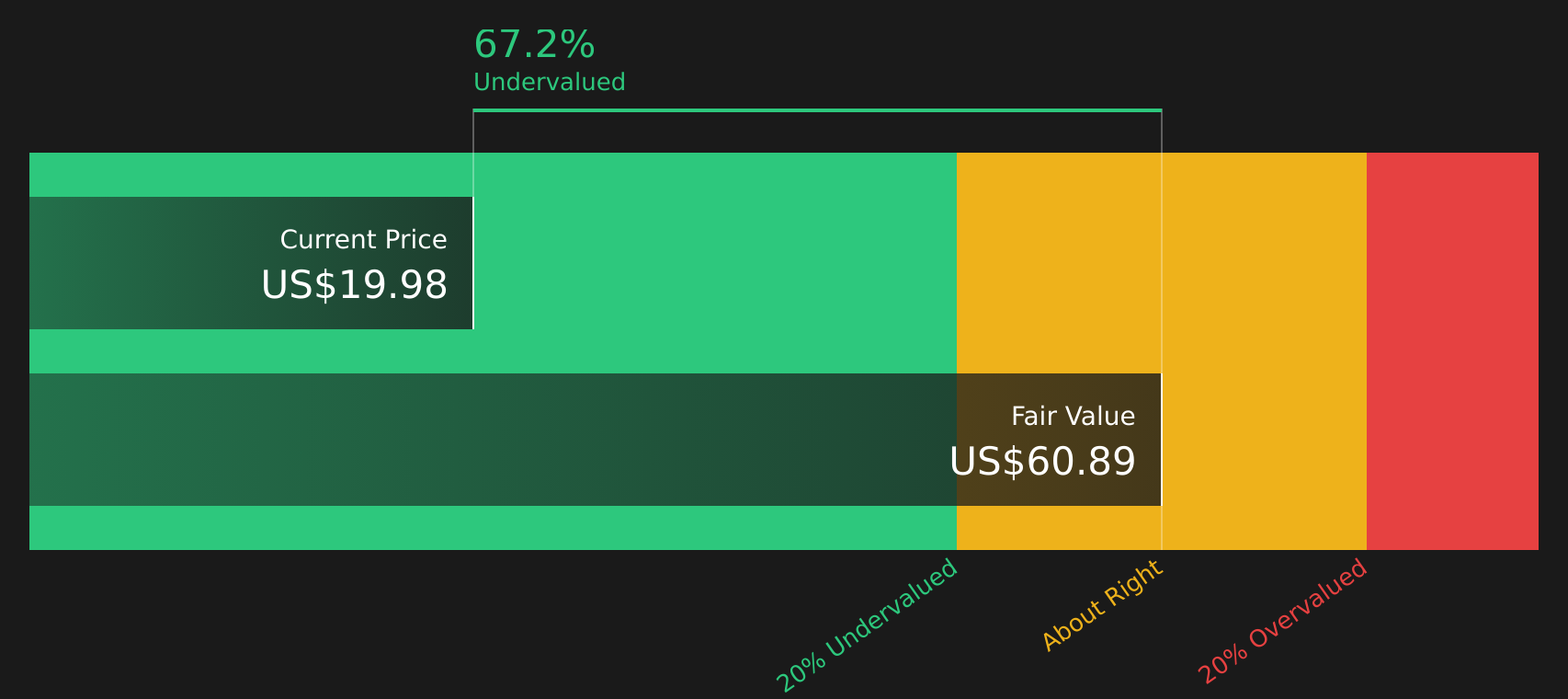

With Sun Country trading at US$21.19 against an analyst price target of about US$20.29, yet showing a modelled intrinsic discount of roughly 65%, the real question is whether there is still a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 9.1% Overvalued

With Sun Country Airlines Holdings closing at $21.19 versus a most-followed fair value estimate of $19.43, the narrative suggests the market price is slightly ahead of that model.

Structural pullbacks by major low-cost competitors and shrinking supply on core Minneapolis routes are reducing competitive pressure, supporting fare stability and potential margin expansion as industry-wide capacity discipline persists, this is likely to positively impact both revenue yields and net margins.

Curious what kind of revenue mix and margin profile could justify that valuation gap, and how earnings might scale if those assumptions hold? The full narrative lays out a detailed roadmap of expected growth, profitability, and future valuation multiples that sits behind that $19.43 fair value call.

Result: Fair Value of $19.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story can change quickly if seasonal leisure demand softens or if higher labor and fleet costs reduce the current net income of US$52.8m.

Find out about the key risks to this Sun Country Airlines Holdings narrative.

Another View: Cash Flows Paint A Different Picture

While the most followed fair value of $19.43 suggests Sun Country Airlines Holdings is about 9.1% overvalued at $21.19, our DCF model points in the opposite direction. It values the shares at $61.37, which screens as very cheap on a future cash flow basis. The gap is huge, so which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sun Country Airlines Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Next Steps

If this mix of upside and risk leaves you on the fence, it is worth looking at the numbers yourself and deciding where you stand. You can balance the positives and concerns in context by checking out the 2 key rewards and 1 important warning sign.

Looking for more investment ideas?

If Sun Country has sharpened your curiosity, this is the moment to widen your watchlist and stress test your thinking against other types of opportunities.

- Spot potential bargains early by checking companies our screener flags as screener containing 24 high quality undiscovered gems before they hit everyone’s radar.

- Prioritise resilience by reviewing 81 resilient stocks with low risk scores that score well on stability so you are not relying on a single story.

- Aim for quality at a sensible price by scanning 55 high quality undervalued stocks and see which names line up with your own view of fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal