Is WTW’s VM-22 RiskAgility Upgrade Quietly Reshaping Its Actuarial Software Edge? (WTW)

- Earlier in February 2026, Willis Towers Watson released a next-generation upgrade of its RiskAgility FM U.S. Library models, fully embedding VM-22 reserving requirements for non-variable annuities and offering insurers an integrated, production-ready platform for statutory valuation.

- This enhancement reinforces WTW’s role in complex actuarial and risk software at a time when insurers face heavier regulatory and modeling demands across annuity and pension risk transfer portfolios.

- We’ll now assess how this VM-22-focused RiskAgility FM upgrade could influence Willis Towers Watson’s broader investment narrative and growth outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Willis Towers Watson Investment Narrative Recap

To own Willis Towers Watson, I think you need to believe it can keep turning its advisory, broking and software capabilities into steady, fee based growth despite competitive and regulatory pressures. The VM 22 upgrade to RiskAgility FM supports that thesis at the margin, but the more immediate catalyst and risk still sit in how effectively WTW responds to AI driven commoditization in broking and consulting, where pressure on pricing and differentiation remains front of mind.

In that context, management’s continued focus on bolt on M&A to deepen broking and wealth capabilities, as discussed on the February 2026 earnings call, matters more than this single software release. If acquisitions enhance WTW’s higher margin specialist areas and data platforms without creating integration drag, they can complement the RiskAgility FM improvements and support the case for sustained operating leverage.

Yet despite these positives, investors should be aware that accelerating AI adoption in insurance broking could still...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion revenue and $2.5 billion earnings by 2028. This requires 3.7% yearly revenue growth and about a $2.4 billion earnings increase from $137.0 million today.

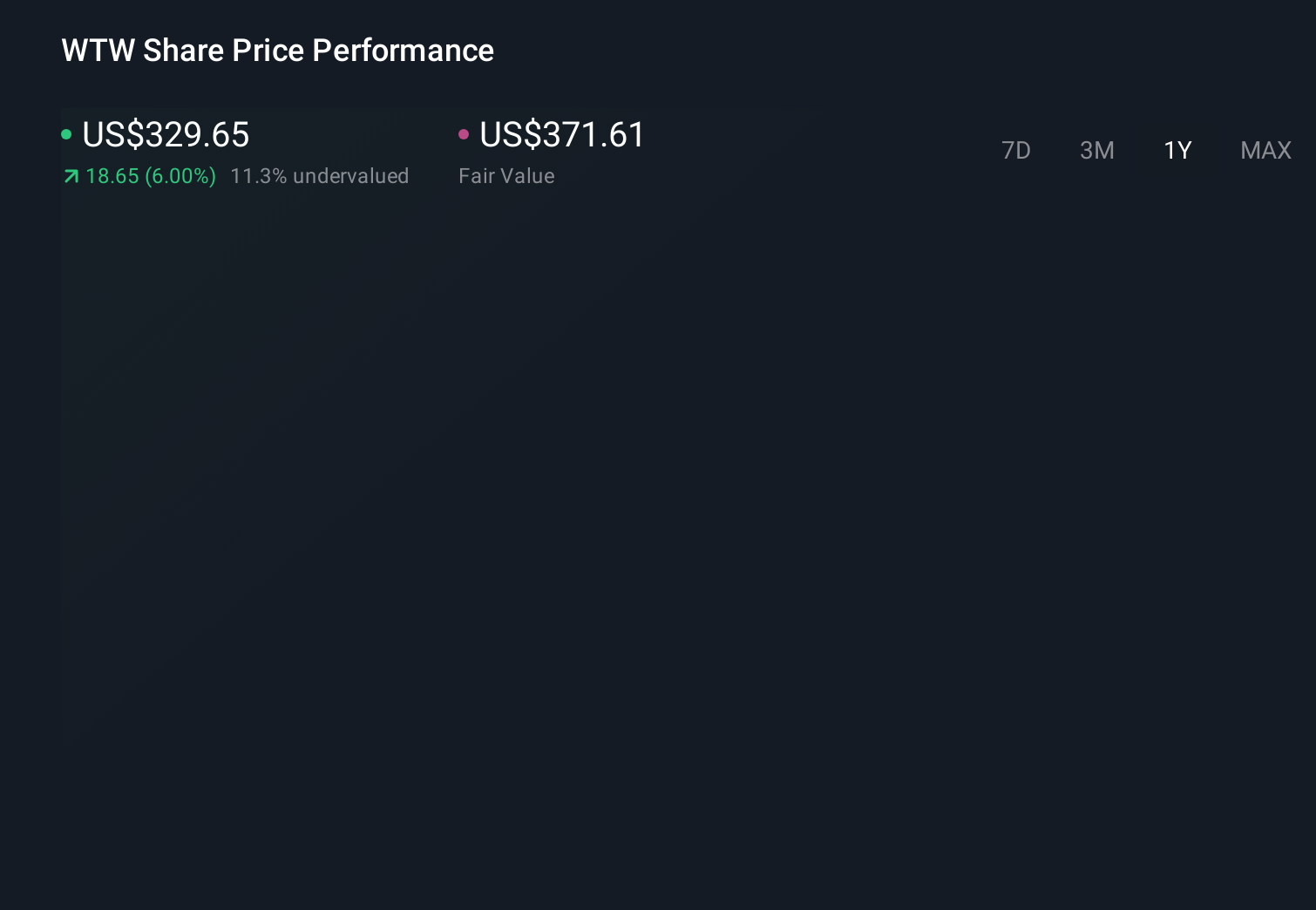

Uncover how Willis Towers Watson's forecasts yield a $374.26 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span a wide band from about US$185 to US$374 per share, underlining how far apart investors can be. Against that spread, the key debate is whether WTW’s push into advanced risk software like the upgraded VM 22 RiskAgility FM can offset concerns about AI driven fee pressure in its core broking and consulting operations, so it is worth weighing several viewpoints before forming your own.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth 36% less than the current price!

Form Your Own Verdict

Don't just follow the ticker - dig into the data and build a conviction that's truly your own.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The future of work is here. Discover the 32 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Find 54 companies with promising cash flow potential yet trading below their fair value.

- Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal