A Look At Huntington Ingalls Industries (HII) Valuation After Its Fourth Quarter Earnings Beat

Huntington Ingalls Industries (HII) recently posted fourth quarter results that exceeded Wall Street’s revenue and profit expectations. Management also pointed to broader gains in shipbuilding productivity, along with ongoing cost and scheduling pressures on margins.

See our latest analysis for Huntington Ingalls Industries.

The earnings beat and recent update on the John F. Kennedy carrier trials have come after a powerful 90 day share price return of 35.20% and a very large 1 year total shareholder return of 165.76%. However, the 30 day share price return shows a 1.67% decline, which suggests some near term momentum has cooled at a last close of $418.78.

If this kind of defense related news has your attention, it could be a good moment to see what else is moving in critical infrastructure and review 25 power grid technology and infrastructure stocks as a curated way to find other ideas built around long term projects and contracted cash flows.

With HII trading at $418.78, a value score of 4, an intrinsic discount estimate of 10.96% and a price target of $401 suggesting markets see limited upside, the key question is whether there is still a buying opportunity or if future growth is already priced in.

Most Popular Narrative: 10% Overvalued

At a last close of $418.78 versus a narrative fair value of $380.60, the widely followed view is that Huntington Ingalls Industries trades at a premium, with that gap grounded in detailed assumptions about revenue, margins and future multiples rather than short term sentiment.

The Fair Value Estimate has risen from US$331.89 to US$380.60, an increase of roughly US$49 per share based on updated modeling inputs.

The future P/E multiple has risen from 20.26x to 22.33x, which increases the valuation placed on projected earnings in the updated analysis.

Want to see what is behind that higher fair value and richer future multiple assumptions? Revenue growth, margin lift and earnings power all sit at the core, but the exact mix and pacing may surprise you.

Result: Fair Value of $380.60 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat story can be knocked off course if big contract awards are delayed, or if political budget wrangling interrupts expected defense funding.

Find out about the key risks to this Huntington Ingalls Industries narrative.

Another Angle On Value

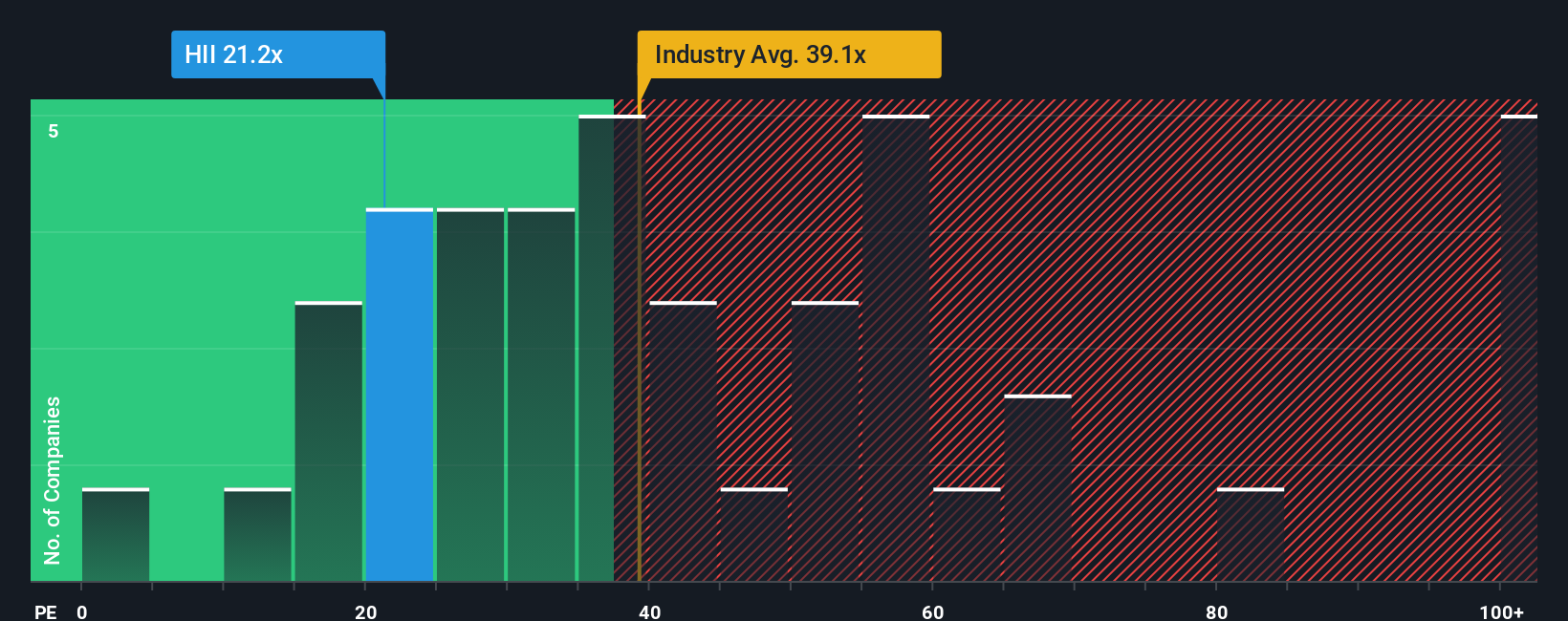

While the narrative fair value of $380.60 suggests Huntington Ingalls Industries is 10% overvalued, the earnings multiple tells a different story. At a P/E of 27.2x versus peers at 42.5x, the US Aerospace & Defense average at 40.7x and a fair ratio of 28.6x, the pricing gap looks tighter. Is this a margin of safety or a signal that expectations are already high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Huntington Ingalls Industries Narrative

If this version of the story does not quite match your view, or you would rather rely on your own work, you can build a custom Huntington Ingalls Industries thesis in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Huntington Ingalls Industries.

Looking for more investment ideas?

If HII has you thinking more broadly about your portfolio, do not stop at one company. Widen your search and pressure test your next moves with data backed ideas.

- Target resilient income by scanning companies with strong yields and staying power through our 12 dividend fortresses.

- Hunt for quality on sale by reviewing our 53 high quality undervalued stocks that combine solid fundamentals with pricing that still looks reasonable.

- Spot potential early before the crowd notices by checking our screener containing 23 high quality undiscovered gems that show strong metrics but limited market attention so far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal