Assessing Alaska Air Group (ALK) Valuation After Mixed Returns And A Rich P/E Multiple

Recent performance snapshot

Alaska Air Group (ALK) has drawn attention after a period of mixed share performance, with a 0.8% decline over the past day, a 7.0% drop over the past week, and a 10.5% gain over the past month.

Over the past 3 months the stock shows a 41.3% return, while the 1 year total return stands at a 27.0% decline. Year to date, shares are up 7.3%, and the 3 year total return is 12.6%.

See our latest analysis for Alaska Air Group.

At a share price of US$55.27, Alaska Air Group has seen short term momentum cool after a strong 90 day share price return of 41.3%, while the 1 year total shareholder return remains negative. This hints at investors reassessing both recovery potential and risk.

If this mixed performance has you thinking about where else to put fresh capital to work, you might want to scan our list of 23 top founder-led companies for other ideas building long term stories.

With Alaska Air Group posting annual revenue and net income growth, alongside a recent share price rebound, investors are asking a simple question: is the current US$55.27 price still conservative or already pricing in future growth?

Most Popular Narrative: 16% Undervalued

At US$55.27, the most followed narrative sees Alaska Air Group’s fair value closer to US$65.47, with that gap resting on specific growth and margin assumptions.

The expansion and optimization of the Seattle international gateway, including new long-haul routes and a growing fleet of Boeing 787s, positions Alaska Air Group to benefit from sustained urban growth and increasing travel demand in West Coast cities, anticipated to drive higher passenger volumes and top-line revenue growth.

Curious what earnings profile and profit margins sit behind that higher fair value, and how a lower future earnings multiple still supports it? The full narrative spells out the revenue path, margin rebuild, and discount rate that need to line up for Alaska Air Group to reach that target.

Result: Fair Value of $65.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can shift quickly if fuel costs stay elevated or the Hawaiian Airlines integration drags, putting pressure on margins and the fair value assumptions.

Find out about the key risks to this Alaska Air Group narrative.

Another way to look at value

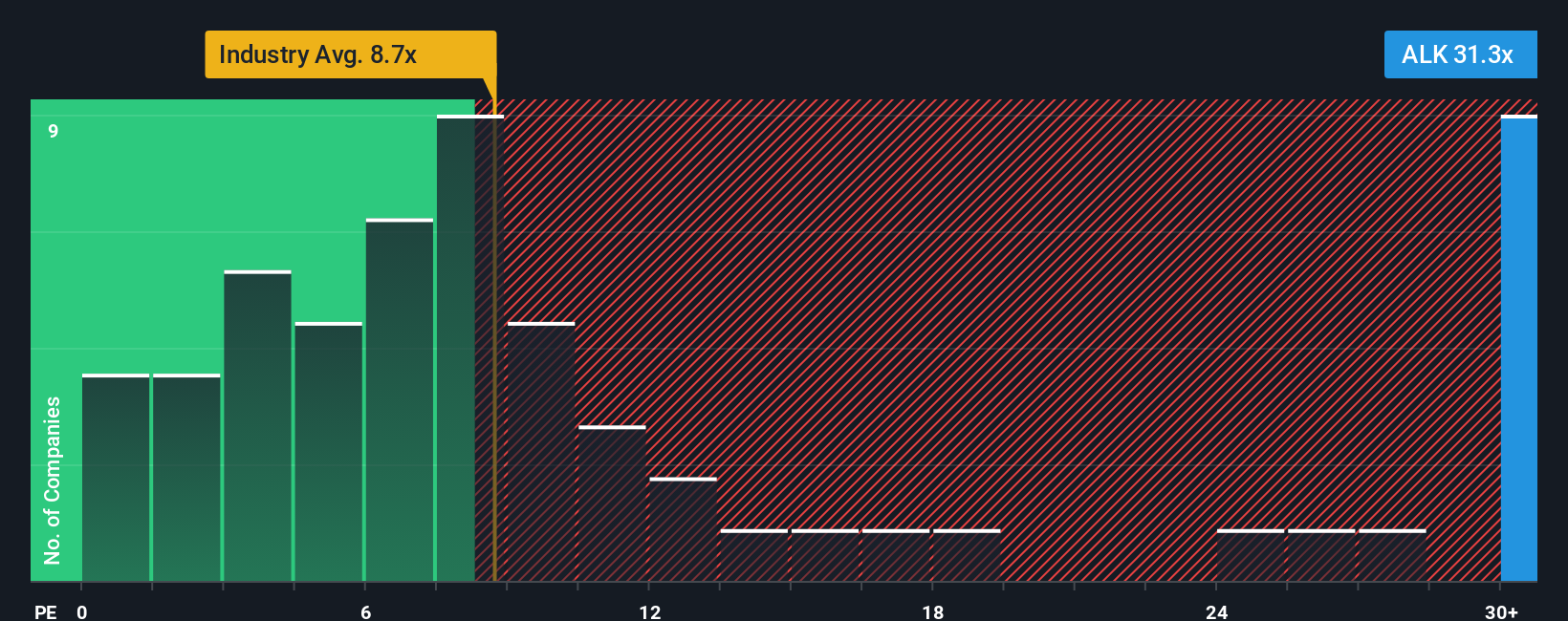

While the narrative pegs Alaska Air Group at a fair value of $65.47, the P/E ratio tells a tougher story. At 63.4x, the shares look expensive compared with a 39x fair ratio, the 27.8x peer average and the 9.8x global airlines average. That kind of gap raises the question: is this optimism or valuation risk building up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alaska Air Group Narrative

If you read this and feel the assumptions do not quite fit your view, you can stress test the numbers yourself and shape a custom thesis in just a few minutes, then Do it your way.

A great starting point for your Alaska Air Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Alaska Air Group does not fully match your plans, do not sit on the sidelines while other opportunities pass by. Widen your search with these focused stock ideas.

- Target potential mispricing by reviewing our list of 53 high quality undervalued stocks that pair established fundamentals with prices that may not fully reflect their underlying business strength.

- Strengthen your income stream by scanning 12 dividend fortresses, highlighting companies with yields of 5% or more that could support a more dependable payout profile.

- Prioritize resilience by checking the 84 resilient stocks with low risk scores, featuring businesses that currently score well on balance sheet quality and risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal