A Look At Energizer Holdings (ENR) Valuation After Mixed Q1 Earnings And Reaffirmed 2026 Guidance

Energizer Holdings (ENR) is back in focus after first quarter results showed sales of US$778.9 million alongside a net loss of US$3.4 million, while management reaffirmed 2026 guidance despite margin pressure from tariffs and softer consumer demand.

See our latest analysis for Energizer Holdings.

That backdrop helps explain why the 1 month share price return of 10.11% and year to date share price return of 14.25% sit alongside a 1 year total shareholder return of 22.73% and 5 year total shareholder return of 38.16%. This points to recent momentum building after a tougher multi year stretch as investors weigh the earnings swing to a loss, reaffirmed 2026 guidance and the completed US$94.18m buyback program.

If Energizer’s mixed picture has you looking wider, this could be a good moment to scan our list of 23 top founder-led companies as potential next ideas to research.

So with Energizer trading close to analyst price targets but showing an implied discount on some valuation metrics, is the recent weakness presenting a buying opportunity, or is the market already pricing in any future growth?

Price-to-Earnings of 7.3x: Is it justified?

On a P/E of 7.3x, Energizer Holdings screens as inexpensive compared to its peers, even with the last close at $22.77 and only a small gap to the $22.80 analyst price target.

The P/E multiple reflects how much investors are paying for each dollar of earnings. This is especially relevant for a mature, cash generating household products group like Energizer. With earnings reported as having grown very strongly over the past year and at an annual rate of 18.2% over the past 5 years, a single digit P/E hints that the market may be assigning a cautious label to those profits.

Relative comparisons sharpen that picture. The current 7.3x P/E is described as good value against the peer average of 21.9x and the global household products industry average of 17.9x. The estimated fair P/E of 14.8x suggests a level the market could move toward if earnings quality and growth remain consistent with expectations. Explore the SWS fair ratio for Energizer Holdings

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, you still need to weigh risks such as recent multi year total return losses, as well as pressure from tariffs and softer consumer demand on future earnings power.

Find out about the key risks to this Energizer Holdings narrative.

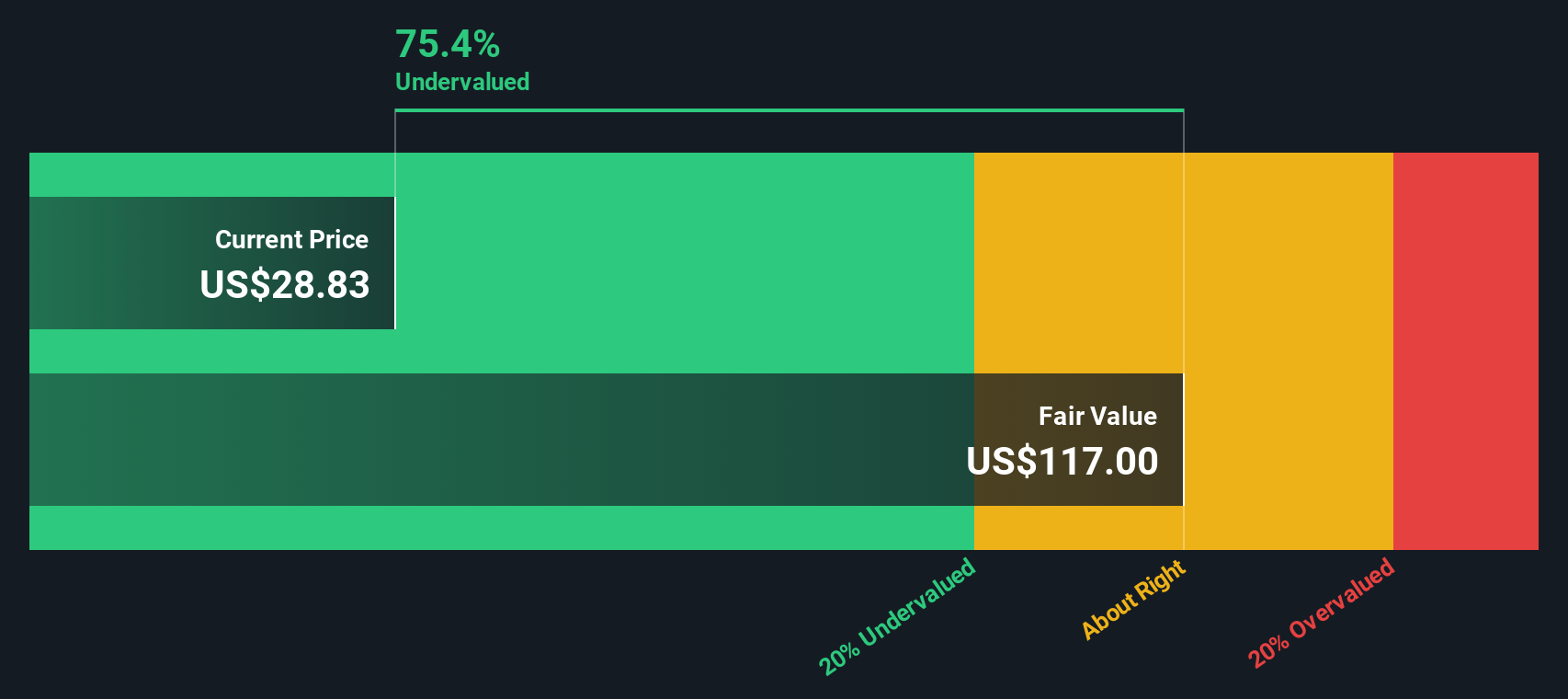

Another View: What Does The SWS DCF Model Say?

The low 7.3x P/E suggests value, but our DCF model comes in even more aggressive, with an estimated future cash flow value of $101.96 per share versus the current $22.77 price. That is a 77.7% discount. If the cash flows materialize as modeled, is the market being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energizer Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energizer Holdings Narrative

If you see the data differently or simply prefer to work through the numbers yourself, you can build a custom view in just a few minutes: Do it your way

A great starting point for your Energizer Holdings research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You have seen what stands out for Energizer, so do not stop here. Use these focused lists to quickly spot other opportunities that might fit your style.

- Target potential value opportunities by checking companies our screener flags as 53 high quality undervalued stocks based on their fundamentals and current pricing.

- Prioritise resilience by reviewing a curated set of businesses in the 84 resilient stocks with low risk scores that score well on our risk checks.

- Get ahead of the crowd by scanning the screener containing 23 high quality undiscovered gems and see which under followed names match your criteria.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal