Monday.com Balances Strong Quarter With Cautious 2026 AI-Focused Outlook

- monday.com (NasdaqGS:MNDY) reported strong fourth quarter results, underscoring solid current business performance.

- The company issued a cautious revenue outlook for 2026, pointing to AI driven competitive pressures and softer demand from small businesses.

- Management indicated it will no longer emphasize long term revenue targets, signaling a shift in how it is framing future growth.

monday.com, listed on NasdaqGS:MNDY, provides work management and collaboration tools used by teams across a wide range of industries. The company operates in a crowded software market where AI powered features are becoming a core part of product offerings, and where budget sensitivity among smaller customers is an ongoing consideration. In that context, the combination of strong recent results with a more cautious tone on 2026 draws attention to how management is thinking about the next phase of the business.

For you as an investor, the key questions now focus on how AI competition and softer small business demand could influence monday.com’s growth mix, pricing power, and product investment priorities. The move away from long term revenue targets also places more weight on upcoming quarterly updates, including how the company discusses AI, customer segments, and capital allocation choices.

Stay updated on the most important news stories for monday.com by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on monday.com.

We've flagged 1 risk for monday.com. See which could impact your investment.

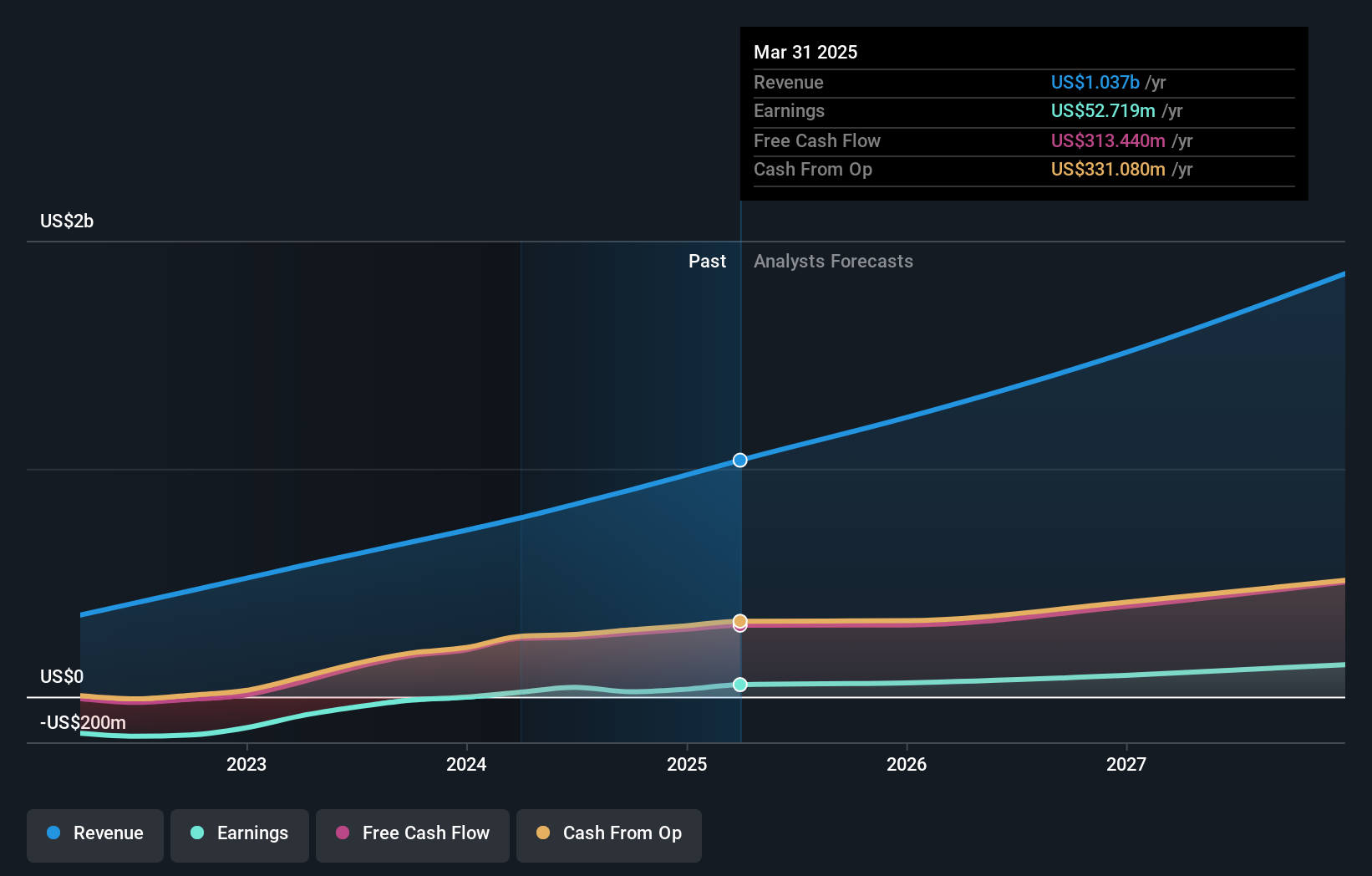

The headline for you is that monday.com’s near-term outlook now looks more balanced between strength in its core business and pressure from AI-driven competition and softer small business demand. Fourth-quarter revenue of US$333.88 million and net income of US$76.69 million, with earnings per share well above the prior year, point to meaningful operating progress. At the same time, 2026 revenue guidance of US$1.452 billion to US$1.462 billion, and management’s decision to stop referencing longer-term revenue targets, suggest management is resetting expectations as the environment changes and as AI tools from players like Microsoft, Atlassian and Salesforce reshape buyer choices.

How This Fits Into The monday.com Narrative

- The strong quarterly earnings and continued revenue growth support the existing narrative that monday.com’s multi-product approach and AI features can keep customers engaged and spending more over time.

- The more cautious 2026 guidance and weaker small business trends challenge earlier assumptions that growth from performance marketing and lower-end customers would remain a reliable driver.

- The decision to stop emphasizing long-term revenue targets, and the recent share buyback of 884,000 shares for US$135 million, add new elements of capital allocation discipline and forecast uncertainty that are not fully reflected in the prior narrative.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for monday.com to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Analysts have flagged that earnings are expected to decline on average over the next few years, which sits awkwardly against the company’s recent profitability gains.

- ⚠️ AI tools from large software vendors and newer entrants could pressure monday.com’s pricing power, especially in the small business segment where demand is already moderating.

- 🎁 Earnings growth over the past year has been very large, reflecting stronger profitability on a growing revenue base.

- 🎁 Revenue is forecast to grow each year and some analysts see the share price as trading well below their assessment of fair value, which some investors may view as a potential opportunity if the business mix holds up.

What To Watch Going Forward

From here, it is worth tracking how quickly monday.com can shift its mix toward larger customers while stabilizing small business trends. Pay close attention to commentary on AI product adoption, customer retention and sales efficiency, as these will show whether the company is holding its own against tools from Microsoft, Atlassian and Salesforce. Guidance updates around revenue and margins, together with any future changes to buyback activity, will give you more information on how management balances growth investment, competitive response and shareholder returns.

To ensure you're always in the loop on how the latest news impacts the investment narrative for monday.com, head to the community page for monday.com to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal