Assessing Leonardo DRS (DRS) Valuation After New AI Counter UAS Collaboration With Axon Vision

Leonardo DRS (DRS) has drawn fresh attention after announcing a collaboration with Israel based Axon Vision to integrate artificial intelligence enabled counter unmanned aircraft system capabilities into its battle platforms for US armed forces.

See our latest analysis for Leonardo DRS.

Those AI focused C UAS and interoperability efforts sit alongside other activity such as its presence at the Singapore Airshow and recent shipboard computing showcases, and come after a 90 day share price return of 11.23% and a 3 year total shareholder return of 192.63%. This suggests that longer term momentum has been stronger than the recent 30 day share price decline of 10.43%.

If this kind of defense tech story has your attention, it could be a good moment to see what else is emerging in our screener of 32 robotics and automation stocks.

With DRS posting a 32.47% 1 year total return, a 192.63% 3 year total shareholder return and trading at a 26% discount to a US$48.10 analyst target, you have to ask: is there still upside here or is the market already pricing in future growth?

Most Popular Narrative: 20.7% Undervalued

With Leonardo DRS last closing at $38.13 versus a narrative fair value of $48.10, the current pricing sits well below what the most followed storyline suggests, and that gap is built on specific growth, margin and earnings assumptions rather than sentiment alone.

Global increases in digitization and modernization of military forces are benefiting DRS's proprietary solutions in network computing, electronic warfare, and electric propulsion, supporting higher average selling prices and expanded platform content, which is expected to enhance net margins and drive operational leverage.

Read the complete narrative. Read the complete narrative.

Curious what kind of revenue build, margin lift and future earnings multiple are needed to back that fair value and price target? The narrative leans on steady contract execution, rising content per platform and a richer mix of higher value programs to justify its view. If you want to see exactly how those assumptions stack up year by year and what they imply for future earnings power, the full narrative lays out the math behind that $48.10 figure.

Result: Fair Value of $48.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those fair value assumptions could be challenged if raw material constraints pressure margins or if large U.S. government contracts face budget or timing setbacks.

Find out about the key risks to this Leonardo DRS narrative.

Another View: Cash Flows Paint A Tighter Picture

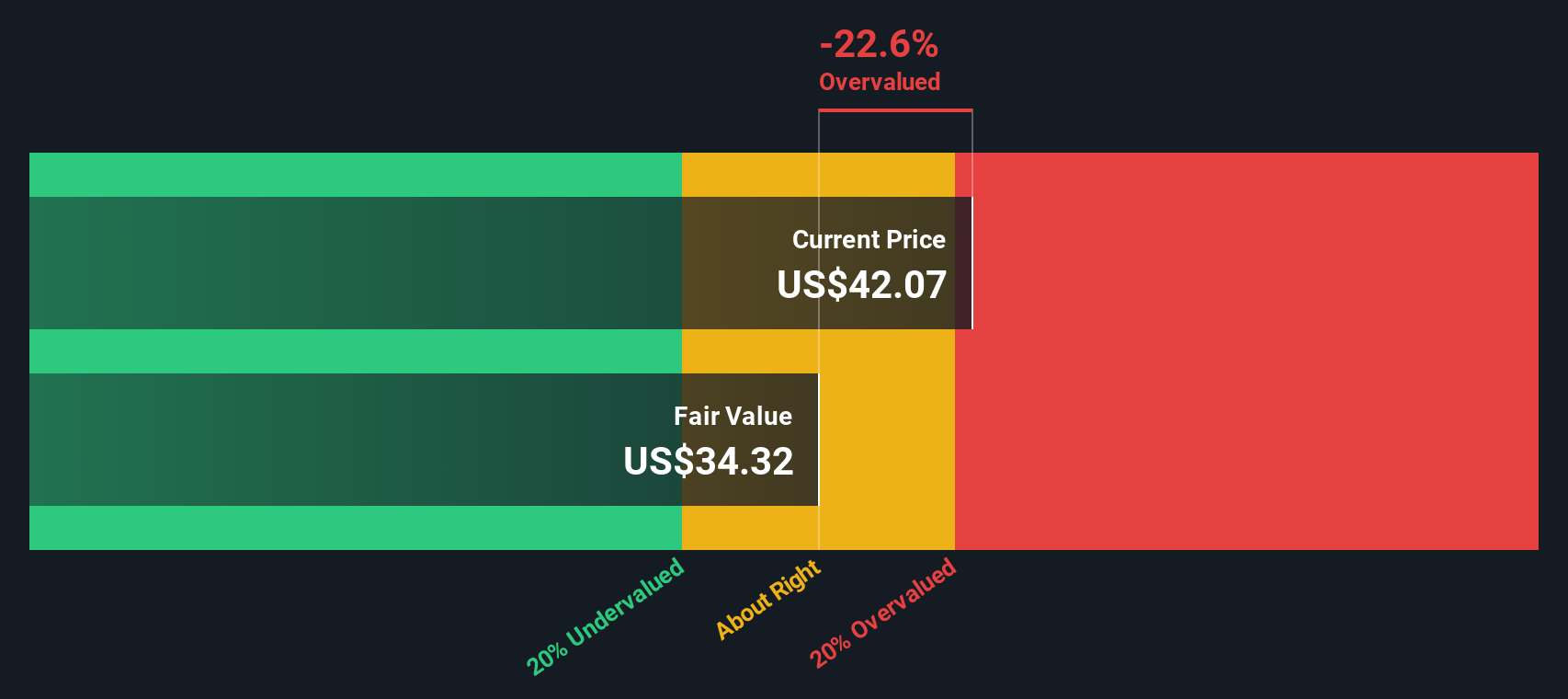

While the popular narrative tags Leonardo DRS as undervalued versus a $48.10 fair value, our DCF model presents a tighter view. It indicates an estimated future cash flow value of $33.24 compared with a $38.13 share price, which screens as overvalued on that basis. Which lens do you trust more, earnings or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo DRS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo DRS Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own assumptions, you can build a custom thesis for Leonardo DRS in just a few minutes and see how it stacks up against the market view using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for more investment ideas?

If you are weighing your next move and do not want to miss other opportunities, it makes sense to scan a few focused stock lists before you decide.

- Target potential value opportunities by checking companies that screen as relatively cheap on fundamentals in our 53 high quality undervalued stocks.

- Prioritize staying power by reviewing businesses with stronger balance sheets and financial profiles through the solid balance sheet and fundamentals stocks screener (45 results).

- Hunt for under the radar opportunities by scanning our screener containing 23 high quality undiscovered gems that combine quality metrics with limited existing market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal