Magnite Expands Premium Ad Ties As Valuation Gap Draws Investor Focus

- Magnite has expanded its partnership with The New York Times, becoming the preferred platform for private marketplace deals on the publisher's premium in app ad inventory.

- The company has also entered new technology focused collaborations with MNTN and Cognitiv to support more advanced targeting and campaign optimization for advertisers.

- These agreements are intended to deepen Magnite's role in premium digital advertising and give buyers streamlined access to high quality audiences.

Magnite, NasdaqGS:MGNI, is drawing fresh attention as it tightens links with a high profile publisher such as The New York Times and aligns with ad tech partners focused on performance driven campaigns. The stock closed at $11.7, with a mixed return profile, including a 3.6% gain over the past week against longer term declines of 23.5% over 30 days, 27.1% year to date, 41.5% over 1 year, 15.0% over 3 years and 80.0% over 5 years.

For investors watching digital advertising infrastructure, these new relationships highlight where Magnite is concentrating its efforts, namely premium supply and tools that support more precise media buying. How effectively the company translates these partnerships into higher usage and revenue will be an important angle to track as you assess the role of NasdaqGS:MGNI in a broader portfolio.

Stay updated on the most important news stories for Magnite by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Magnite.

3 things going right for Magnite that this headline doesn't cover.

Quick Assessment

- ✅ Price vs Analyst Target: At US$11.70 versus a US$26.57 analyst target, the stock trades about 56% below consensus.

- ✅ Simply Wall St Valuation: Simply Wall St flags Magnite as trading 77.6% below its estimated fair value.

- ❌ Recent Momentum: The 30 day return of about 23.5% decline shows weak short term sentiment despite the news.

To assess whether it is the right time to buy, sell or hold Magnite, head to Simply Wall St's company report for the latest analysis of Magnite's Fair Value.

Key Considerations

- 📊 The New York Times and new tech collaborations support Magnite's push into premium inventory and more precise ad buying, which speaks directly to its role as an omni channel sell side platform.

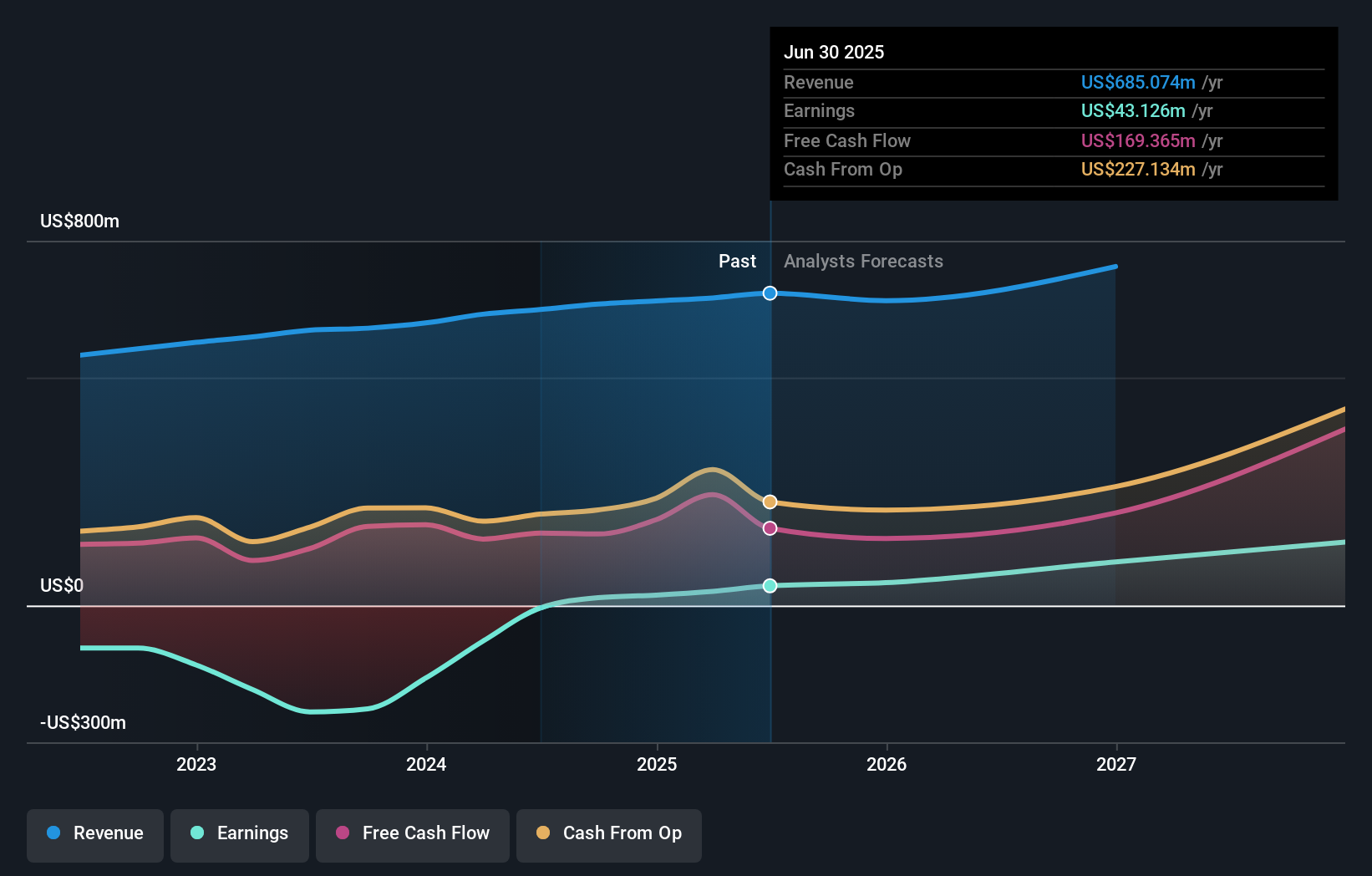

- 📊 Watch how revenue, net income margin of 8.3% and usage trends respond over coming quarters as these partnerships are rolled out across campaigns.

- ⚠️ The share price decline over multiple time frames suggests sentiment risk, so you may want to see evidence that new deals translate into stable earnings and justify the current P/E of about 29 versus the Media industry average of 14.6.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Magnite analysis. Alternatively, you can visit the community page for Magnite to see how other investors believe this latest news will impact the company's narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal