Does Super Group (SGHC) Offer Value After Recent Share Price Weakness?

- If you are wondering whether Super Group (SGHC) is priced attractively right now, the key question is how its current share price compares to what the underlying business might be worth.

- The stock last closed at US$8.96, with a 1.6% decline over 7 days, a 9.8% decline over 30 days, a 23.0% decline year to date, a 12.3% gain over the past year and a 150.9% return over three years.

- Recent moves in the share price sit against an ongoing effort by the company to build its profile as a listed online betting and gaming group, with investors reacting to how that story develops over time. Market attention has focused on how its scale, brand positioning and regulatory footprint could influence both growth prospects and risk.

- On our checklist-based valuation framework, Super Group (SGHC) scores 6 out of 6 for potential undervaluation, as shown in our valuation score. Next we will look at how methods like DCFs and multiples compare, before finishing with a way of thinking about value that goes beyond any single model.

Approach 1: Super Group (SGHC) Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model takes estimates of the cash a business might generate in the future and discounts those amounts back to today to arrive at an estimate of what the whole company could be worth now.

For Super Group (SGHC), the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections. The latest twelve month Free Cash Flow is about $263.6 million. Analysts provide estimates for the next few years, and beyond that Simply Wall St extrapolates to build a 10 year path of Free Cash Flow. Under this framework, projected Free Cash Flow reaches about $752.2 million in 2035, with each future year discounted back to today using the model’s chosen rate.

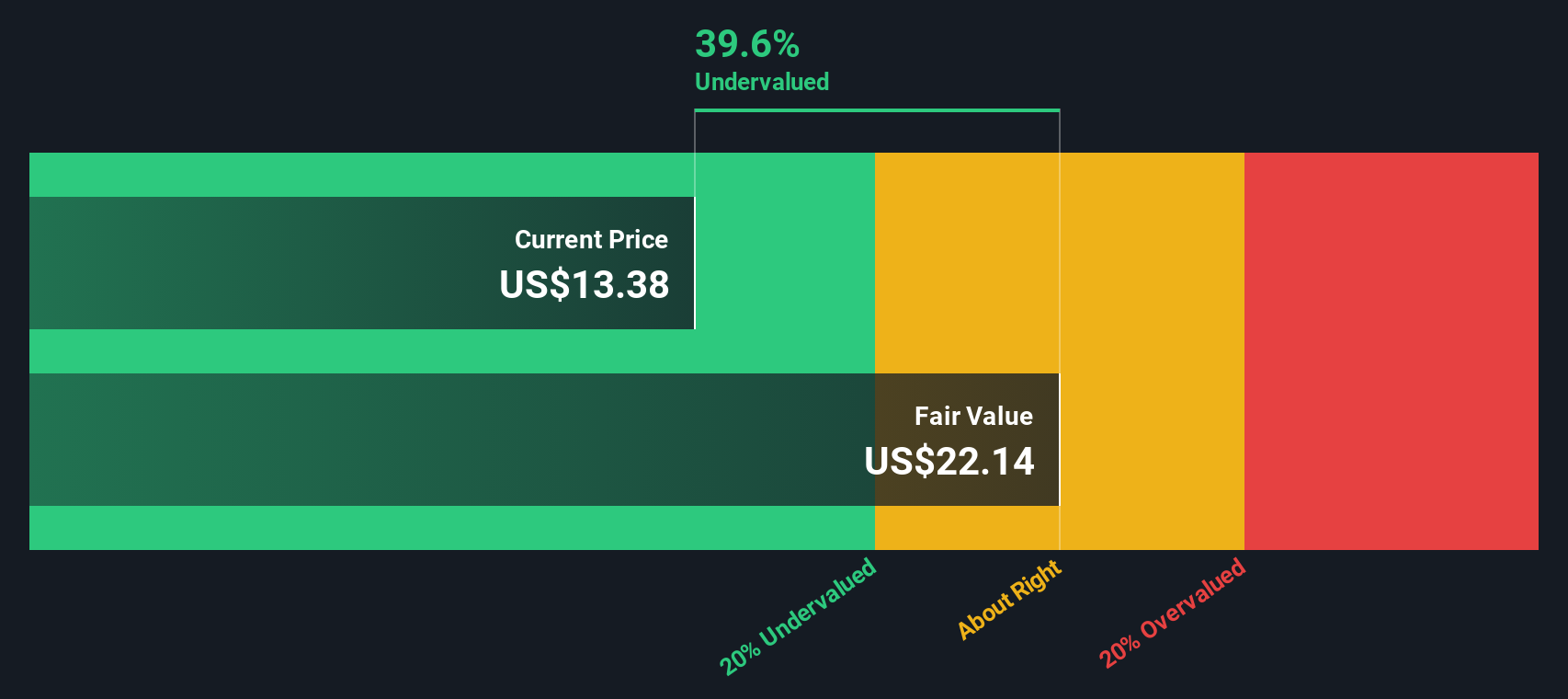

Putting all of those discounted cash flows together gives an estimated intrinsic value of US$22.18 per share, compared with the recent share price of US$8.96. On this view, the DCF implies the stock is about 59.6% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Super Group (SGHC) is undervalued by 59.6%. Track this in your watchlist or portfolio, or discover 54 more high quality undervalued stocks.

Approach 2: Super Group (SGHC) Price vs Earnings

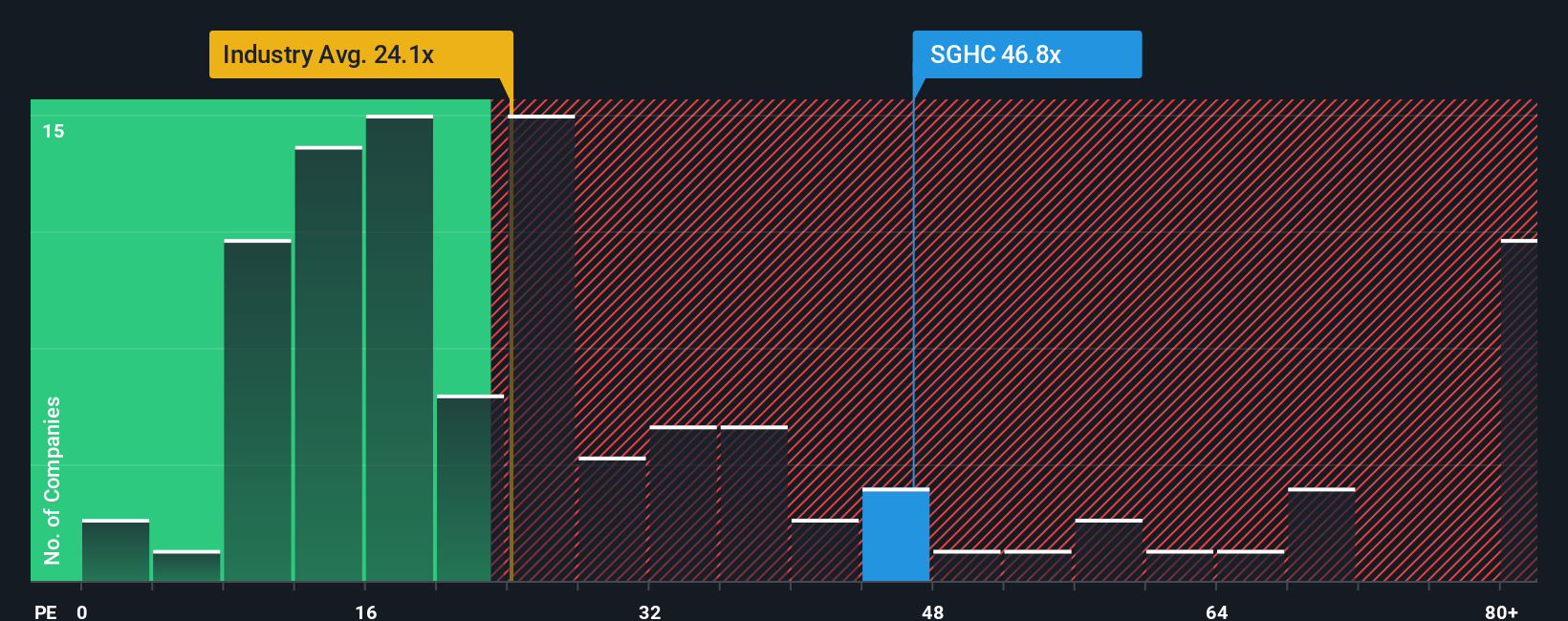

For a profitable company, the P/E ratio is a useful way to think about value because it links what you pay per share to the earnings that each share generates. Investors usually accept a higher P/E if they expect stronger earnings growth or see the business as lower risk, and a lower P/E if they see slower growth or higher risk.

Super Group (SGHC) currently trades on a P/E of 19.6x. That sits below the hospitality industry average of about 21.1x and below the peer group average of 32.7x. On the surface, that suggests the market is assigning a lower earnings multiple than many comparable companies.

Simply Wall St also calculates a Fair Ratio for Super Group (SGHC), which is 24.3x. This is a proprietary estimate of what the P/E might be, given the company’s earnings growth profile, industry, profit margins, market cap and risk factors. Because it blends these company specific inputs, it can be more tailored than a simple comparison with broad industry or peer averages. Comparing the Fair Ratio of 24.3x with the current P/E of 19.6x indicates that the shares are trading below that Fair Ratio.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 23 top founder-led companies.

Upgrade Your Decision Making: Choose your Super Group (SGHC) Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives let you attach a clear story about Super Group (SGHC) to the numbers you care about, such as your view of fair value and your expectations for future revenue, earnings and margins. You can then link that story to a financial forecast and a fair value that you can easily compare with the current share price on Simply Wall St’s Community page. On that page, Narratives are updated as new information like news, dividends or guidance comes through, and different investors can hold very different views. For example, one Narrative might argue that the fair value is around US$17.63 per share based on a certain revenue growth rate, profit margin, discount rate and future P/E, while another might set a materially lower fair value using more cautious assumptions about those same inputs.

Do you think there's more to the story for Super Group (SGHC)? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal