Discovering Undiscovered Gems in the US Market February 2026

As February 2026 begins, the U.S. stock market is experiencing a surge, with major indices like the Dow Jones and S&P 500 showing strong performances despite recent economic uncertainties such as delayed jobs data due to a government shutdown and shifting trade dynamics. In this vibrant yet complex environment, discovering lesser-known stocks that have potential for growth can be an intriguing prospect for investors looking to diversify their portfolios amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cashmere Valley Bank | 30.46% | 5.25% | 1.74% | ★★★★★★ |

| Sound Financial Bancorp | 16.27% | 0.75% | -13.26% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 12.65% | 41.20% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 42.51% | 1.82% | 1.11% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Union Bankshares | 374.44% | 1.12% | -7.71% | ★★★★★☆ |

| Seneca Foods | 38.64% | 2.39% | -18.65% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Flotek Industries (FTK)

Simply Wall St Value Rating: ★★★★☆☆

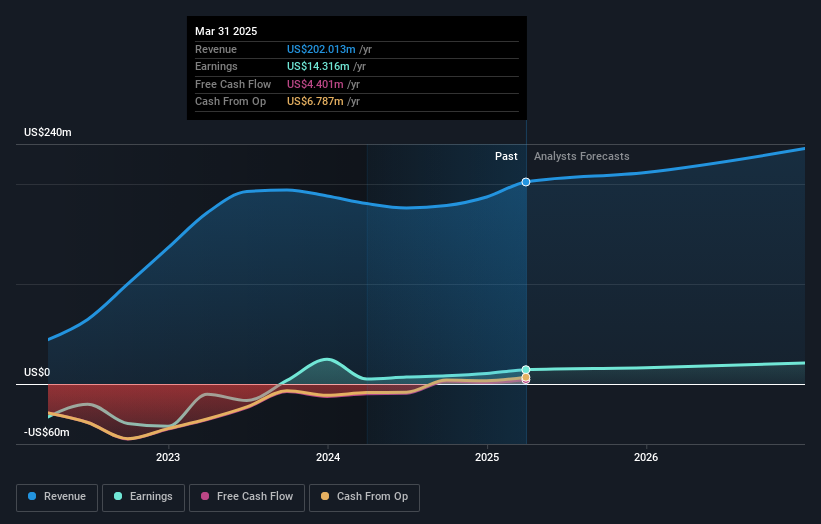

Overview: Flotek Industries, Inc. is a technology-driven green chemistry and data company serving industrial and commercial markets globally, with a market cap of $518.32 million.

Operations: Flotek Industries generates revenue primarily from its Chemistry Technologies segment, which accounts for $200.62 million, and its Data Analytics segment, contributing $19.88 million.

Flotek Industries, a nimble player in the chemicals sector, is making waves with its impressive 290% earnings growth over the past year. This performance outshines the broader industry's -1.5% trend. Despite a net debt to equity ratio rising from 8.8% to 42%, Flotek's interest payments are well-covered by EBIT at a robust 9.5 times coverage, indicating financial stability. Trading at an attractive value—87% below estimated fair value—the company faces challenges like significant insider selling recently and dependency on key clients but remains poised for potential growth with strategic digital expansions.

Luxfer Holdings (LXFR)

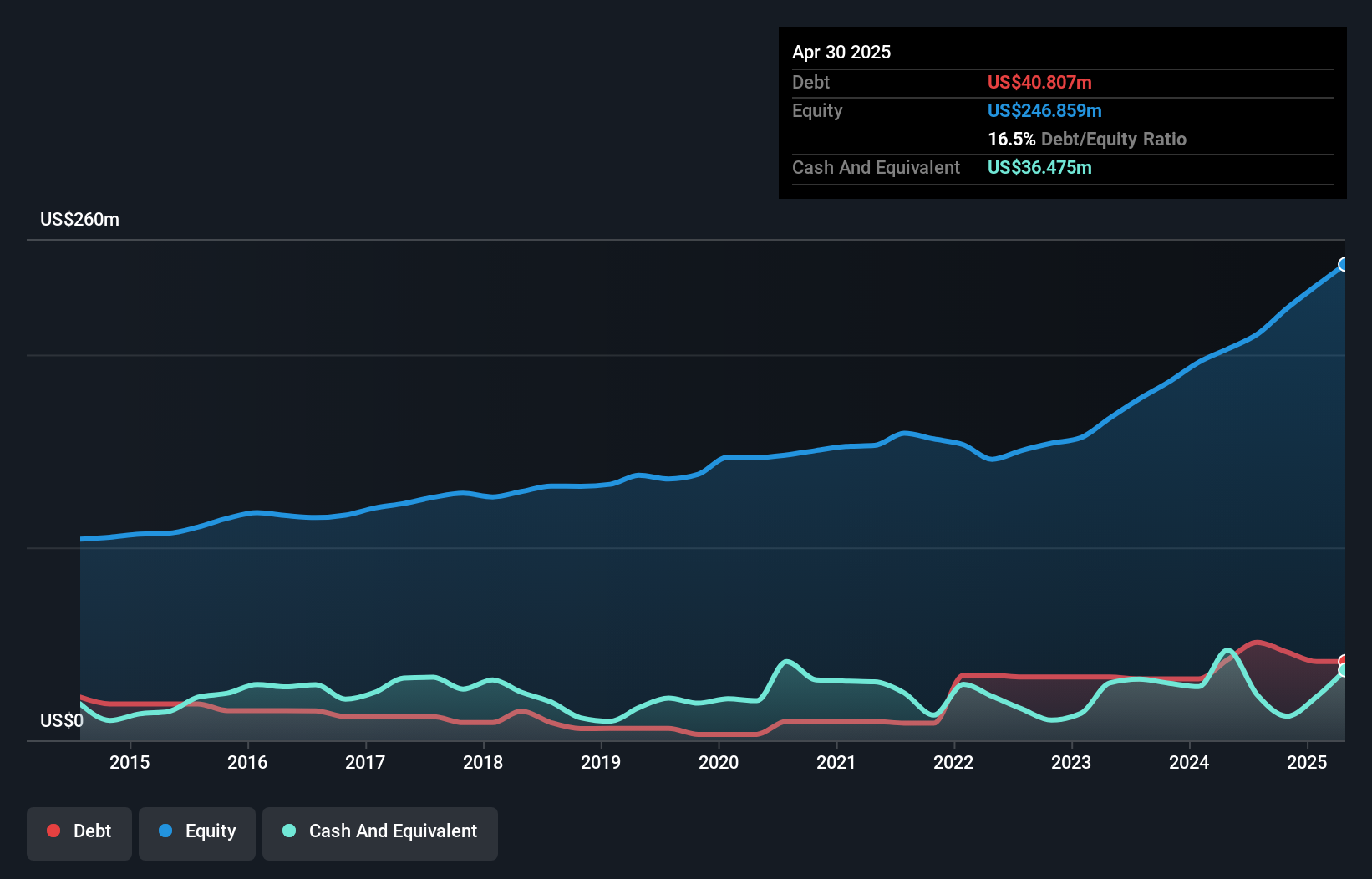

Simply Wall St Value Rating: ★★★★★★

Overview: Luxfer Holdings PLC, with a market cap of $416.05 million, specializes in high-performance materials and components as well as high-pressure gas containment devices for sectors including defense, healthcare, transportation, and general industrial applications.

Operations: Luxfer Holdings generates revenue primarily from its Elektron segment at $197 million and Gas Cylinders segment at $179.5 million, with a smaller contribution from Graphic Arts at $20.8 million.

Luxfer Holdings, a small player in the machinery industry, has shown impressive financial resilience. Despite a one-off loss of US$11.4M impacting its recent results, earnings skyrocketed by 95% last year, outpacing the industry's -0.7% performance. The company’s debt management is commendable with a reduction in the debt-to-equity ratio from 42% to 19% over five years and interest payments well covered at an EBIT coverage of 11x. Additionally, with a price-to-earnings ratio of 25x below the industry average and forecasted earnings growth of nearly 31%, Luxfer seems poised for continued success amidst its challenges.

Oil-Dri Corporation of America (ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in developing, manufacturing, and marketing sorbent products both domestically and internationally with a market capitalization of approximately $964.54 million.

Operations: Oil-Dri generates revenue primarily from two segments: Business to Business Products ($178.47 million) and Retail and Wholesale Products ($299.65 million). The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Oil-Dri Corporation of America, a small player in the household products sector, recently reported a dip in sales to US$120.49 million from US$127.95 million year-on-year for Q1 2025, with net income at US$15.46 million compared to US$16.38 million previously. Despite this, earnings grew by 18.6% last year, outpacing the industry average of 12.5%. The company repurchased 54,677 shares worth US$3.25 million between August and October 2025 as part of a larger buyback initiative totaling over nine percent since its inception in 2005. Oil-Dri's debt-to-equity ratio rose from 6.6% to 14.9% over five years but remains well-covered by EBIT at nearly fifty times interest payments while maintaining more cash than total debt on hand and trading significantly below estimated fair value by about fifty-eight percent.

Seize The Opportunity

- Gain an insight into the universe of 325 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal