Assessing SFL (SFL) Valuation After Recent Share Gains And Conflicting Fair Value Signals

Event context and recent share performance

SFL (NYSE:SFL) has recently attracted attention after its shares closed at US$10.26, with the move coming alongside a period where the stock has logged gains over the past week and month.

See our latest analysis for SFL.

That recent move to US$10.26 comes after a strong run, with a 30.04% year to date share price return and a 16.67% total shareholder return over the past year. This suggests momentum has been building rather than fading.

If this recent upswing has you thinking about where else capital could work hard, it might be worth scanning 23 top founder-led companies as a starting point for fresh ideas.

With SFL trading near its recent high and sitting only slightly below analyst targets, despite an intrinsic value suggesting a 7.32% discount, you have to ask yourself: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 8.9% Overvalued

At $10.26, SFL sits above the most followed fair value estimate of $9.43, which is built using a detailed cash flow and earnings narrative over time.

SFL's diversified fleet structure with significant exposure to container vessels and strong, long-term charters to investment-grade counterparties provides stable recurring revenue streams, high fleet utilization (98%+), and resilience against market volatility, underpinning predictable earnings and dividend coverage.

Read the complete narrative. Read the complete narrative.

Curious how a company that is currently unprofitable still arrives at this fair value? The narrative focuses on factors such as potential margin expansion, earnings growth and a richer future earnings multiple. Want to see exactly how those moving parts tie together into that valuation call?

Result: Fair Value of $9.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also have to weigh risks such as heavy exposure to oil-linked assets and a concentrated container backlog, which could pressure utilization and cash flows if conditions weaken.

Find out about the key risks to this SFL narrative.

Another take: DCF points in a different direction

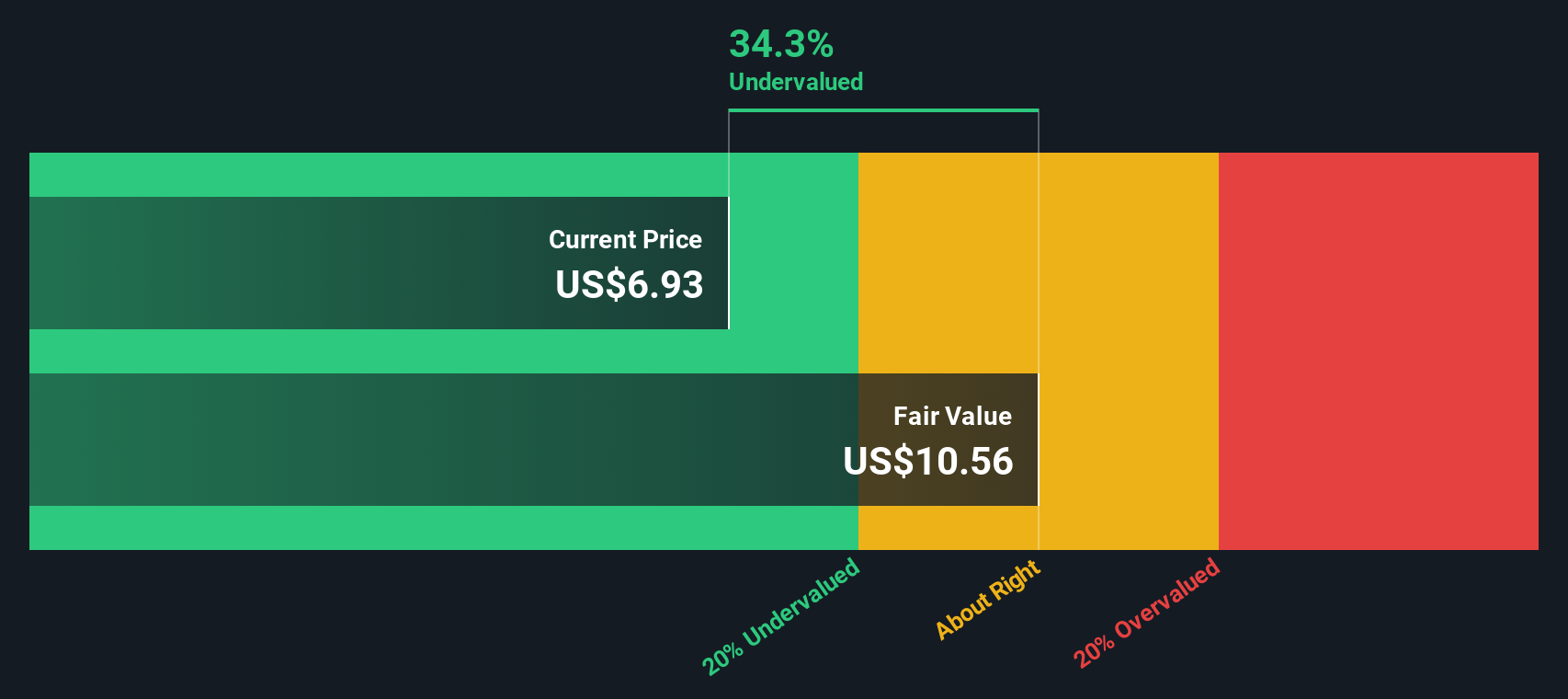

While the narrative based fair value of $9.43 suggests SFL at $10.26 is 8.9% overvalued, the SWS DCF model lands at a higher fair value of $11.07, which makes the current price look 7.3% below that estimate. Two thoughtful methods, two different answers. Which one feels closer to how you see SFL's future cash flows playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SFL for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SFL Narrative

If parts of this story do not quite match how you see SFL, or you prefer to test the assumptions yourself, you can build a custom thesis in just a few minutes and turn your own view into a structured narrative, Do it your way

A great starting point for your SFL research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SFL is already on your radar, do not stop there. The right watchlist of fresh ideas can make a real difference to your results over time.

- Target quality first and stress less about shocks by checking companies in our 85 resilient stocks with low risk scores that keep risk scores in focus.

- Hunt for value by scanning 55 high quality undervalued stocks, a set of high quality names our screener flags as trading below their assessed worth.

- Spot potential early movers by reviewing the 27 elite penny stocks with strong financials, where smaller names come with solid financial checks already applied.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal