Assessing Manhattan Associates (MANH) Valuation After PharmaCare’s SaaS Distribution Network Upgrade

Manhattan Associates (MANH) is back in focus after announcing that PharmaCare upgraded its ANZ distribution network with the Manhattan SCALE platform, citing gains in efficiency, compliance, and inventory control across a consolidated SaaS setup.

See our latest analysis for Manhattan Associates.

Despite PharmaCare’s move reinforcing interest in Manhattan’s warehouse and logistics software, momentum in the shares has cooled recently, with a 30 day share price return of 20.64% and a 1 year total shareholder return of 26.73%.

If this kind of supply chain tech story has you thinking about what else could be reshaping industries, take a look at 31 robotics and automation stocks as a starting list of ideas.

With revenue at US$1.08b, net income of US$219.95m and shares showing a 1 year total shareholder return decline of 26.73%, the real question is whether Manhattan Associates is now overlooked value or if the market already sees stronger growth ahead.

Most Popular Narrative: 14.1% Undervalued

Against the latest close of $137.44, the most followed narrative pegs Manhattan Associates' fair value at $160.00, using an 8.43% discount rate and tighter assumptions on growth and margins.

The addressable market for Manhattan Associates is expected to grow at a double digit compound annual growth rate due to expanding product investments and strong sales team performance, potentially boosting revenue and earnings. Manhattan's strong quarter was exemplified by a 25% year over year increase in Remaining Performance Obligations, reaching nearly $1.9 billion, indicating solid demand and potentially enhancing earnings and future revenue certainty.

Curious what earnings path and margin profile have to line up with that fair value, and how a higher future P/E fits into the story? The full narrative lays out a clear recipe that blends moderate revenue growth, slightly softer margins, and a rich earnings multiple, plus how buybacks shape per share numbers. It is all quantified, just not obvious from the headline fair value alone.

Result: Fair Value of $160.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a chance that stronger cloud and services demand, or wider adoption of its AI agents, could support a tighter and less cautious earnings path.

Find out about the key risks to this Manhattan Associates narrative.

Another View: Expensive On Earnings

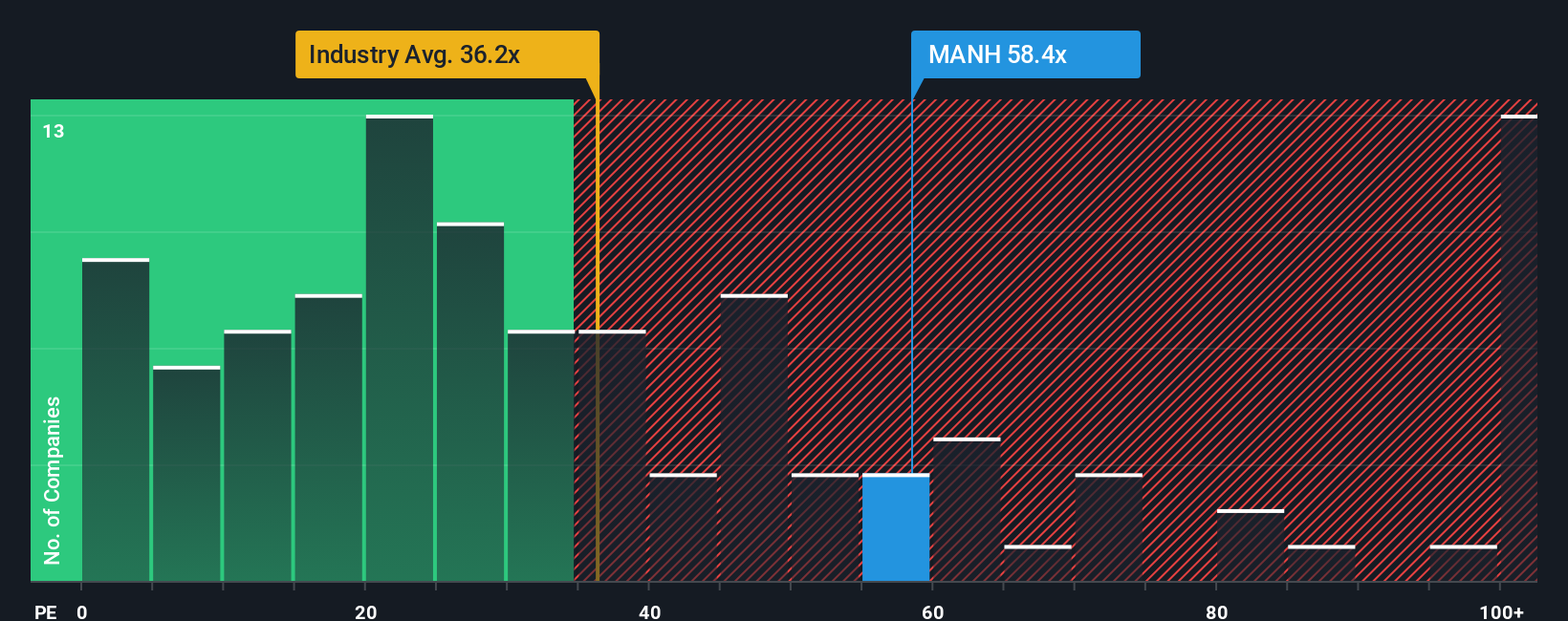

The 14.1% undervaluation story contrasts with how the market is pricing Manhattan Associates on earnings. The shares trade on a P/E of 37.4x versus a fair ratio of 27.6x, and 27.1x for the wider US Software group, even while peers average a much higher 50.5x. That gap points to valuation risk if sentiment cools, or a cushion if peers stay richly priced. Which side of that tradeoff do you think matters more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Manhattan Associates Narrative

If the consensus view does not quite line up with your own thinking, or you simply prefer to test the numbers yourself, you can pull the same data, plug in your assumptions, and shape a version of the story that fits your convictions, then Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Manhattan Associates.

Looking for more investment ideas?

If you are serious about sharpening your portfolio, do not stop at one company. Use the screener to surface other opportunities before the crowd catches on.

- Spot potential bargains early by scanning our market wide list of 55 high quality undervalued stocks that pair quality fundamentals with attractive pricing signals.

- Strengthen your portfolio core by focusing on companies from our solid balance sheet and fundamentals stocks screener (45 results) that prioritize financial resilience and disciplined capital structures.

- Boost your income focus by reviewing our hand picked 16 dividend fortresses that combine higher yields with checks on payout sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal