Assessing Willis Towers Watson’s Valuation After Stock Pullback Mixed Earnings And RiskAgility FM Upgrade

Willis Towers Watson (WTW) has moved into focus after a sharp pullback from its late 2025 share price peak, mixed quarterly earnings, sector jitters around AI distribution, and a fresh upgrade to its RiskAgility FM platform.

See our latest analysis for Willis Towers Watson.

Recent volatility has been sharp, with a 7 day share price return of 13.55% and a 30 day share price return of 13.57% pulling Willis Towers Watson back to US$282.98, even though the 3 year total shareholder return of 21.32% and 5 year total shareholder return of 35.54% still reflect a much stronger longer term picture.

If this insurance and risk consulting story has you thinking more broadly about where growth and disruption might show up next, it could be worth scanning 23 top founder-led companies as another source of potential ideas.

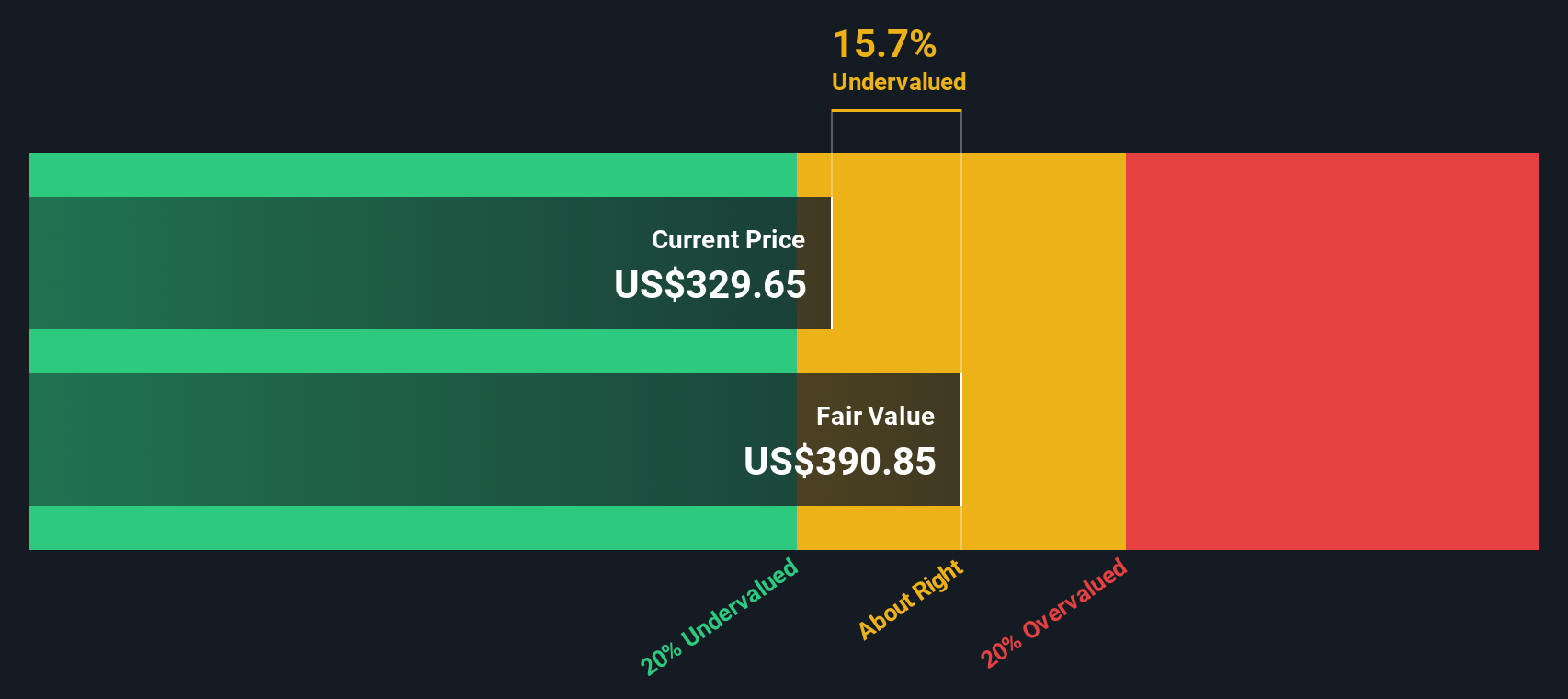

So with WTW sitting around US$282.98 after a pullback, solid full year profitability, ongoing buybacks and upbeat analyst targets, should you see a mispriced opportunity here, or assume the market has already pencilled in future growth?

Most Popular Narrative: 24.4% Undervalued

With Willis Towers Watson last closing at $282.98 against a narrative fair value of $374.26, the most followed view sees meaningful upside baked into its long term cash flows.

Recent research points to a mixed but generally constructive tone around Willis Towers Watson, with several firms moving price targets into the low to high US$300s and one firm taking a more cautious stance with a lower target.

• Bullish analysts are marking WTW with price targets clustered around the mid to high US$300s. This suggests they see room for the current valuation to better reflect execution on organic growth and margins.

Curious what kind of revenue path, margin profile and future P/E multiple have to line up to get to that fair value number? The narrative leans on specific growth and profitability assumptions, plus a discount rate of 7.42%, to justify that gap. If you want to see exactly how those moving parts fit together, the full story is worth a closer look.

Result: Fair Value of $374.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks to that upside story, including faster AI driven fee compression and tougher competition from global peers that could squeeze WTW’s growth and margins.

Find out about the key risks to this Willis Towers Watson narrative.

Another View: SWS DCF Flags Overvaluation

That 24.4% upside story is not the only one in play. Our DCF model, which prices WTW off its forecast future cash flows, arrives at a fair value of $185.06. Compared with the current $282.98 share price, that reading points to WTW trading rich rather than cheap. Which set of assumptions do you find more reasonable?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Willis Towers Watson for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Willis Towers Watson Narrative

If you are not fully on board with any of these takes or simply prefer to stress test the numbers yourself, you can rebuild the story around your own assumptions in just a few minutes and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Willis Towers Watson.

Looking for more investment ideas?

If you want to broaden your watchlist beyond WTW, the Simply Wall Street Screener can help you quickly surface fresh ideas tailored to the way you like to invest.

- Target resilient cash generators with 55 high quality undervalued stocks that combine quality fundamentals with prices that may not fully reflect their underlying strength.

- Prioritise staying power and sleep better at night by scanning 84 resilient stocks with low risk scores for companies with lower risk profiles.

- Spot potential future market leaders early using our screener containing 23 high quality undiscovered gems that highlight quality businesses still flying under most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal