Assessing Mosaic (MOS) Valuation After Recent Share Price Swings And Mixed Fair Value Signals

Mosaic (MOS) has attracted fresh attention after recent price moves, with the stock closing at $29.77 and posting mixed short term returns, including a 4.4% decline over the past day alongside gains over the past week and month.

See our latest analysis for Mosaic.

That sharp 4.4% one day share price decline comes after a stronger run, with Mosaic posting a 7.2% 7 day share price return and an 18.9% year to date share price return. Its 1 year total shareholder return of 16.2% contrasts with a weaker 3 year total shareholder return of a 35.6% loss, hinting that momentum has recently picked up after a tougher multi year stretch.

If Mosaic’s recent move has you thinking about where else value might be hiding in materials and related areas, you may want to scan 8 top copper producer stocks as another way to surface ideas.

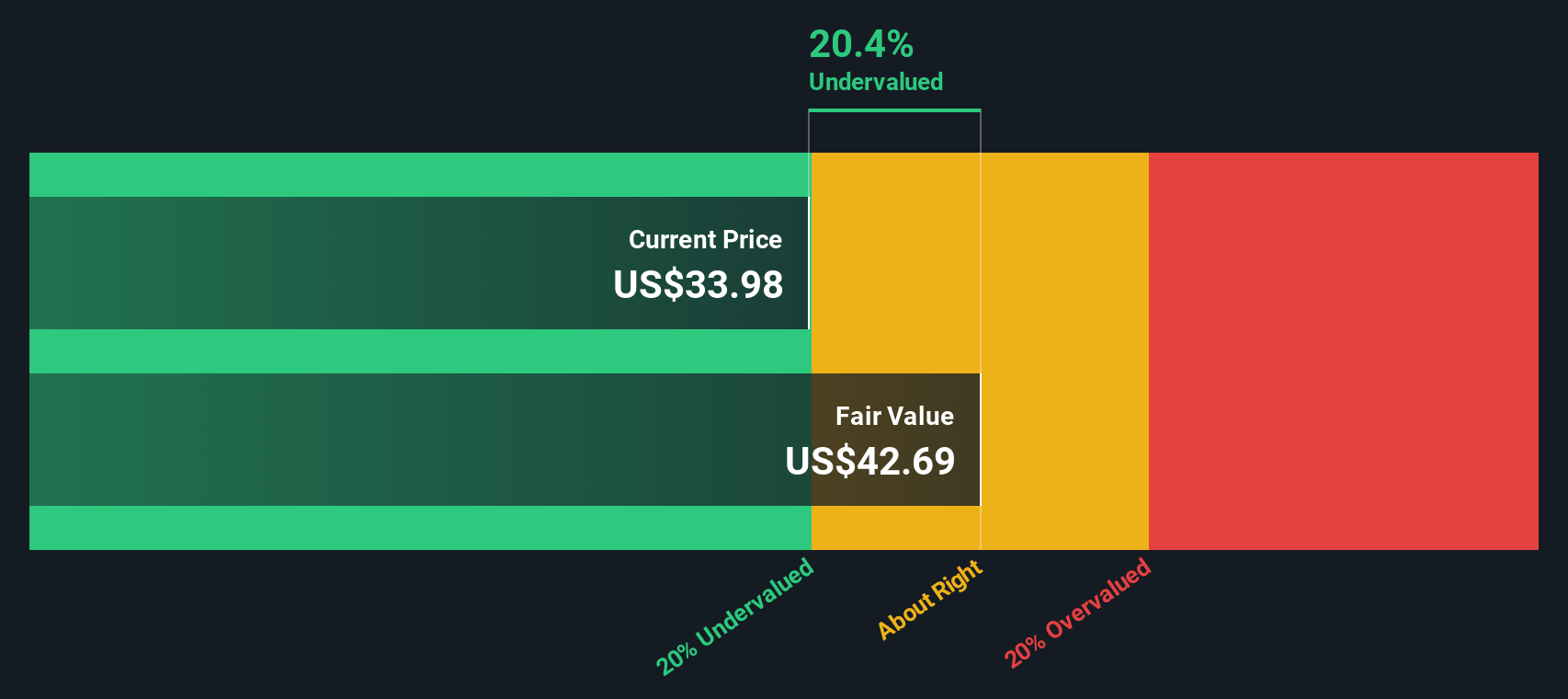

So with Mosaic trading at $29.77, an 8.4% discount to the average analyst price target but a 24.6% premium to one intrinsic value estimate, is this a genuine mispricing, or is the market already baking in future growth?

Most Popular Narrative: 8.3% Undervalued

Compared with Mosaic’s last close at $29.77, the most followed narrative points to a fair value of about $32.46. This creates a modest valuation gap that hinges on specific earnings and margin assumptions.

Global fertilizer supply and demand dynamics remain favorable, with tight markets in both phosphate and potash due to limited new capacity, continued Chinese export restrictions, and record/near-record global shipments; this structural supply constraint, combined with robust farmer demand (driven by rising food needs and government support in key regions like India and Brazil), positions Mosaic to capture higher prices, lifting revenue and margins.

Want to see what kind of revenue path and margin profile are baked into that fair value, and how the future P/E ties it all together? The full narrative lays out a detailed earnings glidepath, a specific profit margin reset, and the valuation multiple needed to make the numbers line up.

Result: Fair Value of $32.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that thesis could easily be tested by any prolonged fertilizer oversupply or tighter environmental regulation, both of which would pressure pricing power and margins.

Find out about the key risks to this Mosaic narrative.

Another View: Cash Flows Point the Other Way

That 8.3% “undervalued” gap from the narrative sits awkwardly next to our DCF model, which puts Mosaic’s future cash flow value at about $23.90 per share. On that view, the current $29.77 price looks closer to overvalued territory, not a bargain. Which story feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mosaic for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mosaic Narrative

If you see the numbers differently or just want to stress test your own view in a few quick steps, build a version that fits your thesis and Do it your way.

A great starting point for your Mosaic research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with just one stock, you could miss other opportunities that fit your style, so use the screener to widen your field of options.

- Target long term compounding potential by reviewing 16 dividend fortresses that aim to pair income with resilience through a history of meaningful cash returns.

- Hunt for quality at a price that makes sense by scanning screener containing 23 high quality undiscovered gems that many investors may not be watching yet.

- Prioritize capital preservation with 84 resilient stocks with low risk scores, a focused set of companies screened for more measured risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal