Assessing Magnite (MGNI) Valuation After Recent Share Price Rebound And Mixed Return Profile

Magnite stock: recent move and what it might mean for investors

Magnite (MGNI) has drawn fresh attention after a period of weak share performance, including an 11.8% last close and negative total returns over the past year and past 3 years.

For investors, the contrast between those returns and Magnite’s reported US$702.6m in revenue and US$58.0m in net income raises questions about how the market is currently valuing its omni channel sell side advertising platform.

See our latest analysis for Magnite.

At a share price of US$11.80, Magnite’s 30 day share price return of 26.66% and 90 day share price return of 16.61% contrast with a 1 year total shareholder return of 39.46% and 5 year total shareholder return of 78.11%. This points to fading momentum and a market that remains cautious about how to price its advertising platform exposure.

If this mixed picture has you thinking about where else capital could work, it may be worth scanning our screener of 22 top founder-led companies as a starting point for other ideas.

With Magnite generating US$702.6m in revenue and US$58.0m in net income, yet delivering a 39.46% 1 year total return decline, you have to ask: is this an undervalued ad tech platform, or is the market already pricing in its future growth?

Most Popular Narrative: 56.1% Undervalued

Magnite’s most followed narrative pegs fair value at $26.86, well above the last close of $11.80. This sets up a very different picture from the share price chart.

The ongoing increase in global internet penetration and mobile device usage is expanding the digital advertising addressable market, with Magnite seeing growth across CTV, mobile, and new publisher partners (e.g., Spotify, T Mobile, Redfin), supporting both top line revenue and diversified inventory supply.

Curious how that kind of growth story gets turned into a fair value more than double today’s price? Revenue assumptions, margin shifts and future earnings power all play a part, but the narrative rests on a few key levers you will want to see for yourself.

Result: Fair Value of $26.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on key risks, including heavy reliance on major CTV partners and uncertainty around regulatory outcomes that could limit the expected upside.

Find out about the key risks to this Magnite narrative.

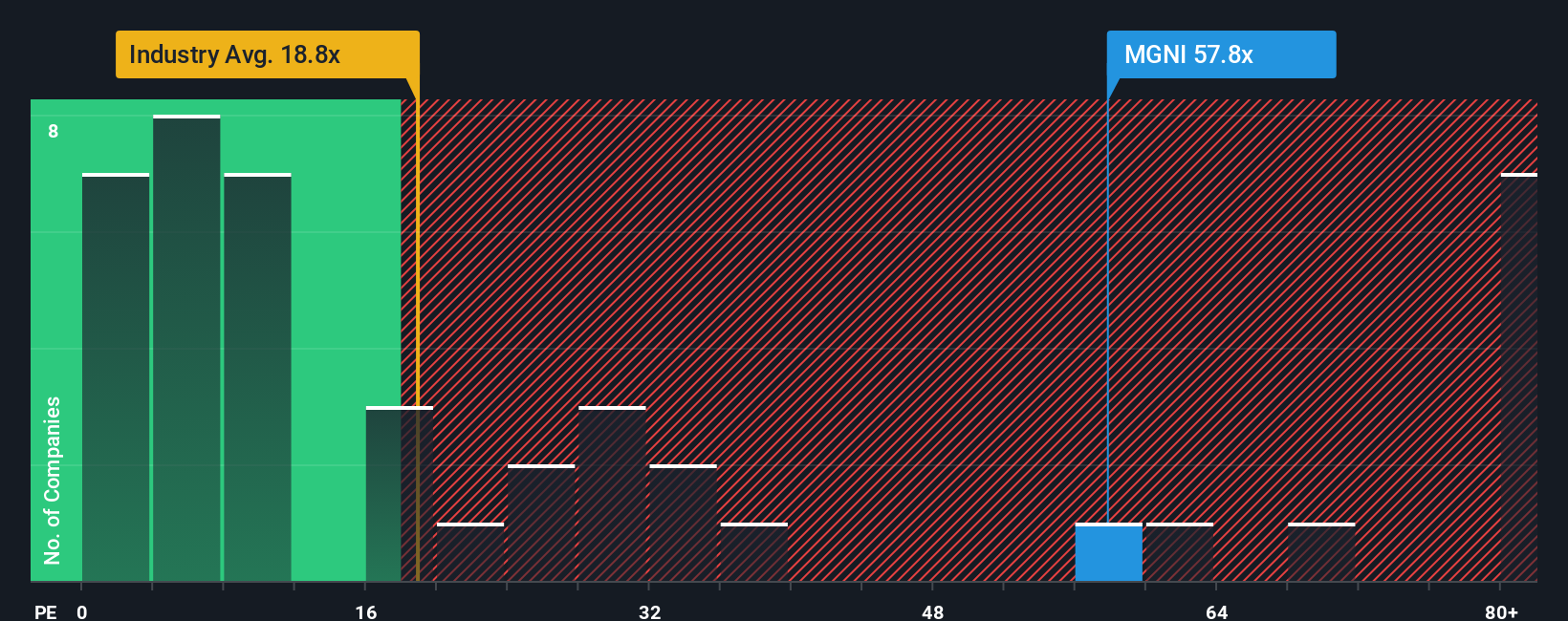

Another View: What The P/E Says

While our DCF model suggests Magnite is trading at a large discount to its estimated future cash flow value of $52.46, the current P/E of 29.2x tells a different story. It sits above both the US Media industry average of 15.3x and the fair ratio of 19.4x, which points to valuation risk if earnings do not keep pace. So which signal do you think carries more weight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Magnite Narrative

If you read this and feel the story does not quite fit your view, you can stress test the numbers yourself and build a fresh angle in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Magnite.

Looking for more investment ideas?

If Magnite has sharpened your thinking, do not stop here. The market offers plenty of other angles that could fit your goals and risk comfort.

- Spot potential bargains by checking companies our tool tags as quality opportunities in the 51 high quality undervalued stocks.

- Prioritise resilience by scanning companies with steadier profiles through the 85 resilient stocks with low risk scores.

- Hunt for lesser known opportunities by reviewing the screener containing 24 high quality undiscovered gems that our filters surface from across the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal