Discovering 3 US Hidden Gems with Strong Fundamentals

As the U.S. stock market begins February on a high note, with major indices like the Dow Jones and S&P 500 experiencing significant gains, investors are keenly observing how economic indicators and policy changes might impact small-cap stocks. Amidst this backdrop of optimism, discovering stocks with strong fundamentals becomes crucial for navigating potential market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 66.33% | 1.28% | -2.88% | ★★★★★★ |

| Franklin Financial Services | 129.39% | 5.72% | -3.22% | ★★★★★★ |

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Cashmere Valley Bank | 30.46% | 5.25% | 1.74% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Winchester Bancorp | 121.44% | 49.13% | 3283.33% | ★★★★★★ |

| Union Bankshares | 374.44% | 1.12% | -7.71% | ★★★★★☆ |

| Seneca Foods | 38.64% | 2.39% | -18.65% | ★★★★★☆ |

| Kingstone Companies | 4.41% | 4.36% | 44.59% | ★★★★☆☆ |

| Oxford Bank | 12.42% | 14.34% | 4.14% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Cricut (CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting professional-looking handmade goods across multiple regions including the United States and Europe, with a market cap of $984.61 million.

Operations: Cricut generates revenue primarily from its platform, amounting to $322.83 million, with an additional segment adjustment of $391.66 million.

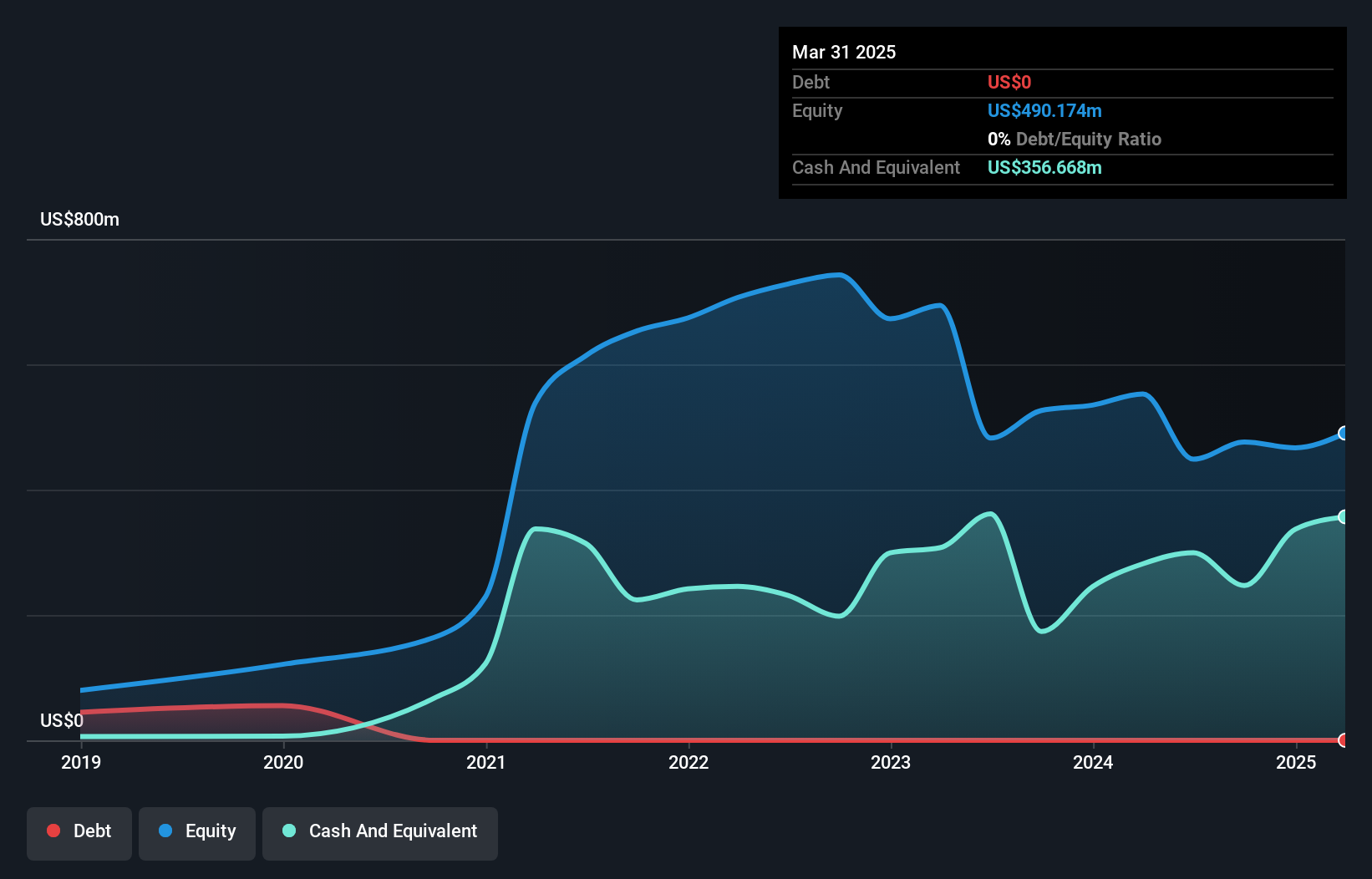

Cricut, a nimble player in the crafting market, has shown impressive financial resilience with no debt over the past five years and a notable 30% earnings growth last year. Despite this, its earnings have slipped by 24% annually over five years. The company is trading at 65.7% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Recently, Cricut unveiled the EasyPress SE line, enhancing its product offerings with user-friendly features and competitive pricing at US$99 and US$119 for different models. This innovation could bolster future performance amidst evolving consumer needs.

- Get an in-depth perspective on Cricut's performance by reading our health report here.

Examine Cricut's past performance report to understand how it has performed in the past.

Fresh Del Monte Produce (FDP)

Simply Wall St Value Rating: ★★★★★★

Overview: Fresh Del Monte Produce Inc. operates globally through its subsidiaries to produce, market, and distribute fresh and fresh-cut fruits and vegetables, with a market capitalization of approximately $1.87 billion.

Operations: The company generates revenue primarily from its Fresh and Value-Added Products segment, which contributes $2.63 billion, and the Banana segment, contributing $1.49 billion. Gross profit margin trends can provide insights into operational efficiency over time.

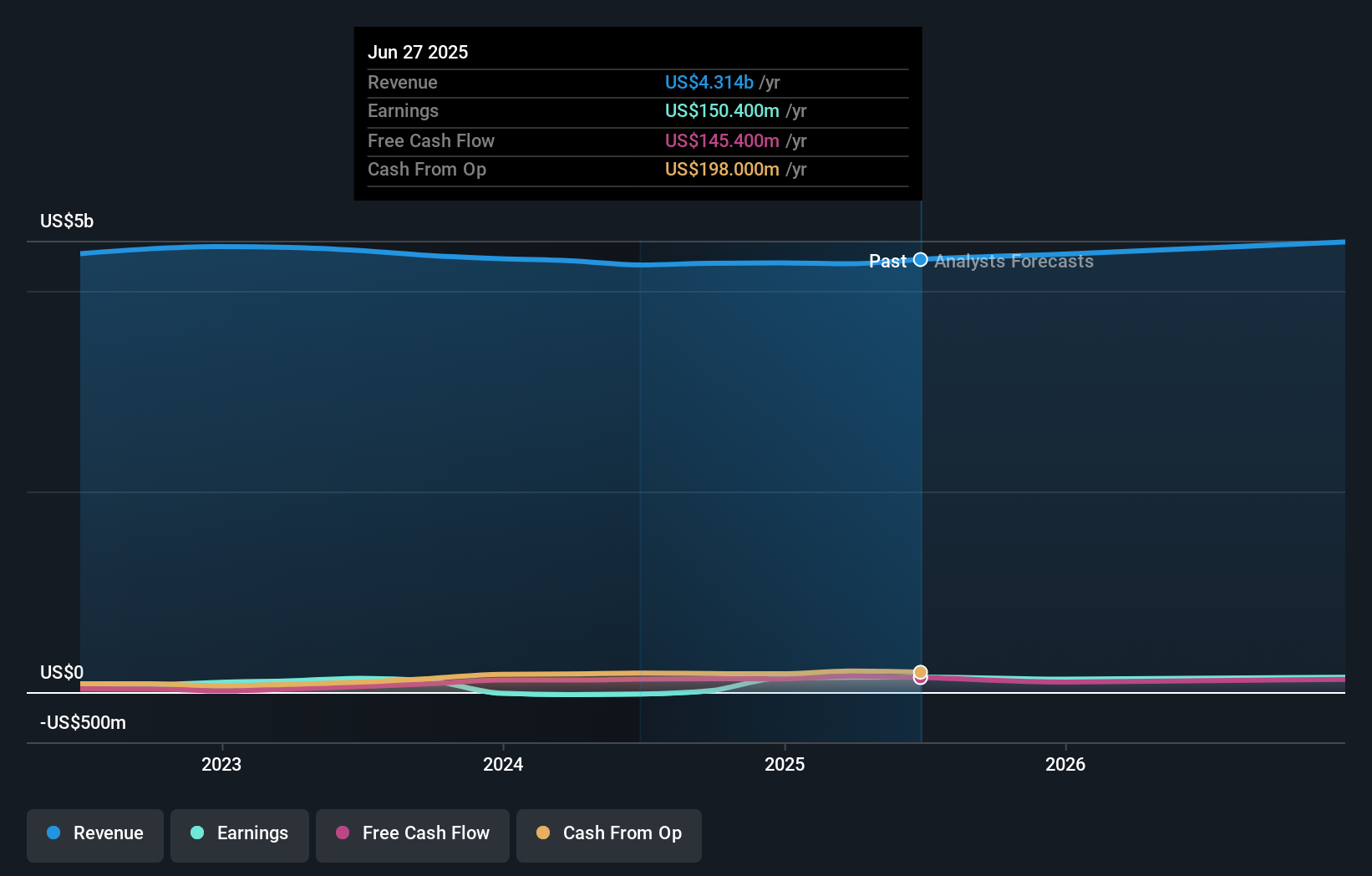

Fresh Del Monte Produce, a notable player in the food industry, is trading at 41.7% below its estimated fair value, suggesting potential undervaluation. The company's earnings have surged by 430.5% over the past year, far outpacing the industry's 1.4% growth rate. With a net debt to equity ratio of just 3.7%, their financial health appears robust despite a one-off $39.9M loss impacting recent results. A strategic partnership with THACO Agri aims to enhance sourcing and supply chain stability in Southeast Asia, aligning with Fresh Del Monte's global expansion strategy and commitment to operational excellence amidst rising production challenges.

- Navigate through the intricacies of Fresh Del Monte Produce with our comprehensive health report here.

Understand Fresh Del Monte Produce's track record by examining our Past report.

Global Ship Lease (GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market capitalization of approximately $1.33 billion.

Operations: GSL generates revenue primarily from chartering containerships, with reported revenue of $747.04 million from its shipping operations. The company operates under fixed-rate charters, providing a stable income stream.

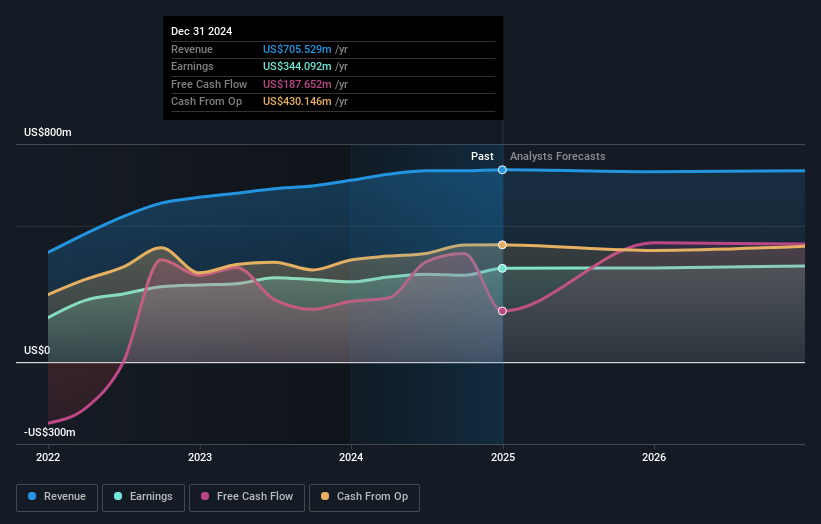

Global Ship Lease, a player in the containership sector, is making waves with its strategic focus on midsize vessels and fixed-rate charters. The company has seen earnings grow by 24.6% over the past year, outperforming the shipping industry which faced a 17.1% contraction. With a debt to equity ratio now at 30.1%, significantly down from 184.9% five years ago, GSL demonstrates financial prudence and stability in managing liabilities. Trading at an attractive valuation of 64.5% below estimated fair value, it offers potential upside despite forecasts of an average annual earnings decline of 13.8% over the next three years due to market volatility and regulatory pressures.

Where To Now?

- Reveal the 324 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal