Will Shift From 2025 Losses to 2026 Profit Guidance Change Centene's (CNC) Narrative

- In early February 2026, Centene Corporation reported fourth-quarter 2025 revenue of US$49.73 billion and a net loss of US$1.10 billion, with full-year 2025 revenue of US$194.78 billion and a net loss of US$6.67 billion.

- Alongside these results, Centene issued 2026 guidance calling for total revenue of US$186.50 billion to US$190.50 billion and GAAP diluted EPS of more than US$1.98, while highlighting margin improvement efforts and mixed membership trends across Medicaid and Commercial plans.

- Now, we'll examine how Centene's move from 2025 losses to 2026 EPS guidance above US$1.98 reshapes its investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Centene Investment Narrative Recap

To own Centene, you need to believe its large government-focused health plans can convert big revenue into consistent profits while managing policy and medical cost volatility. The key near term catalyst is management’s push to improve margins after a US$6.67 billion loss in 2025, while the biggest risk remains reimbursement and rate adequacy across Medicaid and Marketplace plans. The new 2026 EPS guidance signals a directional shift but does not remove that policy and cost risk.

The most relevant update here is Centene’s 2026 outlook, calling for US$186.50 billion to US$190.50 billion in revenue and GAAP diluted EPS above US$1.98. Taken together with management’s comments on margin improvement and mixed membership trends, this guidance sits at the center of the near term catalyst: restoring earnings power without sacrificing pricing discipline, even as Medicaid rolls shrink and Commercial business grows.

Yet behind the improved 2026 EPS guidance, investors should also be aware of the ongoing uncertainty around Medicaid rate adequacy and how...

Read the full narrative on Centene (it's free!)

Centene's narrative projects $195.6 billion revenue and $2.1 billion earnings by 2028. This requires 7.0% yearly revenue growth and no change in earnings from $2.1 billion today.

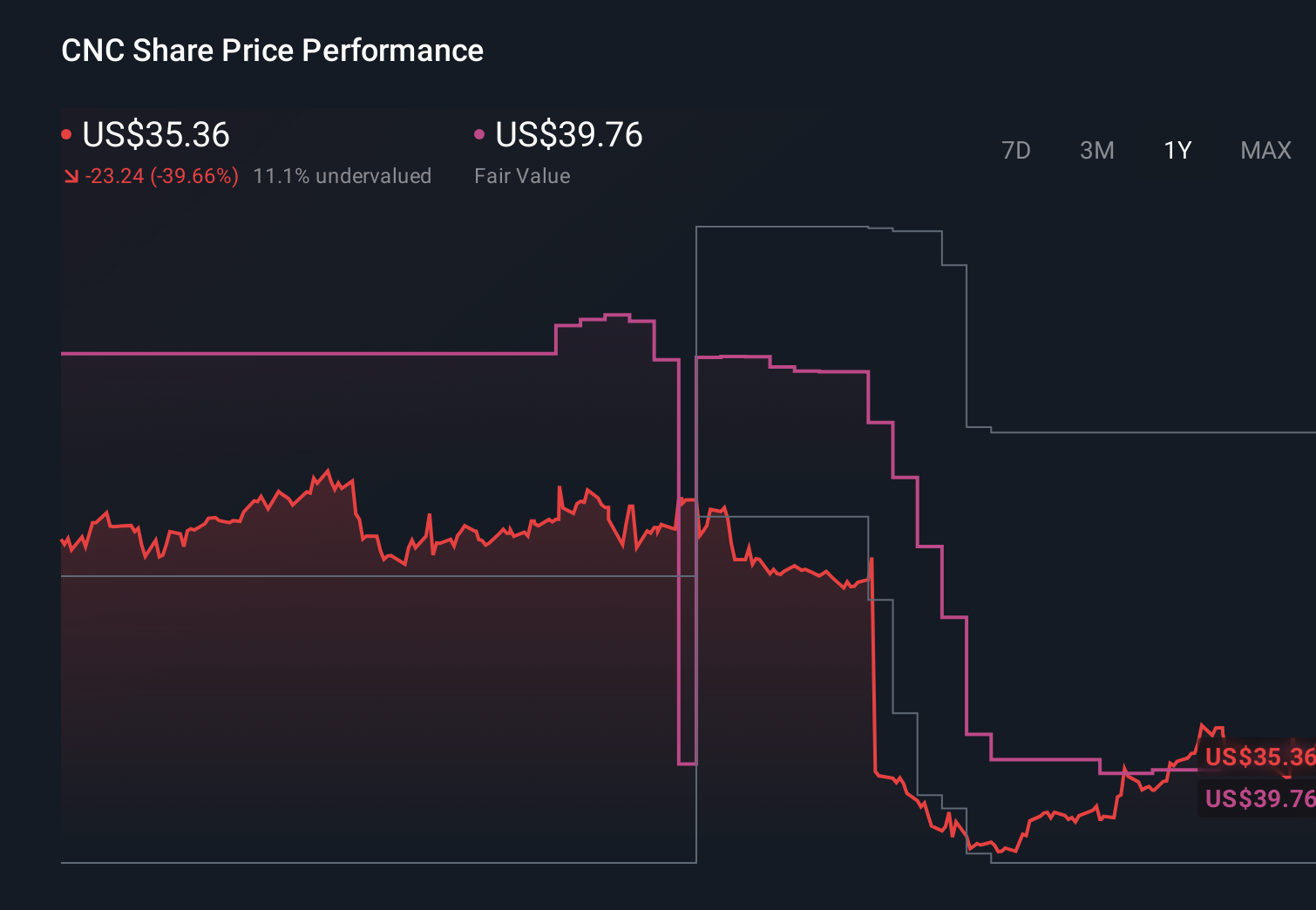

Uncover how Centene's forecasts yield a $41.12 fair value, in line with its current price.

Exploring Other Perspectives

Before this earnings release, the most optimistic analysts were assuming revenue could reach about US$215.7 billion and earnings US$2.7 billion by 2028, a far faster recovery than the consensus view that focused on gradual Medicaid margin repair. This latest loss and reset of 2026 guidance may lead both camps to revisit those assumptions, so it is worth weighing how your own expectations line up with such a wide range of possible outcomes.

Explore 16 other fair value estimates on Centene - why the stock might be worth 21% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've uncovered the 13 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find 51 companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal