A Look At DICK'S Sporting Goods (DKS) Valuation As Outdoor Store Closures Reshape Growth Story

Why DICK'S Sporting Goods (DKS) is back in focus

DICK'S Sporting Goods (DKS) is reshaping its outdoor footprint by closing Moosejaw stores and cutting back Public Lands locations, while recent store expansion and same store sales performance keep investor attention on the stock.

See our latest analysis for DICK'S Sporting Goods.

The reshaping of DICK'S outdoor concepts comes as the share price sits at US$204.41, with a 1-day share price return of 2.30% contrasting with a 30-day share price return decline of 5.18% and a 1-year total shareholder return decline of 13.18%. At the same time, the 3-year total shareholder return of 67.37% and 5-year total shareholder return of about 3x suggest longer term holders have still seen strong gains, which may indicate that recent news is contributing to a period of cooling momentum rather than a reset of the longer term story.

If this shake up in outdoor retail has you thinking about where else growth could come from, it might be worth scanning 22 top founder-led companies as a fresh set of ideas.

With the share price around US$204 and mixed recent returns set against multi year gains and analyst targets above the current level, you have to ask: is DICK'S Sporting Goods undervalued today, or is future growth already priced in?

Most Popular Narrative: 13.8% Undervalued

With DICK'S Sporting Goods last closing at $204.41 against a narrative fair value of about $237, the most followed view in the market sees a meaningful gap that hinges on how core margins and earnings hold up over time.

The analysts have a consensus price target of $237.2 for DICK'S Sporting Goods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $280.0, and the most bearish reporting a price target of just $165.0.

Curious what is sitting behind that fair value gap? The narrative focuses on steady revenue gains, firmer margins and a richer earnings multiple, all analyzed using a discount rate just under double digits.

Result: Fair Value of $237.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could be challenged if the Foot Locker deal drags on margins or if rising fixed costs collide with softer store traffic and slower same store sales.

Find out about the key risks to this DICK'S Sporting Goods narrative.

Another View: Cash Flows Paint A Tougher Picture

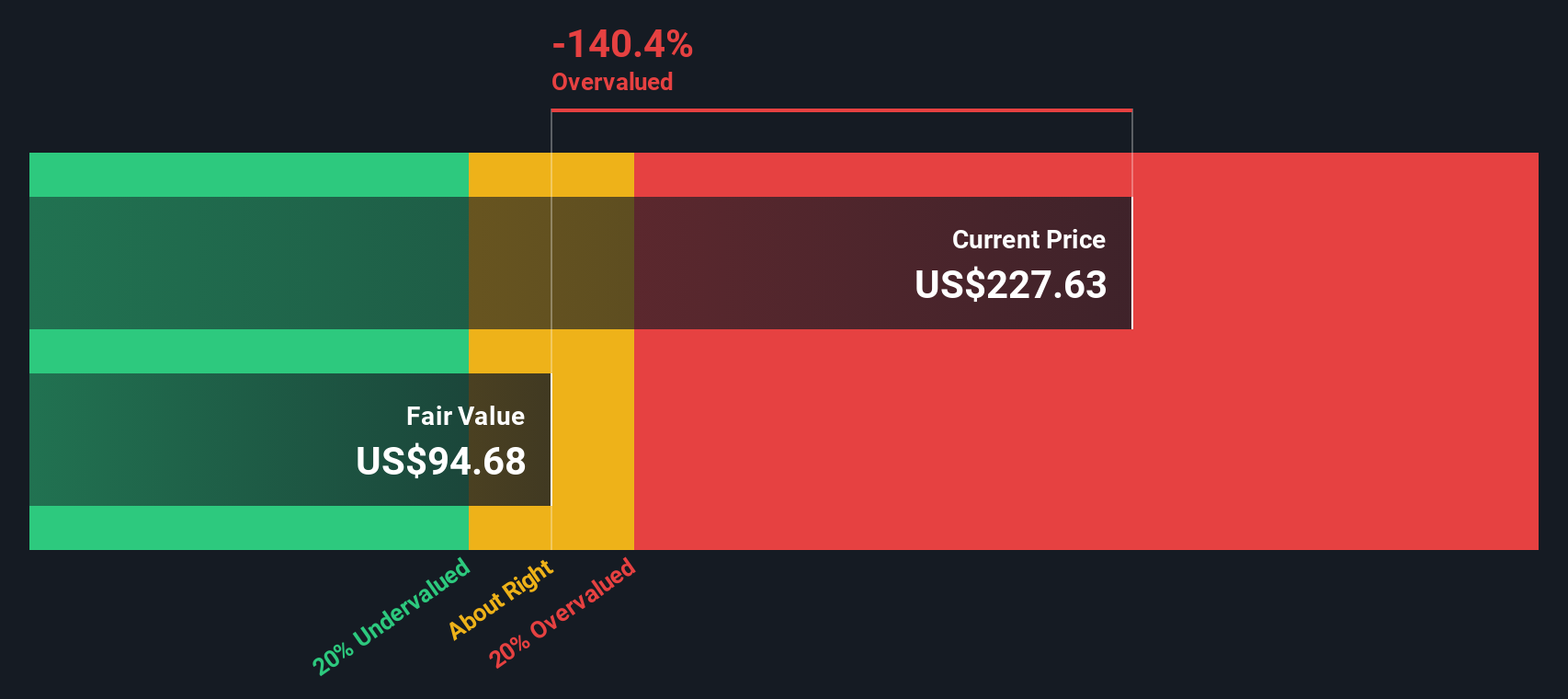

There is a twist when you look at DICK'S Sporting Goods through the SWS DCF model instead of earnings based estimates. On this view, the fair value sits around $71.90 per share, well below the current $204.41 price, which frames the stock as overvalued using projected cash flows.

So you have one approach flagging undervaluation and another pointing to downside. This raises the real question for you as an investor: do you trust the earnings path implied by analysts or the cash generation profile in the DCF?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DICK'S Sporting Goods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DICK'S Sporting Goods Narrative

If you see the story differently or simply prefer to work from your own numbers, you can build a custom view in just a few minutes by starting with Do it your way.

A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are not checking other opportunities now, you could miss out on stocks that better match your goals, risk comfort and income needs.

- Target potential mispricing by reviewing our list of 51 high quality undervalued stocks that combine quality fundamentals with a price that may not fully reflect them.

- Strengthen your portfolio’s foundation by scanning solid balance sheet and fundamentals stocks screener (45 results) where financial resilience and cleaner balance sheets are the focus.

- Lock in potential income streams by comparing 13 dividend fortresses that offer higher yields alongside an assessment of sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal