Warner Music Group (WMG) Is Up 5.6% After AI Licensing Push And Dividend Update Has The Bull Case Changed?

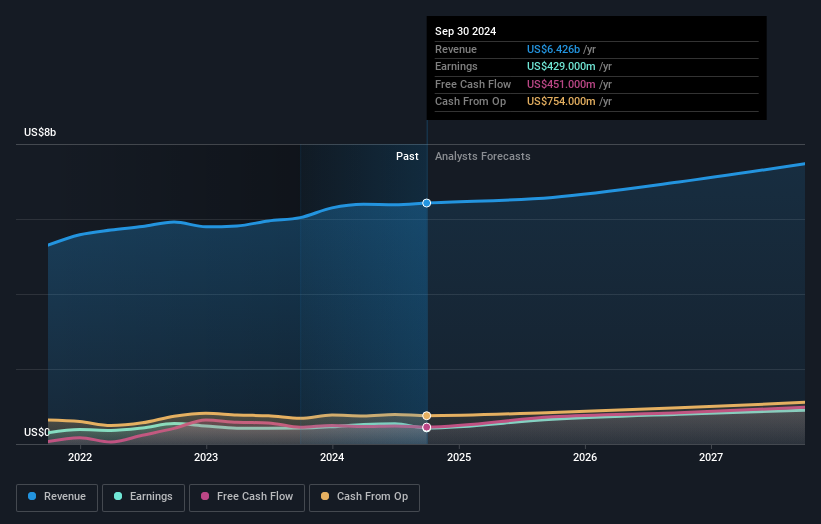

- Warner Music Group recently reported past first-quarter 2025 results showing higher sales of US$1.84 billion versus US$1.67 billion a year earlier, while net income declined to US$176 million, alongside ongoing share repurchases totaling 1,397,281 shares for US$41.36 million and the Board affirming a regular US$0.19 per-share dividend payable in March 2026.

- Management’s emphasis on revenue growth from streaming, AI licensing agreements, and expanded catalog acquisition joint ventures highlights how Warner is trying to reshape its earnings mix toward higher-margin digital and intellectual property income streams.

- Next, we’ll examine how Warner’s push into AI-driven licensing and catalog acquisitions shapes its investment narrative in light of recent share performance.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Warner Music Group's Investment Narrative?

For Warner Music Group, you really have to believe in the long-term value of its music and publishing assets and their ability to keep earning through streaming, licensing and new digital formats. The latest quarter reinforced that story on the top line, but the weaker net income and slim 4.4% margin keep profitability squarely in focus as a near term catalyst. Management’s push into AI licensing and catalog joint ventures sits at the heart of that earnings mix shift, and the recent AI deal commentary ties directly into why many investors are willing to look through short term volatility. The fresh US$0.19 dividend affirmation and modest buybacks signal confidence but do not materially alter the risk profile, which still includes high leverage, uneven cash coverage of debt, and a premium earnings multiple after a soft one year share return.

However, Warner’s high valuation and thinner margins are risks investors should really understand. Warner Music Group's shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Warner Music Group - why the stock might be worth just $31.00!

Build Your Own Warner Music Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warner Music Group research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Warner Music Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warner Music Group's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The future of work is here. Discover the 30 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Capitalize on the AI infrastructure supercycle with our selection of the 34 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal