Is It Too Late To Reassess Envista Holdings (NVST) After The Recent Share Price Surge?

- Wondering if Envista Holdings is priced attractively or if the recent buzz has already been baked into the share price? This article is here to help you frame that question clearly before you make any decisions.

- The stock has recently been active, with returns of 27.9% over 7 days, 29.4% over 30 days, 39.5% year to date, and 45.1% over 1 year, compared to declines of 24.9% over 3 years and 20.6% over 5 years.

- These moves sit against a backdrop of ongoing interest in Envista Holdings within the healthcare and dental equipment space, as investors weigh its positioning among peers and the broader sector. Market attention around the company provides useful context for interpreting both the shorter term gains and the weaker multi year track record.

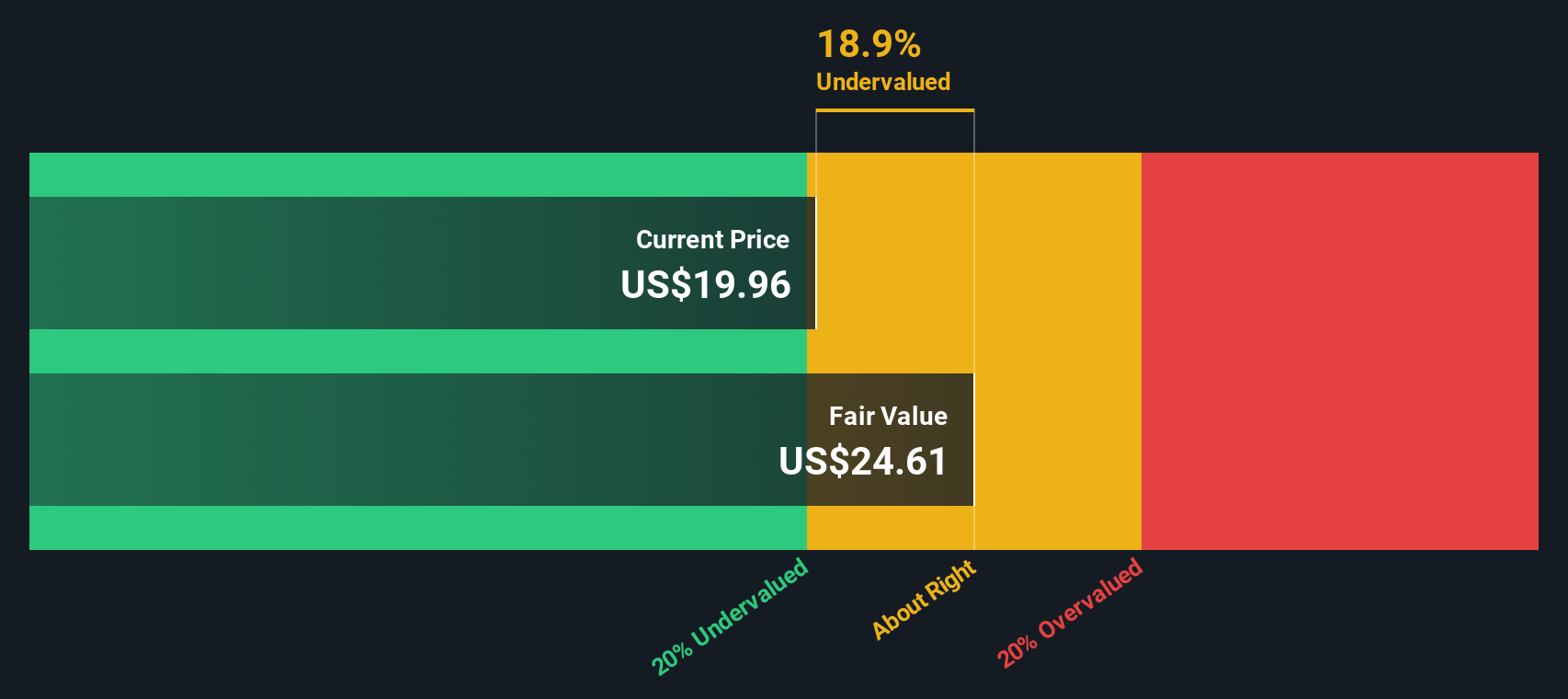

- On our checks, Envista Holdings currently has a valuation score of 1 out of 6. This suggests only a small portion of our valuation tests point to undervaluation. Next we will look at different valuation methods and then finish with a more complete way to think about what the stock might be worth.

Envista Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Envista Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth by projecting its future cash flows and then discounting those back to today’s value using a required rate of return.

For Envista Holdings, the model used is a 2 Stage Free Cash Flow to Equity approach, built on cash flow projections. The latest twelve month free cash flow stands at about $227.8 million. Analyst inputs and subsequent extrapolations suggest free cash flow reaching around $327.3 million in 2035, with interim annual projections between 2026 and 2034 ranging from roughly $238.5 million to $319.1 million, all expressed in dollars.

When these projected cash flows are discounted, the DCF model produces an estimated intrinsic value of $30.63 per share. Compared with the current share price used in this model, that implies Envista Holdings is trading at roughly a 1.2% discount, which is a very small gap between price and modelled value.

Result: ABOUT RIGHT

Envista Holdings is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

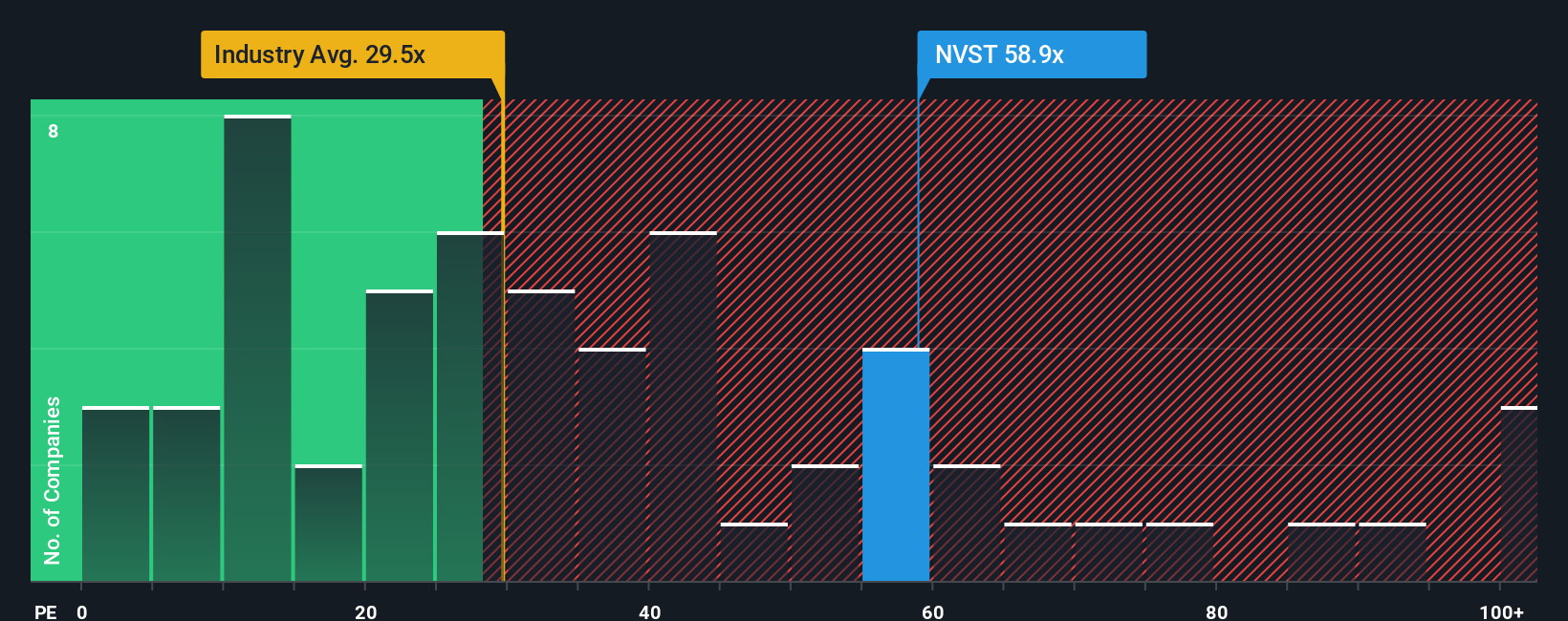

Approach 2: Envista Holdings Price vs Earnings

For a profitable company, the P/E ratio is a useful way to see how much you are paying for each dollar of earnings. A higher or lower P/E often reflects what investors expect for future growth and how much risk they see in the business, so a “normal” level is not the same for every stock.

Envista Holdings currently trades on a P/E of 105.46x. That sits well above the Medical Equipment industry average of 30.85x and also above the peer group average of 36.18x. On those simple comparisons alone, the shares look expensive relative to many alternatives in the same space.

Simply Wall St’s Fair Ratio for Envista, at 33.21x, is an attempt to adjust for factors that basic comparisons miss, including the company’s earnings growth profile, profit margins, industry, market value and risk characteristics. Because it blends all of these into a single benchmark tailored to Envista, it can be more informative than just lining the stock up against an industry or peer average. With the current P/E of 105.46x versus a Fair Ratio of 33.21x, the stock screens as materially above the level suggested by this framework.

Result: OVERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Envista Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation. Narratives on Simply Wall St’s Community page let you turn your view of Envista Holdings into a clear story that links assumptions about future revenue, earnings and margins to a forecast and then to a fair value. This helps you compare that fair value with today’s share price when thinking about buying or selling. It also updates automatically when new earnings or news arrive, and makes it easy to see how different investors can reasonably disagree. For example, one Envista Narrative might lean closer to a higher fair value around US$35.00 based on stronger execution and higher future P/E assumptions, while another might anchor nearer US$18.00 with more cautious growth and margin expectations. You can then decide which story feels closer to your own view.

For Envista Holdings however we will make it really easy for you with previews of two leading Envista Holdings Narratives:

Fair value: US$35.00

Gap to this fair value versus the last close of US$30.26: about 13.6% below that narrative fair value

Revenue growth assumption: 4.11%

- Analysts in this camp see Envista improving execution, trimming costs and lifting margins, helped by G&A reductions, lower unit costs and operating leverage.

- They expect growing demand for restorative dentistry, AI enabled digital tools and software like services to support earnings power over time, including in emerging markets.

- This view leans on analysts using a future P/E in the low twenties, with higher earnings and margins than today, to arrive at a fair value of US$35.00.

Fair value: US$18.00

Gap to this fair value versus the last close of US$30.26: about 68.1% above that narrative fair value

Revenue growth assumption: 3.57%

- Analysts in this camp focus on risks from slower procedure volumes, regulatory pressure on pricing and the need to keep up with digital dentistry and new competitors.

- They highlight cost and margin headwinds, and the influence of large dental service groups with greater pricing power, as reasons to be cautious on earnings resilience.

- To reach a fair value of US$18.00, this view combines modest revenue growth, tighter margin assumptions and a lower valuation multiple than many peers.

If you want to go beyond these short previews and see how the numbers, risks and assumptions are joined together into full stories, you can read the complete Community Narratives for Envista and compare how different investors are thinking about the same stock.

Curious how numbers become stories that shape markets? Explore Community Narratives

Do you think there's more to the story for Envista Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal