A Look At SiriusPoint (SPNT) Valuation As Capital Structure And Underwriting Leadership Evolve

Why SiriusPoint’s capital move and leadership change matter for shareholders

SiriusPoint (SPNT) has put investors on alert with two fresh developments: a full redemption of its Series B preference shares in February 2026 and a new senior underwriting hire in North America P&C Insurance.

See our latest analysis for SiriusPoint.

After a muted few months, with a year to date share price return of 5.03% decline and a 90 day share price return of 1.28% decline, SiriusPoint’s recent 1 day share price gain of 1.88% comes against a backdrop of strong long term momentum, including a 1 year total shareholder return of 40.32% and a 3 year total shareholder return of about 18x.

If this capital reshuffle has you thinking about where else value might emerge, it could be a good time to broaden your search and check out 23 top founder-led companies.

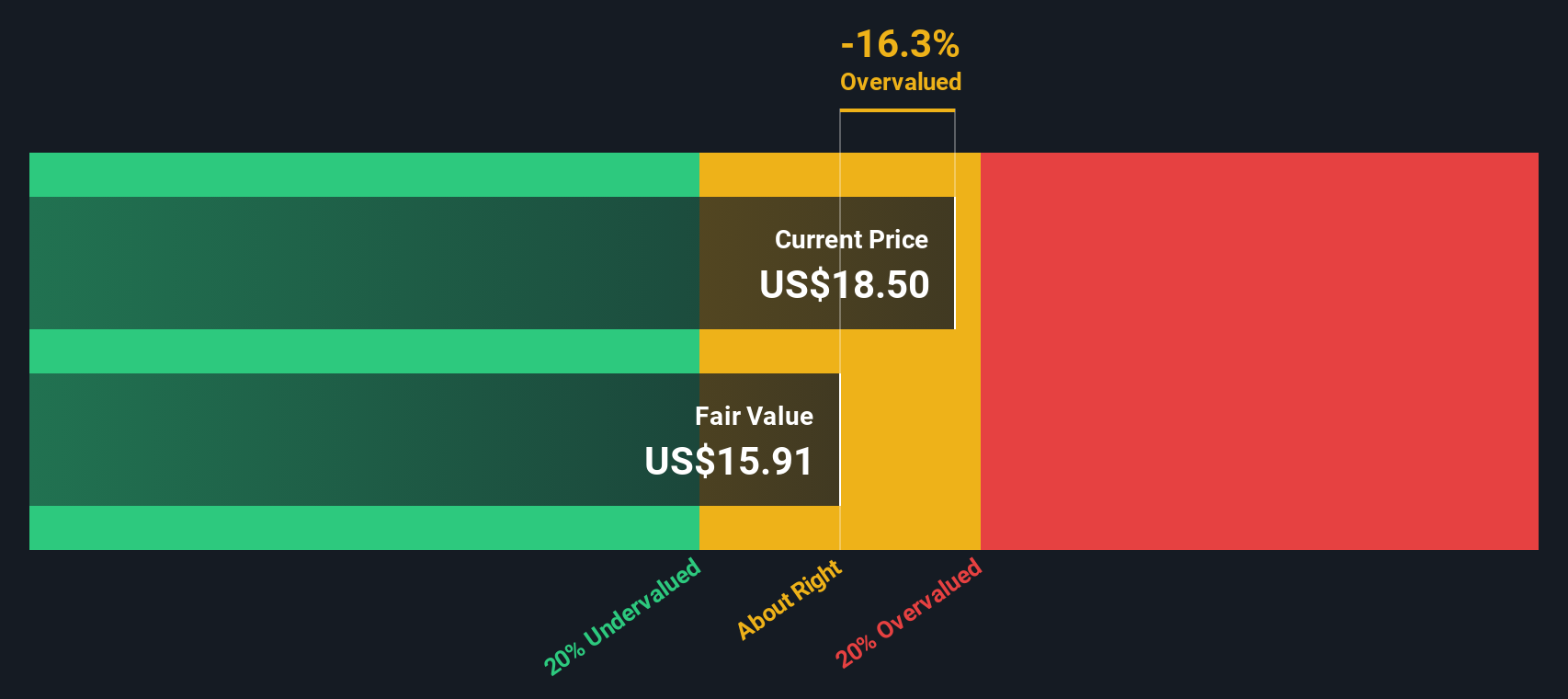

SiriusPoint now trades around $20.01, with an indicated 40% intrinsic discount and room to the average analyst target. The key question is whether today’s price still underestimates the business or already reflects future progress.

Most Popular Narrative: 27.2% Undervalued

With SiriusPoint last closing at $20.01 and the most followed fair value estimate sitting at $27.50, the narrative points to a sizeable gap the market has not closed yet, anchored on underwriting discipline and capital strength.

The prudent reserving philosophy, consistent favorable reserve development, and a strong capital position (BSCR ratio of 223%) support underwriting confidence and capital deployment. In an environment of tightening industry regulation and rising capital requirements, this is expected to support market share gains and book value per share growth for well-capitalized players like SiriusPoint.

Curious what kind of revenue path, margin lift, and earnings multiple are baked into that fair value number? The narrative leans on specific growth, profitability, and capital return assumptions that create a very different picture from the current $20.01 share price. However, the exact mix of those ingredients might surprise you.

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on MGA partnerships and reserving staying on track, and any hit to investment income or catastrophe losses could quickly challenge that undervalued story.

Find out about the key risks to this SiriusPoint narrative.

Another view on SiriusPoint’s $27.50 fair value

Our DCF model suggests a higher fair value of $33.31 per share, compared with the $27.50 narrative estimate and the current $20.01 price. The current price also sits 39.9% below our fair value. If both methods are pointing in the same direction, is the market being too cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SiriusPoint Narrative

If you are not fully on board with these assumptions or prefer to test your own, you can build a custom SiriusPoint view in just a few minutes, starting with Do it your way.

A great starting point for your SiriusPoint research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for your next opportunity?

If SiriusPoint has sharpened your thinking, do not stop here. Put that momentum to work by scanning for other ideas before the market moves on without you.

- Target resilient income potential by reviewing 14 dividend fortresses that could help anchor your portfolio with steady cash flows.

- Spot potential mispricings early by running through 51 high quality undervalued stocks that combine solid fundamentals with room for a re rating.

- Unearth off the radar opportunities by checking the screener containing 24 high quality undiscovered gems that most investors may not be paying attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal