A Look At Spectrum Brands (SPB) Valuation After Buyback Launch And Strong Pet Care Results

Spectrum Brands Holdings (SPB) has caught investor attention after first quarter results, a new US$300 million share buyback authorization, continued dividends, and management commentary highlighting acquisition plans in Global Pet Care and Home & Garden.

See our latest analysis for Spectrum Brands Holdings.

The earnings beat in Global Pet Care, fresh US$300 million buyback authorization, ongoing repurchases and confirmed dividend have arrived alongside a 90 day share price return of 43.82% and a 1 year total shareholder return of 0.53%. This suggests momentum has recently picked up after a flatter longer term outcome.

If this kind of rebound has your attention, it could be a good moment to broaden your watchlist with 22 top founder-led companies and see what other businesses are starting to gain traction.

With the shares up sharply over the past 90 days and trading at US$74.18, compared with an average analyst price target of US$85.29 and a potential intrinsic value gap, investors may wonder whether there is still a buying opportunity or if the market has already priced in future growth.

Most Popular Narrative: 1.3% Undervalued

At $74.18, Spectrum Brands Holdings sits slightly below the most followed fair value estimate of $75.14, which is built using a 6.96% discount rate.

As supply chain disruptions and tariff-related pricing negotiations subside, Spectrum's normalized shipping activity and restored customer relationships position the company to recapture lost sales volume, supporting revenue growth and margin recovery into fiscal 2026. Accelerated product innovation and expanded distribution in pet care (e.g., new health/wellness treats, Nature's Miracle, international launches) enable Spectrum to benefit from the ongoing global increase in pet ownership and premiumization, driving recurring revenue and market share gains.

Curious what sits behind that near term recovery story? Revenue barely grows, yet earnings and margins tell a very different tale. One valuation multiple quietly does the heavy lifting. The full narrative lays out the precise earnings path needed to justify that fair value tag.

Result: Fair Value of $75.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on supply chains staying stable and consumer demand holding up. Renewed trade tensions or weaker pet and home spending could quickly undermine that recovery story.

Find out about the key risks to this Spectrum Brands Holdings narrative.

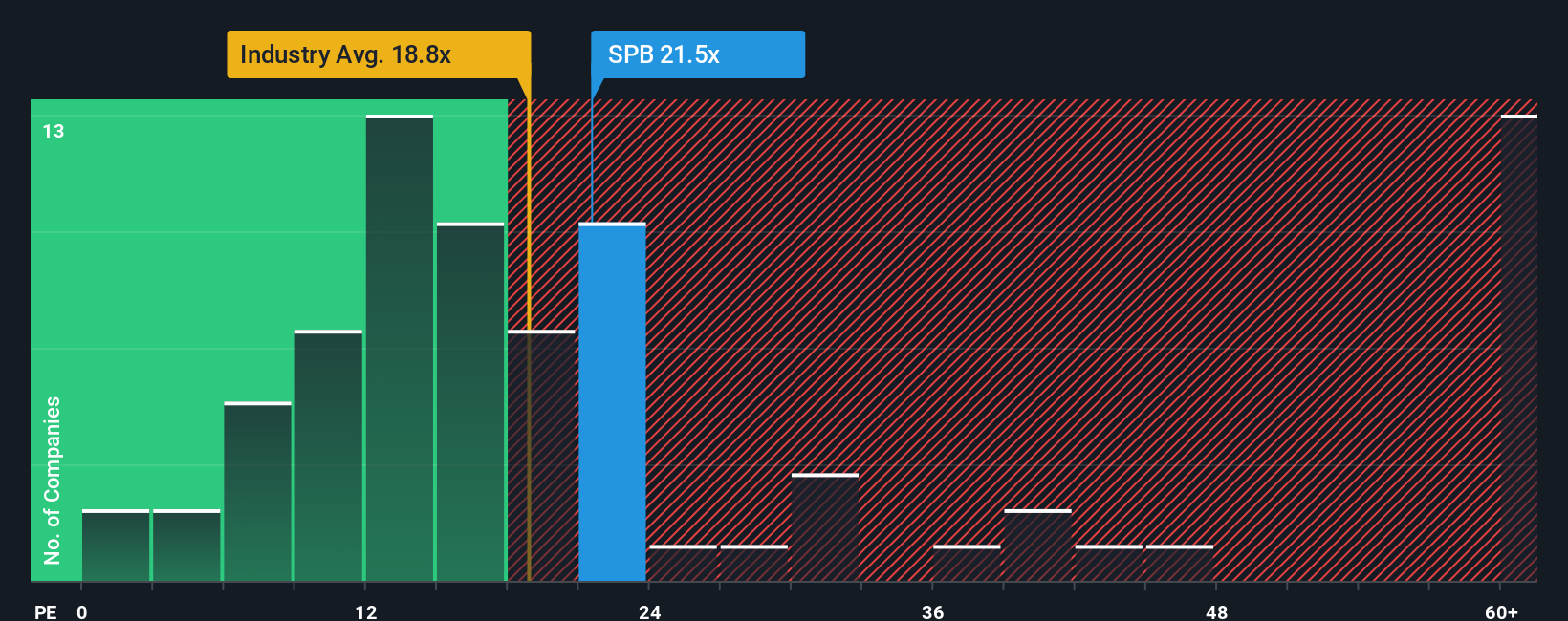

Another View: Earnings Multiple Sends a Mixed Signal

Our earnings based view is less generous than the 1.3% undervalued fair value. At a P/E of 16.4x, Spectrum Brands trades above our fair ratio of 15.7x, yet below both the global Household Products group at 17.3x and peer average of 19.2x.

So is this a mild overvaluation on our fair ratio, or a relative discount to peers that could close over time, depending on how you rate the risks and earnings outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Spectrum Brands Holdings Narrative

If you see the story differently or prefer to test the assumptions yourself, you can create a tailored view in minutes with Do it your way.

A great starting point for your Spectrum Brands Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to find your next idea?

If Spectrum Brands has you thinking more broadly about your portfolio, this is the moment to widen your search before the next set of opportunities moves on without you.

- Target long term compounding potential by reviewing 52 high quality undervalued stocks that pair solid fundamentals with prices that sit below many investors' radar.

- Secure your income stream by checking out 14 dividend fortresses that aim for 5%+ yields while still focusing on stability.

- Protect your downside by focusing on 83 resilient stocks with low risk scores that score well on balance sheet strength and risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal