Reassessing GameStop (GME) Valuation After Recent Volatility And Bold $220 Fair Value Narrative

Why GameStop Is Back in Focus for Investors

GameStop (GME) is back on many watchlists after recent trading left the stock with a mix of short term losses and gains, prompting investors to reassess what is currently priced in.

See our latest analysis for GameStop.

Recent trading has been choppy, with a 1-day share price return of 1.36% decline and a 7-day share price return of 4.68% decline. However, the 30-day and year to date share price returns of 16.06% and 19.50% suggest momentum has been rebuilding after earlier weakness. Over a longer window, the 1-year total shareholder return of 8.08% decline contrasts with the 3-year and 5-year total shareholder returns of 26.61% and 90.30%. This highlights how sentiment around GameStop can shift sharply as investors reassess both risk and potential.

If this kind of volatility has your attention, it could be a good moment to broaden your watchlist with other opportunities such as 22 top founder-led companies.

With GameStop trading at a sizeable intrinsic discount and recent returns pointing in different directions over short and long periods, the real question is whether you are looking at an overlooked opportunity or a stock where the market already prices in future growth.

Most Popular Narrative: 88.8% Undervalued

At a last close of $24.64 versus a narrative fair value of $220, the gap is wide enough that many investors are asking what assumptions bridge that difference.

GameStop Corp. has completed a fundamental transformation from a struggling retailer hemorrhaging cash to a profitable enterprise with one of the strongest balance sheets in consumer retail. While legacy media narratives focus on declining revenue, sophisticated investors recognize this as deliberate optimization, prioritizing sustainable profitability over vanity metrics.

Curious what has to happen for that higher value to make sense? The narrative leans on rapid earnings expansion, richer profit margins and a premium future earnings multiple. The full story joins those pieces into one bold set of numbers behind that $220 figure.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on GameStop keeping stores and costs under control, as well as managing Bitcoin exposure, both of which could quickly challenge that $220 narrative.

Find out about the key risks to this GameStop narrative.

Another View: What Earnings Multiples Are Saying

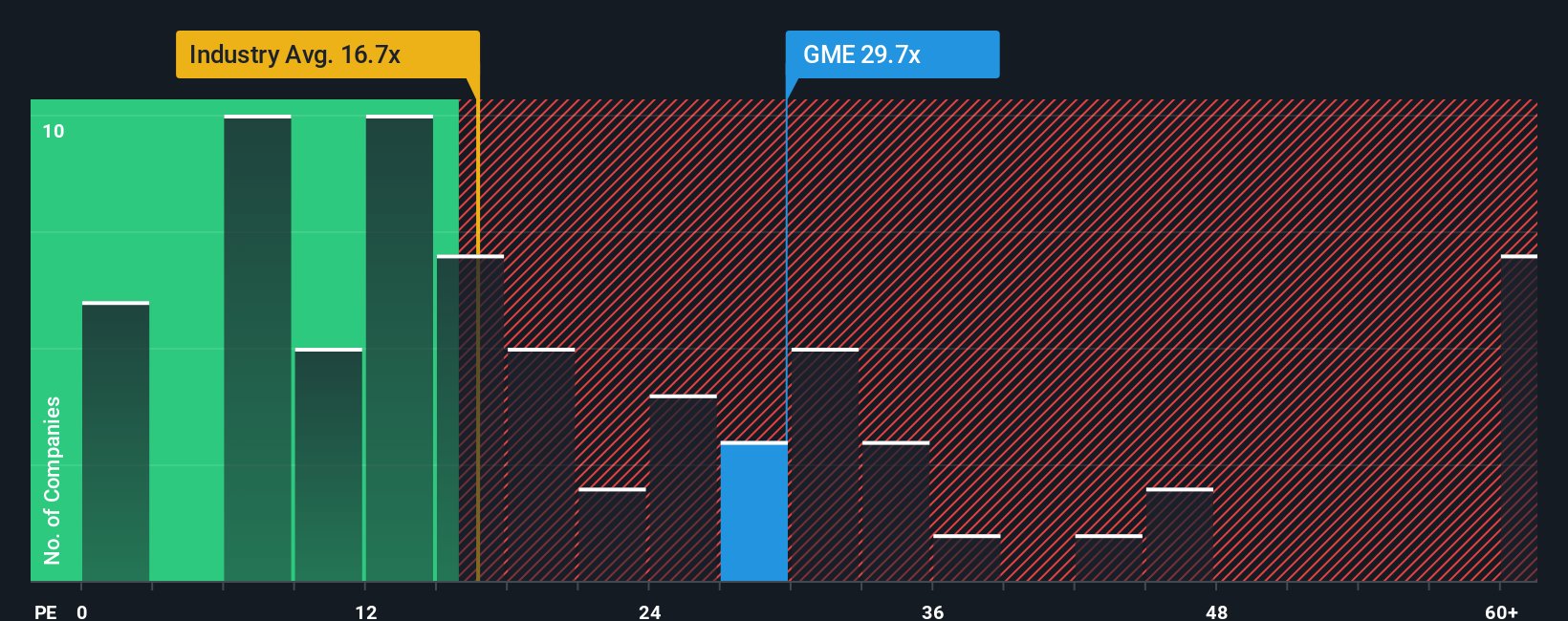

That $220 fair value narrative is bold, but the market is currently pricing GameStop at a P/E of 26.2x, which is higher than both the US Specialty Retail industry at 21.5x and its peer average of 20.6x. Put simply, the market is already asking you to pay more per dollar of earnings than for many alternatives. The key question is whether that represents a cushion or additional valuation risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you see the numbers differently or simply prefer to test your own assumptions, you can build your version of the story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for more investment ideas?

If GameStop has sharpened your thinking, do not stop here. Widen your watchlist with a few focused screens that surface very different types of opportunities.

- Target potential mispricings by scanning companies that show up in our 52 high quality undervalued stocks, where price and fundamentals can look out of sync.

- Prioritize resilience by tracking businesses filtered through our solid balance sheet and fundamentals stocks screener (45 results), so you focus on companies that may better handle financial stress.

- Hunt for lesser known opportunities by running our screener containing 24 high quality undiscovered gems, before these names end up on everyone else's radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal