DOJ Antitrust Probe Puts Netflix Warner Bros Deal And Stock In Focus

- Netflix, ticker NasdaqGS:NFLX, is under an expanded US Department of Justice antitrust investigation tied to its proposed $82.7b acquisition of Warner Bros. Discovery.

- The probe now covers both the merger and Netflix's broader business practices, with Senate and regulatory hearings putting the deal and the company under intense public scrutiny.

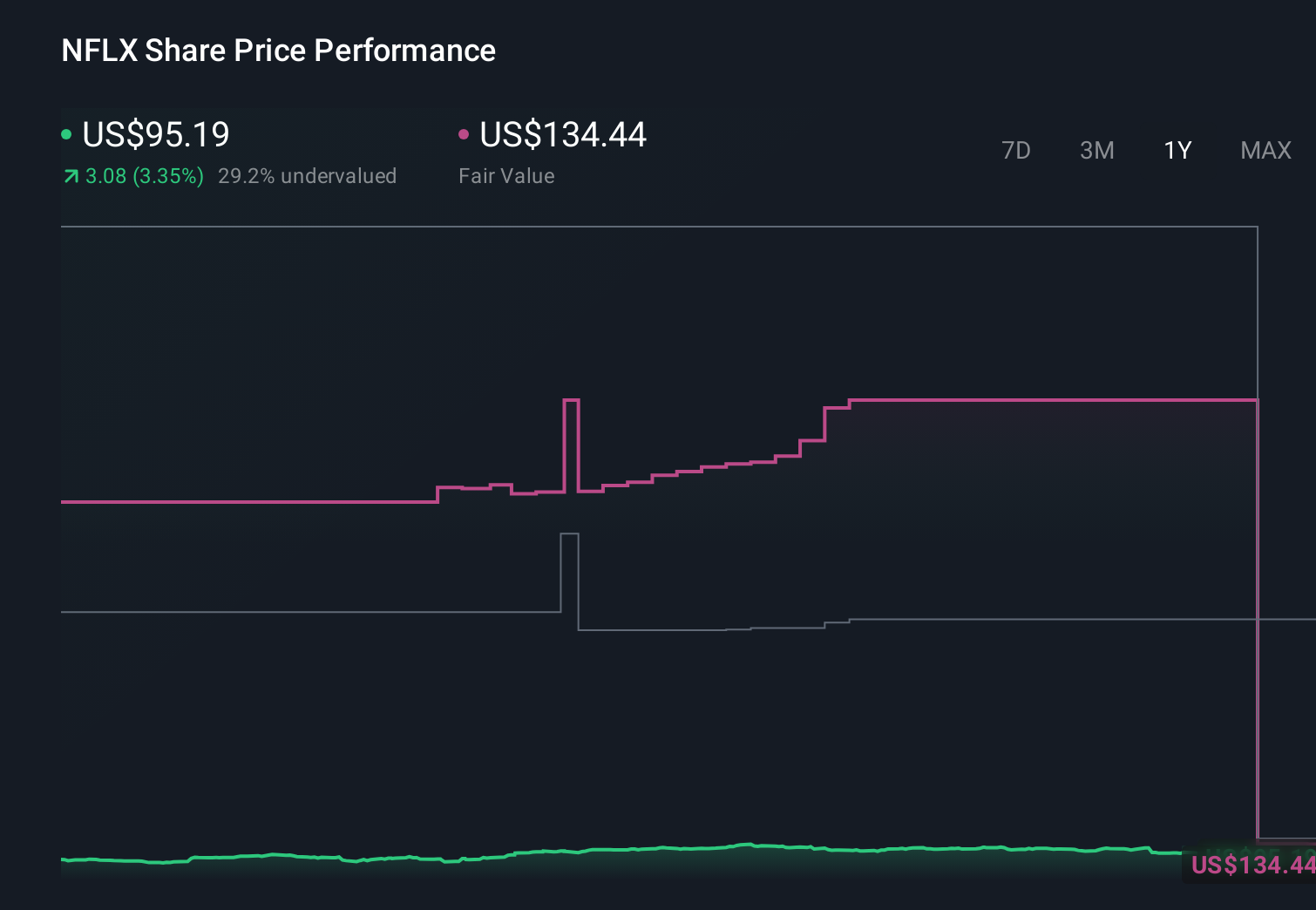

- This review comes as Netflix trades at $82.2, with the stock showing a 136.6% return over 3 years, a 47.7% return over 5 years, and an 18.9% decline over the past year.

For investors watching NasdaqGS:NFLX, the DOJ's broader antitrust review comes at a time when the share price is $82.2 and the performance picture is mixed. The stock has delivered a 136.6% return over 3 years, while the 5 year return is 47.7% and the 1 year return shows an 18.9% decline. Over shorter periods, the shares show a 1.5% decline over 7 days, an 8.1% decline over 30 days, and a 9.7% decline year to date.

Regulatory outcomes are uncertain, and this investigation adds another layer of complexity for anyone assessing Netflix's long term role in streaming and media. As the DOJ and Senate review the proposed Warner Bros. Discovery deal and Netflix's market position, investors may watch for any changes to the transaction terms, the company's deal pipeline, or its approach to content and partnerships.

Stay updated on the most important news stories for Netflix by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Netflix.

Is Netflix financially strong enough to weather the next crisis?

The expanded DOJ antitrust probe goes beyond the Warner Bros. Discovery deal terms and into Netflix's broader conduct, which means the potential impact is not just whether the $82.7b transaction closes but also whether regulators push for changes in how Netflix operates in streaming and content licensing. For investors, the key questions are whether the review leads to structural remedies such as content access commitments, limits on exclusivity or even a lawsuit that delays or blocks the deal and extends uncertainty for longer.

How this fits with the Netflix narrative you have been following

Existing investor narratives around Netflix focus heavily on ad supported plans, margin expansion, and its evolution into a mature, high profit entertainment platform, with live sports and content scale as important levers. This investigation sits directly in the middle of that story because combining Netflix with Warner Bros. Discovery's studios and HBO Max could deepen its content pool versus peers like Disney and Amazon, while also increasing regulatory attention on how it uses that scale to support long term earnings growth.

Risks and rewards investors are weighing right now

- ⚠️ Regulatory risk that the DOJ or other agencies seek to block or heavily condition the Warner Bros. Discovery acquisition, which could disrupt Netflix's deal thesis and timing.

- ⚠️ Balance sheet and cash flow risk from an $82.7b all cash deal that adds debt, pauses buybacks and could interact with any fines, legal costs or mandated remedies.

- 🎁 Scale opportunity if the transaction goes ahead, giving Netflix control of a larger content library and HBO Max, which could support its ad business and global subscriber monetization versus Disney+ and Amazon Prime Video.

- 🎁 Options market data showing calls outnumbering puts and a relatively low put or call ratio, which some investors may read as interest in upside exposure even as the investigation unfolds.

What to watch next

From here, the practical markers to watch are any DOJ timelines, signals of a formal lawsuit or settlement talks, comments from the Senate Judiciary hearings, and how Netflix updates guidance on margins, ad revenue and leverage as the review progresses. If you want to see how other investors are interpreting this in the context of Netflix's long term story, take a moment to read the community narratives on Netflix's dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal