A Look At Adtalem Global Education’s Valuation As It Rebrands To Covista And Highlights Healthcare Focus

Why Covista’s rebrand matters for Adtalem shareholders

Adtalem Global Education (ATGE) is in the middle of a visible shift, formally adopting the Covista name and updating its corporate charter, bylaws, and registered agent as it leans into a healthcare focused identity.

This name change lines up with a coming Investor Day and a planned ticker switch to CVSA, giving investors a fresh lens on how the company sees its role in addressing documented healthcare workforce needs.

See our latest analysis for Adtalem Global Education.

Recent trading has been mixed, with a 1-day share price return of 1.22% but a 30-day share price return showing an 8% decline. The 3-year total shareholder return is up more than 2.5x, which points to longer term momentum despite a 1-year total shareholder return decline of 3.14%.

If Covista’s healthcare focus has your attention, it could be a good moment to see what else is reshaping care through technology, starting with our screener of 26 healthcare AI stocks.

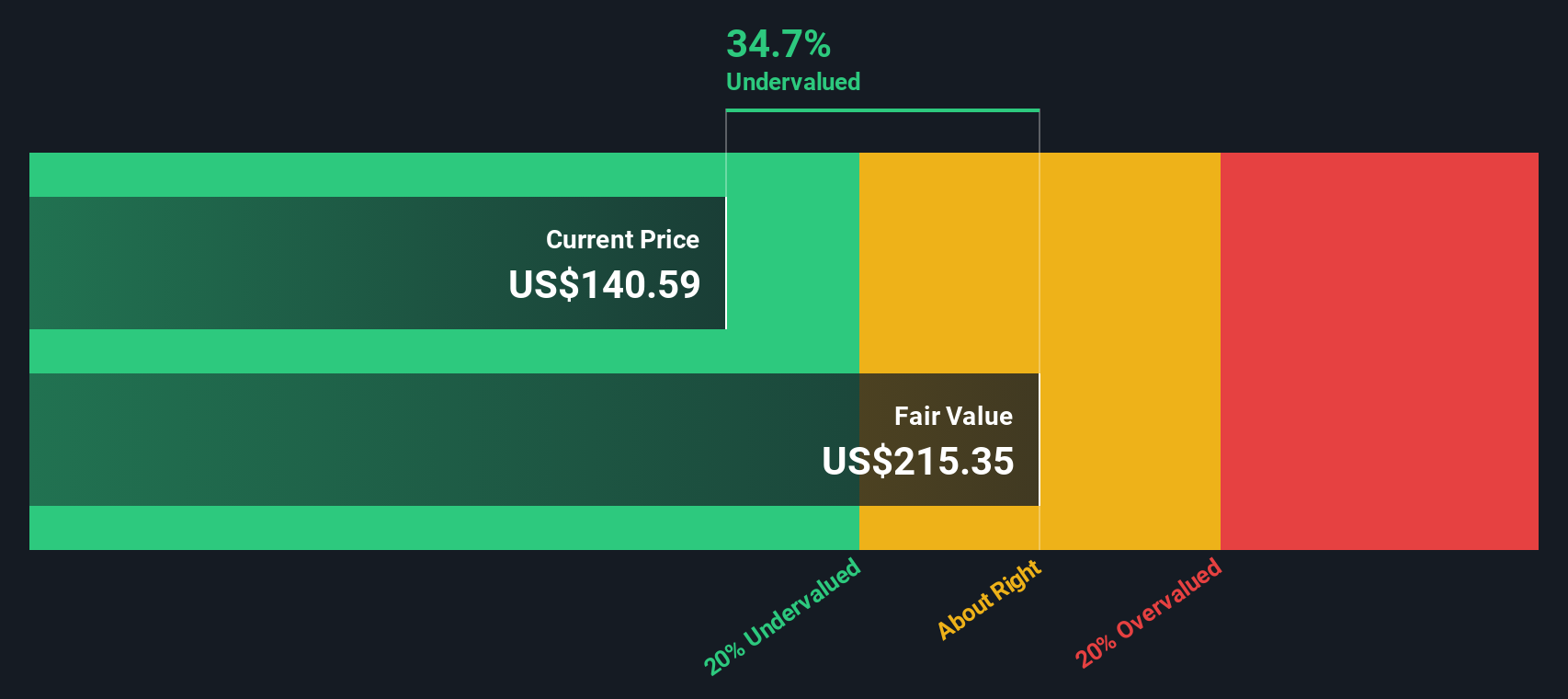

With the rebrand in motion, solid recent earnings and the stock trading at what some models flag as a discount to estimated value, you have to ask: is this a genuine opening, or is the market already pricing in future growth?

Price-to-earnings of 14.2x: Is it justified?

On the numbers, Adtalem looks inexpensive relative to several benchmarks, with a P/E of 14.2x and multiple signals suggesting the market price may be conservative.

The P/E multiple compares the current share price of $104.48 to the company’s earnings per share and is a common way investors gauge how much they are paying for each dollar of profit. For Adtalem, this 14.2x P/E is flagged as good value against several anchors, which raises the question of whether expectations for future earnings are being priced cautiously.

First, the stock is described as trading at good value compared to peers and the broader US Consumer Services industry. Its 14.2x P/E sits below the peer average of 19.7x and below the US Consumer Services industry average of 16.2x. On top of that, the SWS fair P/E estimate is 19.1x, which is materially higher than where the market sits today and could be a level investors watch if sentiment shifts.

Taken together with revenue of $1.89b, net income of $253.98m, annual revenue growth of 6% and annual net income growth of 13.14%, the current P/E suggests the market is assigning a lower multiple than both sector averages and the fair ratio models indicate.

Explore the SWS fair ratio for Adtalem Global Education

Beyond multiples, the SWS DCF model also points to a gap between price and estimated value. At a last close of $104.48, Adtalem is described as trading 55.4% below an internal estimate of fair value and below an estimated future cash flow value of $234.25 per share in $.

The DCF approach projects the cash the business is expected to generate in the future and discounts those flows back to today using a required rate of return. That can give a sense of what the shares might be worth if those cash flows arrive as expected.

For a company focused on healthcare education, with growing earnings, higher net profit margins than last year and high quality earnings, that kind of model can help investors frame how much future cash generation is implied at the current price.

Look into how the SWS DCF model arrives at its fair value.

Result: Price-to-earnings of 14.2x (UNDERVALUED)

However, the picture is not one sided, with a flat year to date return and a 1 year total return decline of 3.14% hinting at sentiment risk.

Find out about the key risks to this Adtalem Global Education narrative.

Another view using cash flows

The earnings multiple paints Adtalem as inexpensive, but our DCF model also suggests the shares are trading well below an estimated future cash flow value of $234.25 per share, versus the current price of $104.48. If both signals point to undervaluation, what might the market be hesitating about?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adtalem Global Education for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Adtalem Global Education Narrative

If you see the data differently or want to stress test your own view, you can build a custom thesis in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Adtalem Global Education.

Looking for more investment ideas?

If Adtalem has sparked your interest, do not stop here. The same data driven tools can help you spot other opportunities that fit your style.

- Target potential value opportunities by scanning our list of 52 high quality undervalued stocks, built from companies that pair supportive fundamentals with prices that some models flag as conservative.

- Prioritise resilience by reviewing a solid balance sheet and fundamentals stocks screener (45 results) so you can focus on businesses with financial positions that may better handle pressure.

- Hunt for fresh ideas using a screener containing 24 high quality undiscovered gems that highlights companies with strong underlying metrics that many investors may not be watching yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal