Exploring 3 High Growth Tech Stocks In The US Market

As February begins, the U.S. stock market has shown a robust start with major indices like the Dow Jones and S&P 500 posting significant gains, reflecting positive sentiment despite recent economic uncertainties such as delayed jobs reports and trade policy shifts. In this dynamic environment, high growth tech stocks are often characterized by their innovative capabilities and potential to leverage emerging trends like AI and cloud computing, making them intriguing options for investors seeking exposure to sectors poised for expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 25.70% | 26.55% | ★★★★★★ |

| 22.17% | 28.23% | ★★★★★★ | |

| Workday | 10.61% | 28.21% | ★★★★★☆ |

| Procore Technologies | 11.43% | 60.07% | ★★★★★☆ |

| Zscaler | 15.86% | 45.93% | ★★★★★☆ |

| Sandisk | 28.86% | 45.57% | ★★★★★★ |

| Circle Internet Group | 24.24% | 85.21% | ★★★★★☆ |

| Viridian Therapeutics | 46.35% | 51.40% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Protagonist Therapeutics (PTGX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Protagonist Therapeutics, Inc. is a biopharmaceutical company focused on developing peptide therapeutics for hematology and blood disorders, as well as inflammatory and immunomodulatory diseases, with a market cap of $5.28 billion.

Operations: Protagonist Therapeutics focuses on developing peptide therapeutics, generating revenue primarily from its biotechnology startup segment, which reported $209.22 million.

Protagonist Therapeutics has demonstrated a robust trajectory in the biotech sector, particularly with its recent advancements in polycythemia vera treatment through rusfertide. The drug, which mimics hepcidin to regulate iron and red blood cell production, has shown promising results in Phase 3 trials, achieving primary and secondary endpoints effectively. This innovation not only underscores Protagonist's commitment to addressing complex medical needs but also positions it favorably as it secures multiple FDA designations aimed at expediting the drug's review process. Despite a recent dip in net profit margins from 52.8% to 21.9%, the company anticipates significant earnings growth at an annual rate of 46%, outpacing the U.S market prediction of 15.7%. This potential is further highlighted by an expected revenue growth rate of 25.9% annually, suggesting a strong upward trajectory for Protagonist amidst competitive pressures and market dynamics.

- Dive into the specifics of Protagonist Therapeutics here with our thorough health report.

Gain insights into Protagonist Therapeutics' past trends and performance with our Past report.

Praxis Precision Medicines (PRAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Praxis Precision Medicines, Inc. is a clinical-stage biopharmaceutical company focused on developing therapies for central nervous system disorders characterized by neuronal excitation-inhibition imbalance, with a market cap of $8.86 billion.

Operations: Praxis Precision Medicines focuses on developing therapies for central nervous system disorders related to neuronal excitation-inhibition imbalance. As a clinical-stage biopharmaceutical company, it is primarily engaged in research and development activities without current revenue streams.

Praxis Precision Medicines is reinforcing its leadership in neurological disorders with strategic executive appointments, notably Dr. Orrin Devinsky as Head of Clinical Strategy. This move, coupled with a robust R&D focus, underscores Praxis's commitment to advancing its late-stage portfolio, particularly in epilepsy treatment. The company recently completed a significant follow-on equity offering of $575.12 million, highlighting investor confidence and bolstering its financial position for upcoming commercial and developmental milestones. These developments are pivotal as Praxis navigates the competitive biotech landscape with an annual revenue growth forecast at 59.5% and earnings expected to surge by 60.6%.

BILL Holdings (BILL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BILL Holdings, Inc. offers a financial operations platform tailored for small and midsize businesses globally, with a market capitalization of approximately $4.84 billion.

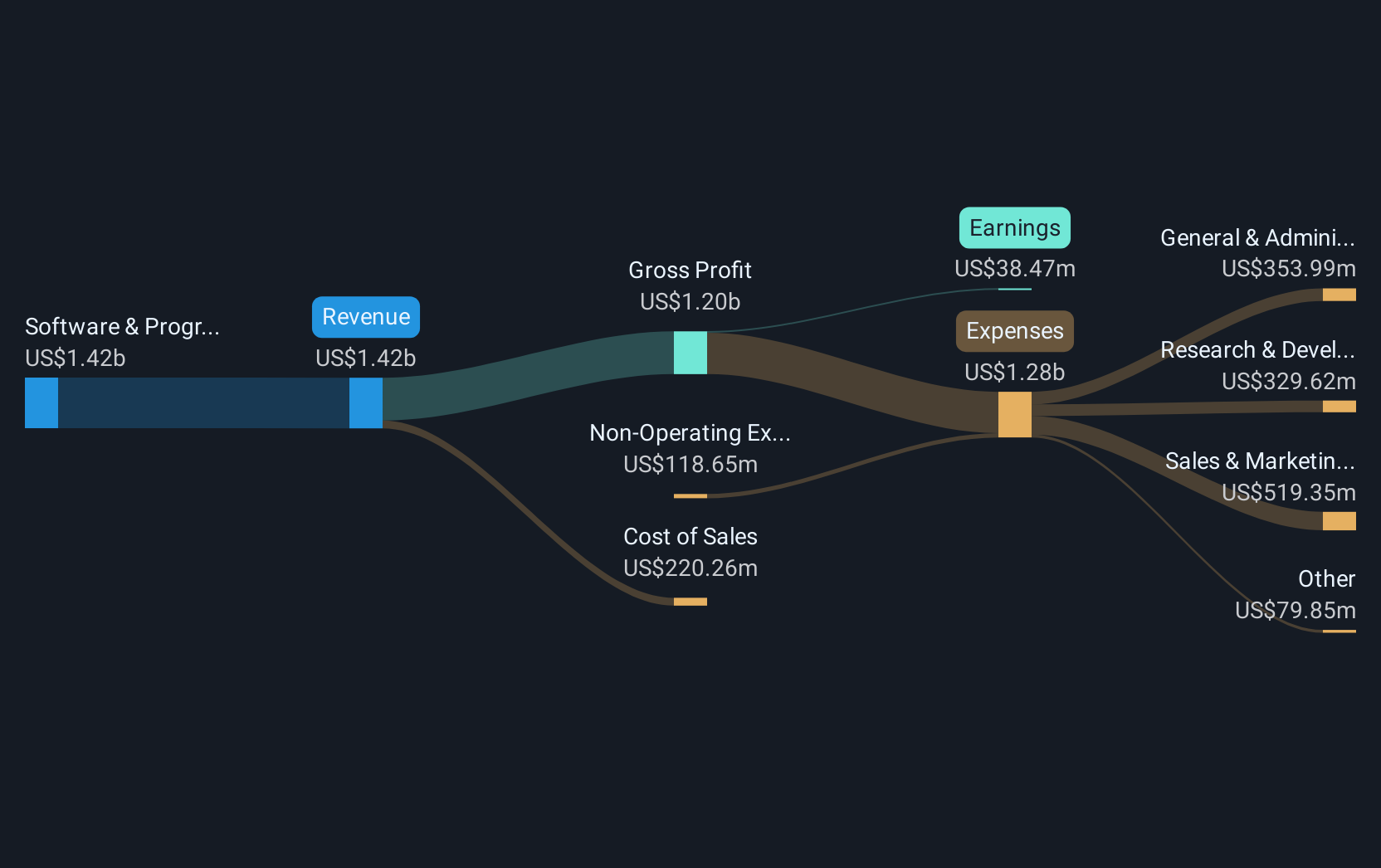

Operations: The company generates revenue primarily through its software and programming segment, which contributes approximately $1.55 billion.

Despite recent challenges, BILL Holdings is navigating through a transformative phase with strategic maneuvers that are reshaping its financial landscape. With a reported revenue increase to $810.41 million from $721 million year-over-year and an aggressive share repurchase program totaling $148.26 million, the company is making significant strides in strengthening its market position. Moreover, the integration with Digits enhances BILL's capabilities in automating financial operations, potentially setting new standards in B2B financial automation by leveraging real-time data for better decision-making. This strategic focus on innovation and efficiency could be pivotal as BILL aims to transition from current losses towards profitability, guided by an optimistic revenue forecast of up to $1.651 billion for the fiscal year.

- Click to explore a detailed breakdown of our findings in BILL Holdings' health report.

Review our historical performance report to gain insights into BILL Holdings''s past performance.

Key Takeaways

- Unlock our comprehensive list of 72 US High Growth Tech and AI Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal