Assessing Eaton (ETN) Valuation After Strong Earnings And Positive 2026 Guidance

Eaton (ETN) is back in focus after reporting its fourth quarter and full year 2025 results along with fresh 2026 guidance, giving investors new data on sales, earnings and expected organic growth.

See our latest analysis for Eaton.

Eaton shares have been on a strong run, with the latest share price at $373.82 and a 1 month share price return of 15.2%, alongside a 1 year total shareholder return of 18.36%. The 5 year total shareholder return of 228.09% points to sustained momentum as investors digest recent earnings, 2026 guidance and the new US$8b term credit facility.

If Eaton's recent move has you thinking about where the next power and infrastructure winners could come from, it might be worth scanning 24 power grid technology and infrastructure stocks as a starting list of ideas.

With earnings guidance, a US$8b term credit facility and a strong multiyear share price run already on the table, the key question now is whether Eaton still offers upside or if the market is already pricing in future growth.

Most Popular Narrative: 7.5% Undervalued

At a last close of $373.82 versus a narrative fair value of about $404.06, the widely followed view sees some remaining headroom, anchored in Eaton's power management and data center exposure.

Eaton's portfolio realignment, exiting lower-growth legacy Vehicle and eMobility exposures while doubling down on high-margin, sustainability-driven, and electrification technologies, continues to improve the company's margin profile and sets the stage for robust earnings growth as secular demand for efficient, intelligent power management rises globally.

Curious what revenue path, margin lift and earnings power sit behind that fair value? The narrative leans on firm compound growth assumptions and a premium profit multiple. Want to see exactly how those elements combine into the $404 number and how sensitive it is to slight shifts in either growth or margins?

Result: Fair Value of $404.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view could be challenged if AI driven data center demand cools, or if heavy spending and acquisitions fail to deliver the expected margin lift.

Find out about the key risks to this Eaton narrative.

Another Take: Cash Flows Paint A Different Picture

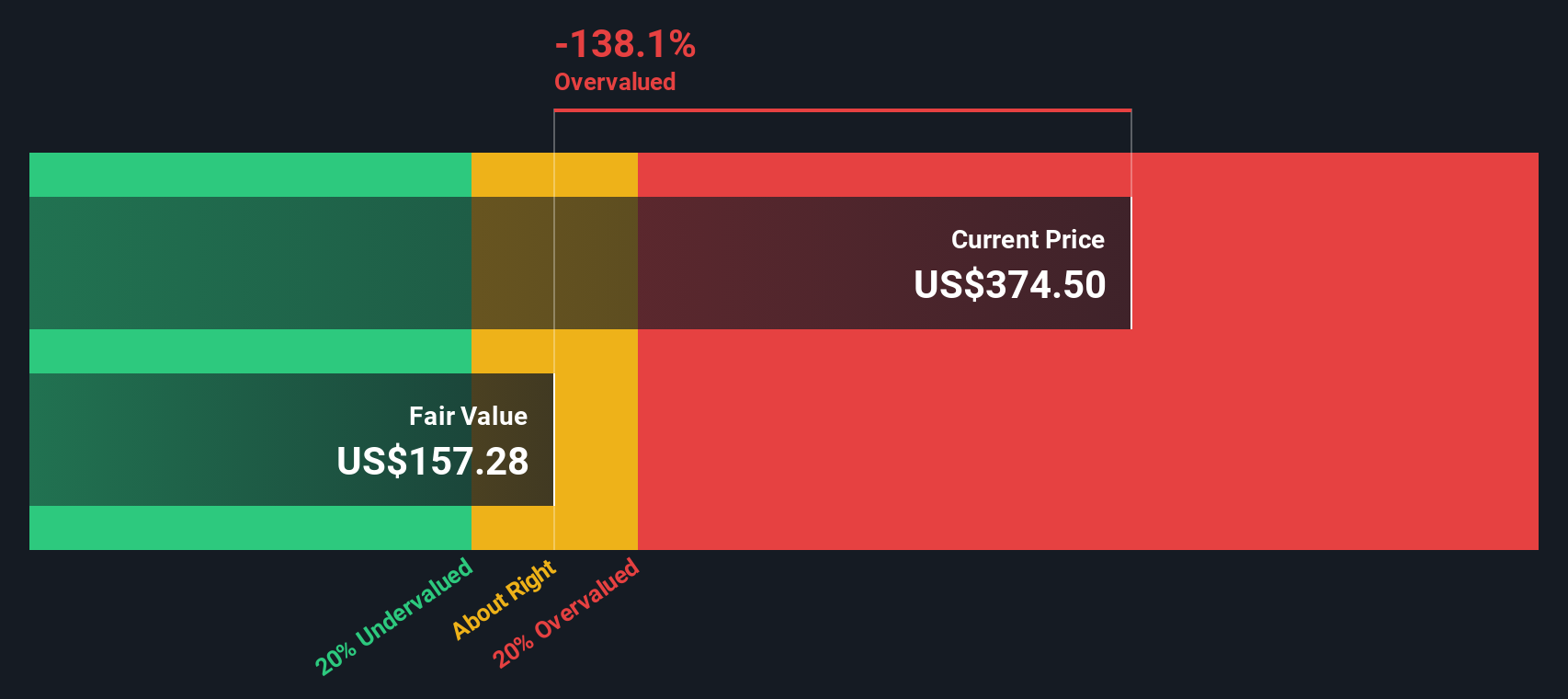

If you switch from the narrative fair value to our DCF model, the story changes. On this view, Eaton at $373.82 is trading well above an estimated future cash flow value of $225.54, which points to an overvalued signal rather than a discount.

That gap raises a simple question for you as an investor: do you trust the earnings powered narrative more, or the DCF view that leans on long term cash flow assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eaton for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eaton Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes with Do it your way

A great starting point for your Eaton research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Eaton has sharpened your interest, do not stop here. Use the Simply Wall St screener to spot other opportunities that fit the way you like to invest.

- Target potential value candidates by scanning our list of 52 high quality undervalued stocks that combine solid fundamentals with prices that may sit below their estimated worth.

- Prioritize resilience and sleep better at night by checking companies in the 84 resilient stocks with low risk scores that score well on balance sheet strength and risk factors.

- Get ahead of the crowd by reviewing a screener containing 24 high quality undiscovered gems that have strong underlying metrics but limited current attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal