Assessing Henry Schein’s Valuation As Recent Share Price Momentum Draws Fresh Investor Attention

Why Henry Schein Is Back on Investors’ Radar

Henry Schein (HSIC) has drawn fresh attention after a stretch of mixed share performance, with modest gains over the past month and past 3 months prompting investors to reassess the stock’s current pricing.

See our latest analysis for Henry Schein.

At a share price of US$79.72, Henry Schein has recently seen stronger short term momentum, with a 1 day share price return of 3.53% and a 90 day share price return of 9.21%, while the 1 year total shareholder return of 0.91% and 3 year total shareholder return of 7.39% decline point to a more muted longer term picture.

If you are looking beyond healthcare distributors and want fresh ideas, this could be a good moment to widen your watchlist with our screener of 26 healthcare AI stocks as potential additions to research.

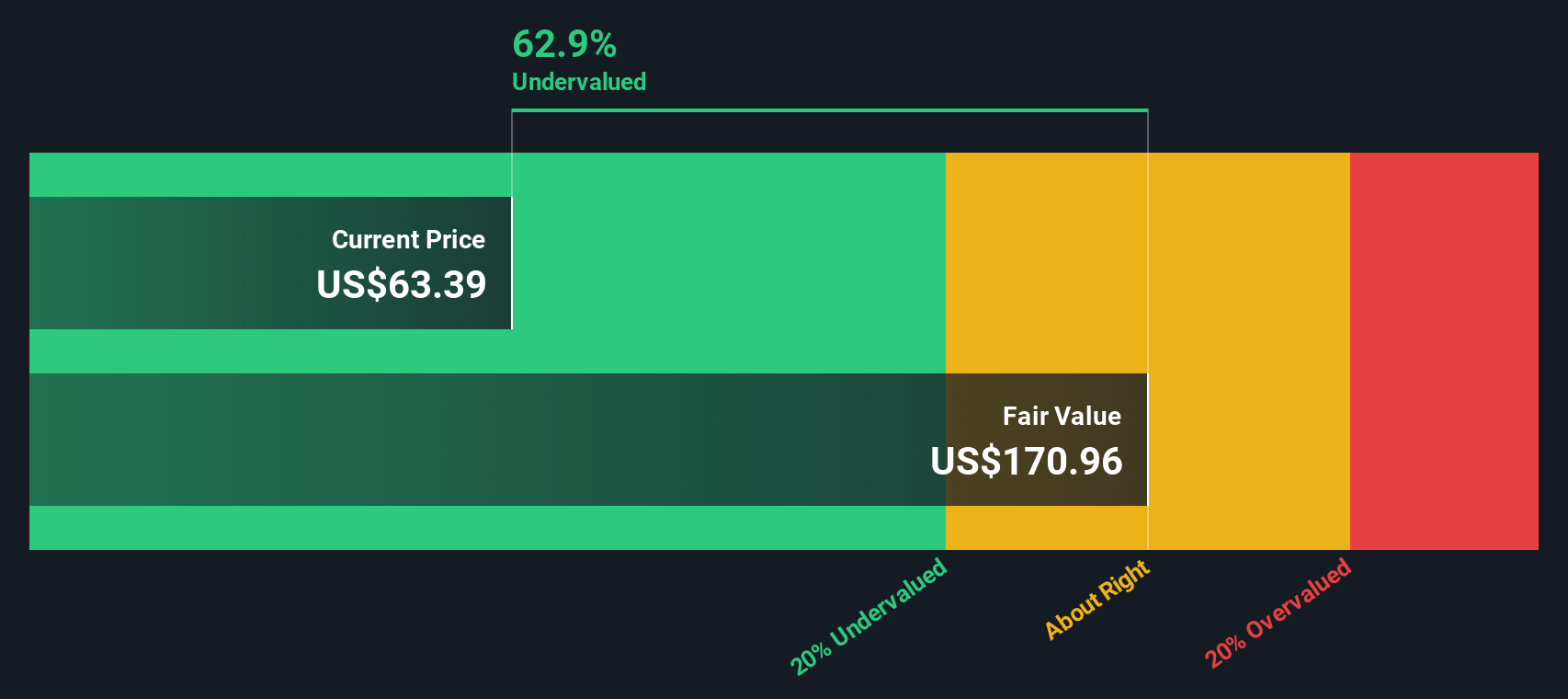

With Henry Schein trading at US$79.72, sitting close to analyst price targets but with an intrinsic value estimate that suggests a large discount, you have to ask yourself: is there a genuine buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 2% Overvalued

Compared with the current share price of $79.72, the most followed narrative sits on a fair value estimate of $78.14, suggesting the market is only slightly ahead of that view and putting more focus on the story behind the numbers.

Henry Schein is actively pursuing operational efficiencies, including $100M+ cost savings run-rate by end of 2025 and further value creation initiatives led by KKR's Capstone, which are expected to lower operating expenses and drive net margin improvement from 2026 onward.

Curious how a modest fair value premium rests on cost cuts, steady top line assumptions, and a lower future earnings multiple than many healthcare peers, all discounted at under 7%? The narrative lays out a detailed path tying those pieces together without assuming rapid growth.

Result: Fair Value of $78.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear risks, including ongoing pricing pressure in key categories and execution challenges related to cost savings and the multiyear leadership transition.

Find out about the key risks to this Henry Schein narrative.

Another Angle on Valuation

The narrative fair value pegs Henry Schein as about 2% overvalued at $78.14, but our DCF model paints a very different picture. On that view, the shares trade at roughly a 56% discount to an estimated $179.68 per share. So which story do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Henry Schein Narrative

If you look at the numbers and see a different story, or simply prefer to test your own assumptions, you can build a tailored view in just a few minutes using Do it your way.

A great starting point for your Henry Schein research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Henry Schein has sharpened your thinking, do not stop here. Broaden your opportunity set with a few focused screens that can surface very different types of ideas.

- Target long term compounding potential by reviewing companies our screener highlights as 52 high quality undervalued stocks with solid fundamentals already in place.

- Prioritize resilience by checking out businesses flagged in our 82 resilient stocks with low risk scores that may offer a calmer ride when markets get choppy.

- Get ahead of the crowd by scanning our screener containing 24 high quality undiscovered gems that the broader market might not be paying much attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal