A Look At Sun Country Airlines (SNCY) Valuation After Recent Share Price Surge

Context for Sun Country Airlines Holdings

Sun Country Airlines Holdings (SNCY) has drawn fresh attention after recent trading, with the stock showing double digit moves over the past month and past 3 months, prompting investors to reassess its current valuation.

The company reports revenue of US$1,126.769m and net income of US$52.809m. These figures give investors a starting point for thinking about how current pricing lines up with the business it operates.

See our latest analysis for Sun Country Airlines Holdings.

At a share price of US$21.84, Sun Country Airlines Holdings has seen momentum build sharply, with a 38.49% 1 month share price return and 77.42% 3 month share price return, alongside a 32.36% 1 year total shareholder return and a 4.80% 3 year total shareholder return that put the recent surge in a more measured longer term context.

If this kind of sharp move has you thinking about where else strength could be forming, now could be a good time to scan our list of 22 top founder-led companies and see what stands out.

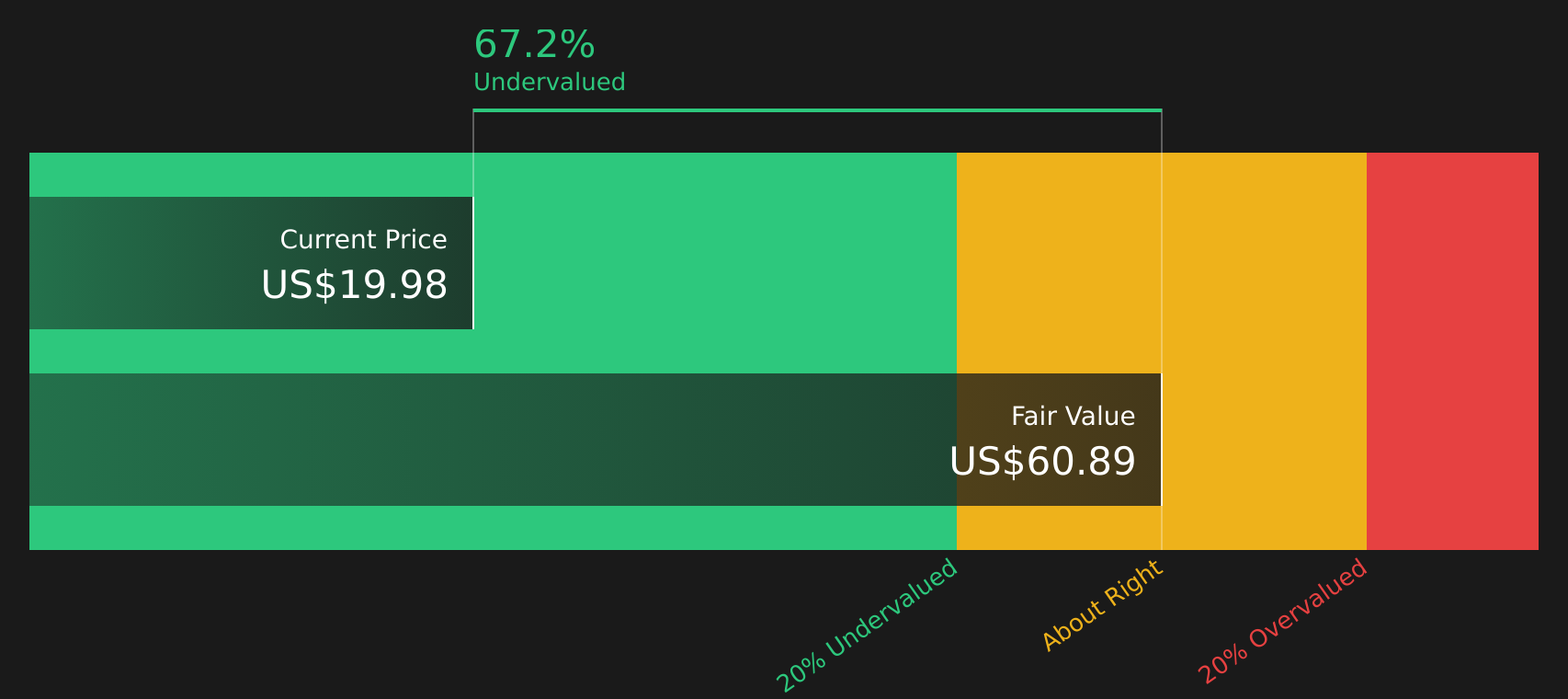

With Sun Country trading at US$21.84 and an intrinsic value estimate that implies a 64.27% discount, the big question is whether the market is still underappreciating this carrier or already factoring in its expected future growth.

Most Popular Narrative: 12.4% Overvalued

With Sun Country Airlines Holdings last closing at $21.84 against a most-followed fair value estimate of $19.43, the current price sits above that narrative anchor, which draws a lot of attention to what is driving the story underneath.

Analysts have nudged their fair value estimate for Sun Country Airlines Holdings to $19.43 from $18.56, citing updated price targets that reflect views on potential margin expansion, the Allegiant acquisition agreement, and a slightly higher assumed future P/E multiple.

Curious what kind of earnings ramp and margin profile would support a higher multiple even after factoring in the Allegiant deal terms and a specific discount rate? The narrative pulls together detailed revenue build outs, profit assumptions, and a targeted earnings multiple to explain why fair value lands where it does, and how that stacks up against today’s share price.

Result: Fair Value of $19.43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could shift quickly if leisure demand softens outside peak seasons, or if higher labor and fleet costs squeeze already thin net income.

Find out about the key risks to this Sun Country Airlines Holdings narrative.

Another Take: Cash Flows Point in a Different Direction

While the popular narrative tags Sun Country as 12.4% overvalued at $19.43 fair value, our DCF model points the other way, with a future cash flow value of $61.13 per share. That is a large gap for you to weigh, so which story feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sun Country Airlines Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sun Country Airlines Holdings Narrative

If this interpretation does not sit right with you, or you would rather test your own assumptions directly against the numbers, you can build a full Sun Country Airlines Holdings view in just a few minutes and Do it your way.

A great starting point for your Sun Country Airlines Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are weighing what to do next after looking at Sun Country Airlines Holdings, it is worth lining up a few fresh ideas side by side.

- Spot potential bargains early by scanning our list of screener containing 24 high quality undiscovered gems that combine strong fundamentals with under the radar profiles.

- Focus on resilience and support a calmer approach by checking companies in our 82 resilient stocks with low risk scores that score well on stability factors.

- Zero in on financial strength by reviewing companies filtered through our solid balance sheet and fundamentals stocks screener (45 results) so you can compare balance sheet quality quickly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal