Medtronic (MDT) Valuation Check After Recent Share Price Momentum And Mixed Long Term Returns

Medtronic stock moves after recent performance data

Medtronic (MDT) has drawn fresh attention after recent performance figures showed a 5.5% return over the past month and 11.1% over the past 3 months, alongside a trailing 1-year total return of 17.9%.

See our latest analysis for Medtronic.

At a share price of $102.90, Medtronic’s recent 30 day and 90 day share price returns suggest momentum has picked up compared to its more modest year to date move, while multiyear total shareholder returns have been mixed, including a slightly negative 5 year figure.

If this has you thinking about where else capital could work in healthcare related technology, it may be worth scanning our screener for 26 healthcare AI stocks as a starting list of ideas.

With Medtronic trading at $102.90 and sitting near a modest intrinsic discount, the key question now is simple: Is this a reasonable entry point, or is the market already pricing in the company’s future growth?

Most Popular Narrative: 8.3% Overvalued

According to Evangelos, the most followed narrative pegs Medtronic’s fair value at $95.00, which sits below the current $102.90 share price and frames the recent move as slightly ahead of that thesis.

Specialization vs. Conglomerates: Unlike J&J (which spun off its consumer health division), or Abbott (split into devices and nutrition), Medtronic’s pure-play focus on medical devices allows for targeted R&D and operational agility. Diabetes Care Differentiation: While Abbott’s Freestyle Libre leads the CGM market, Medtronic’s closed-loop MiniMed system offers integrated pump-CGM solutions, appealing to patients seeking all-in-one management, a niche Abbott lacks.

Curious what kind of growth and margin profile supports a lower fair value than today’s price, even with this product breadth and cash generation power? The full narrative spells out the revenue runway, profitability assumptions and the profit multiple that need to line up for that $95.00 figure to make sense.

Result: Fair Value of $95.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, keep in mind that product recalls, delayed approvals, and ongoing pressure in the diabetes unit could quickly challenge the assumptions behind that $95.00 fair value.

Find out about the key risks to this Medtronic narrative.

Another angle on valuation

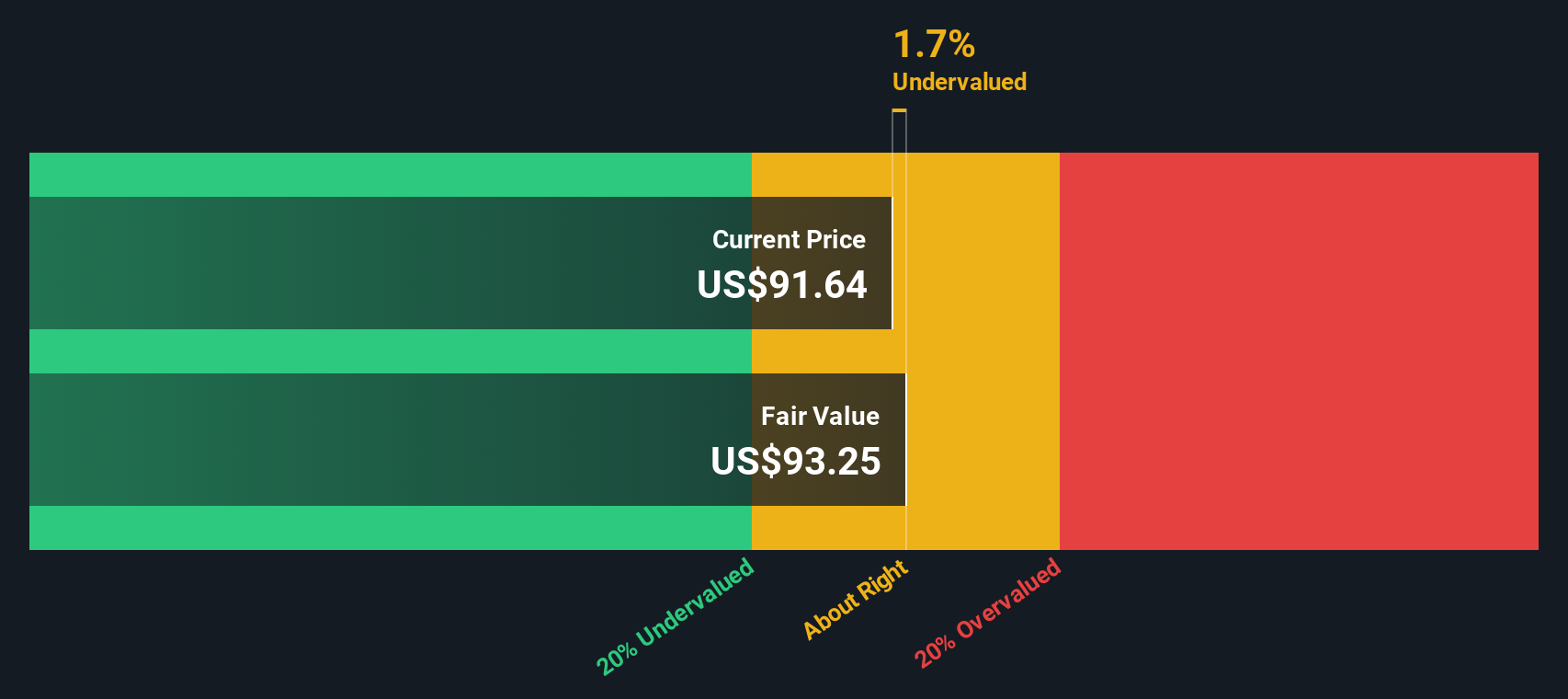

Evangelos’ $95.00 fair value is based on one set of assumptions, but our DCF model points in a different direction. On those cash flow estimates, Medtronic at $102.90 sits about 3.4% below an indicated value of roughly $106.51. This frames the stock as slightly undervalued instead of overvalued.

So you have one narrative calling the shares 8.3% rich and another suggesting a small discount. This raises a simple question for you as an investor: Which set of assumptions about Medtronic’s future cash generation feels more realistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Medtronic Narrative

If you find yourself questioning these assumptions or simply prefer to work from your own numbers, you can quickly build a personalised Medtronic thesis in just a few minutes by starting with Do it your way.

A great starting point for your Medtronic research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about tightening up your portfolio, do not stop at one company, use the screener to spot fresh opportunities before others do.

- Target potential mispricings by scanning companies our tools flag as 52 high quality undervalued stocks, and see which ones line up with your research and risk appetite.

- Strengthen the quality core of your portfolio by reviewing businesses in the solid balance sheet and fundamentals stocks screener (45 results), where financial resilience is a key filter.

- Get ahead of the crowd by checking the screener containing 24 high quality undiscovered gems, a curated set of under the radar names that may not yet be widely followed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal