A Look At Align Technology (ALGN) Valuation After Record Earnings Beat And Upgraded Outlook

Align Technology (ALGN) has drawn investor attention after reporting record fourth quarter 2025 results, beating analyst expectations on revenue and earnings, and pairing that with 2026 guidance for measured worldwide revenue growth.

See our latest analysis for Align Technology.

The latest record quarter, updated 2026 guidance and ongoing share repurchases appear to be feeding into renewed optimism, with a 1 day share price return of 6.82% and a 90 day share price return of 35.72% pushing the stock to US$187.60. This is occurring even though the 1 year total shareholder return is still a 10.90% decline and the 5 year total shareholder return is a 69.22% decline, so recent momentum contrasts sharply with the longer term picture.

If this earnings jump has you watching teeth straightening and dental tech more closely, it could be a good moment to scan 26 healthcare AI stocks for ideas riding similar trends.

With Align now at US$187.60, only about 4% below the average analyst price target and trading after a sharp 90 day rebound but multi year share price declines, is this renewed strength a fresh entry point, or is future growth already reflected?

Most Popular Narrative: 2% Overvalued

At $187.60, the most followed narrative pegs Align Technology’s fair value at about $183.87, so the current price sits modestly above that estimate using a 7.68% discount rate.

The Fair Value Estimate has risen slightly from US$180.47 to US$183.87 per share, reflecting a modestly higher modeled value.

The future P/E has moved up from 21.14x to 21.72x, suggesting a somewhat higher valuation multiple applied to projected earnings.

Want to see what justifies paying up for Align’s earnings power? The narrative points to measured revenue growth, firmer margins and a richer earnings multiple. Curious how those pieces fit together across the next few years?

Result: Fair Value of $183.87 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that weaker orthodontic case starts, along with pressure on clear aligner pricing or scanner demand, could challenge the optimistic earnings path analysts are using.

Find out about the key risks to this Align Technology narrative.

Another View: Cash Flows Paint a Different Picture

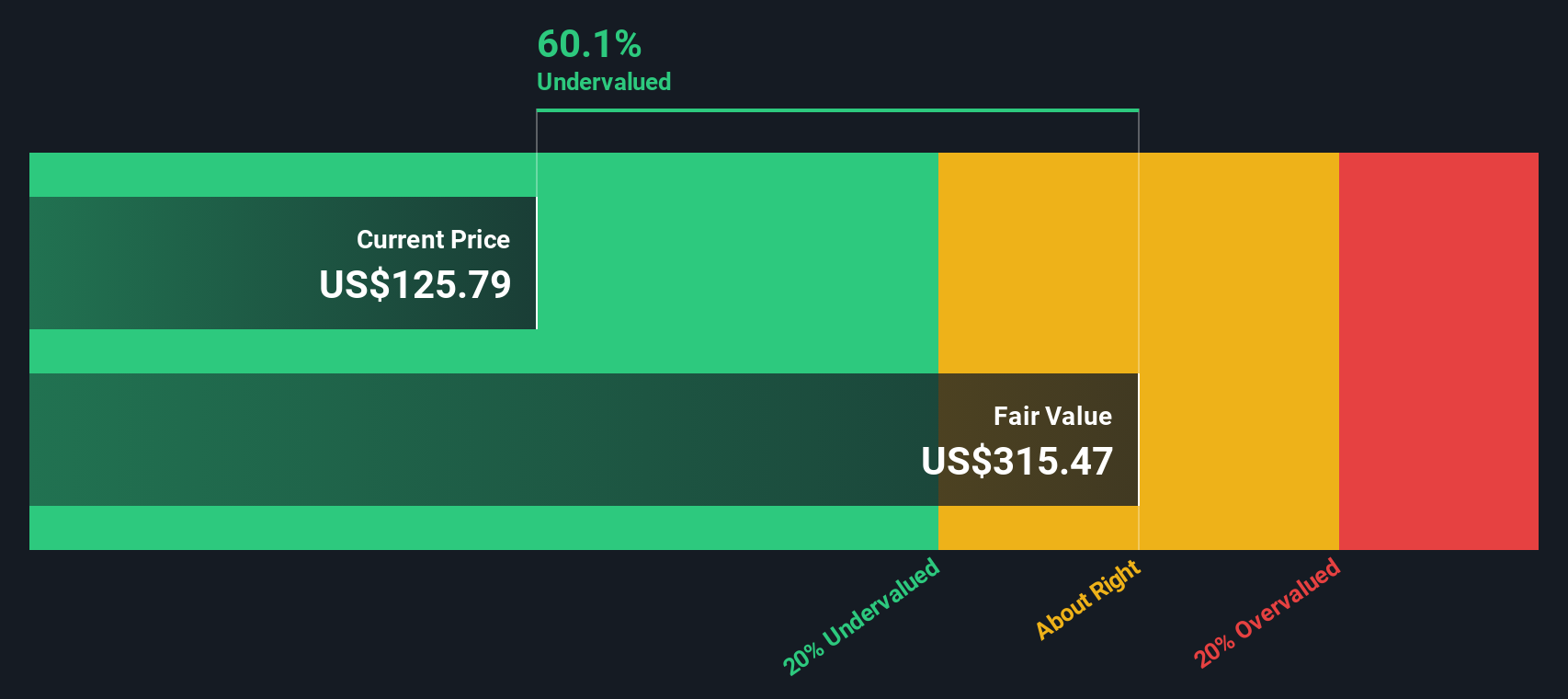

While the popular narrative calls Align slightly overvalued at $187.60 versus a fair value of $183.87 based on earnings and multiples, our DCF model comes out more optimistic and points to a future cash flow value of $222.94. That implies Align trades at about a 16% discount. Which signal do you trust more: the cash flows or the earnings multiple?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Align Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Align Technology Narrative

If you are not fully on board with these views, or simply prefer to weigh the numbers yourself, you can build a tailored thesis in minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Align Technology.

Ready to hunt for more investment ideas?

If Align has sparked your interest, do not stop at one stock. Use focused screeners to spot clear opportunities and avoid missing ideas that match your style.

- Target value first and see which companies currently line up as 52 high quality undervalued stocks based on solid fundamentals and pricing clues.

- Prioritize resilience by checking out 82 resilient stocks with low risk scores that score well on stability and lower overall risk profiles.

- Unearth lesser known prospects using our screener containing 24 high quality undiscovered gems that combine quality metrics with relatively limited market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal