Assessing Amgen (AMGN) Valuation After Strong Q4 Earnings And Rising Obesity Drug Optimism

Why Amgen’s latest earnings are drawing fresh investor attention

Amgen (AMGN) has moved into focus after its Q4 2025 earnings update, which showed higher revenue and net income versus a year earlier, alongside growing interest in its obesity drug candidate MariTide.

See our latest analysis for Amgen.

The strong Q4 report and enthusiasm around MariTide have been reflected in the recent move, with a 30 day share price return of 17.9% and a 1 year total shareholder return of 35.2%, suggesting momentum has been building rather than fading.

If this kind of move in a large pharma name has caught your eye, it could be a good moment to consider other opportunities in obesity and metabolic health, starting with our screener of 26 healthcare AI stocks.

With Amgen now near 52 week highs, a strong 1 year total return of 35.2% and the stock trading at an 11% premium to the average analyst target, it is fair to ask: is there still a buying opportunity here, or is the market already pricing in years of future growth?

Most Popular Narrative: 17.3% Overvalued

Amgen’s most followed narrative pegs fair value at about $327.74, noticeably below the last close at $384.32, which sets up a clear valuation gap for you to judge.

Analysts nudged their fair value estimate for Amgen higher to about $328 per share, up from roughly $323. This reflects slightly firmer revenue expectations and a higher assumed future P/E, balanced against more conservative profit margin assumptions and mixed Street views that highlight both the stability of the core business and uncertainty around patent expiries and new launches.

Want to see what justifies paying up for that future earnings stream? Revenue creep, margin assumptions and a richer earnings multiple all sit at the heart of this fair value story.

Result: Fair Value of $327.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if drug pricing pressure intensifies, or if biosimilar competition and patent expiries hit key products harder than analysts currently assume.

Find out about the key risks to this Amgen narrative.

Another Way To Look At Value

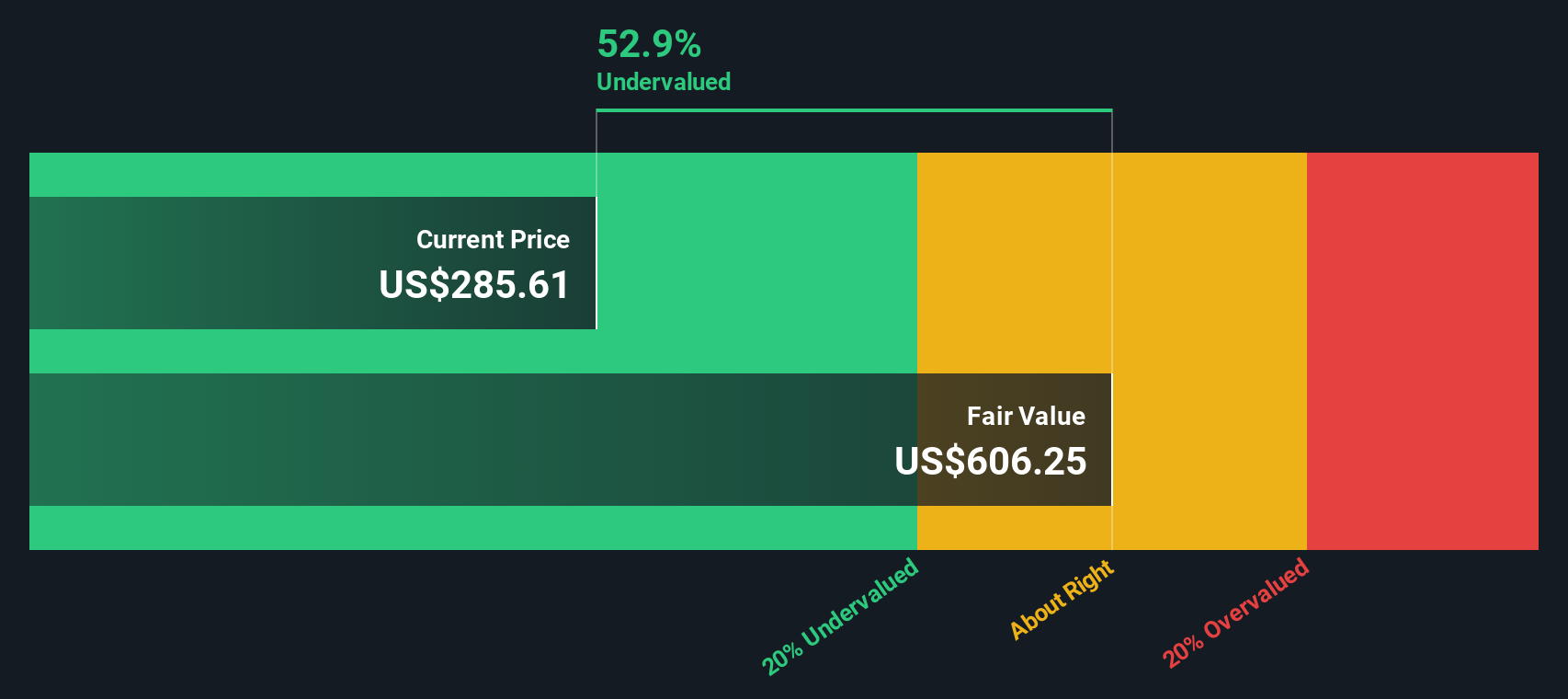

That fair value of $327.74 suggests Amgen is 17.3% overvalued, but our DCF model tells a very different story. On this view, the shares at $384.32 sit around 40.8% below an estimated future cash flow value of $648.91, implying a wide gap for you to interpret.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amgen for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amgen Narrative

If you look at these numbers and reach a different conclusion, or simply want to test your own view against the data, you can build a custom thesis for Amgen in just a few minutes: Do it your way.

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Amgen has you thinking bigger about your portfolio, do not stop here. The next move that fits your style could already be waiting in our screeners.

- Target stability first and cut back on unpleasant surprises by scanning for 82 resilient stocks with low risk scores that score well on our risk checks.

- Spot potential mispricings quickly by checking our list of 52 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them.

- Grow your watchlist with income focused ideas using our 14 dividend fortresses that combine higher yields with an emphasis on resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal