A Look At Champion Homes (SKY) Valuation After Strong Q4 Earnings Beat And Cash Flow Performance

Champion Homes (SKY) shares moved after the company reported fourth quarter 2025 results with adjusted earnings and EBITDA above analyst expectations, stronger free cash flow, and net sales growth despite pressure on operating margins.

See our latest analysis for Champion Homes.

At a share price of $83.59, Champion Homes has seen a 6.65% 7 day share price return and a softer 30 day share price return of 4.03%. The 1 year total shareholder return of 19.53% contrasts with a 5 year total shareholder return of 90.93%, suggesting longer term holders have seen stronger momentum than more recent investors.

If this earnings jump has you looking at housing related themes more broadly, it could be worth scanning the 24 power grid technology and infrastructure stocks as a starting point for other infrastructure linked names.

With the stock up sharply after earnings but still trading below the average analyst price target and flagged with a zero value score, you have to ask: Is Champion Homes still mispriced, or is the market already counting on future growth?

Most Popular Narrative: 12.7% Undervalued

Champion Homes latest fair value narrative points to $95.80 per share versus the recent $83.59 close, which frames the current debate around the stock clearly.

Strategic expansion into high-margin multifamily and commercial modular segments, alongside the recent Iseman Homes acquisition and continued integration synergies, is described as positioning Champion to structurally improve net margins and drive earnings growth over time.

Broader adoption of off-site construction solutions among builders and developers, along with growing builder/developer pipelines, is cited as increasing Champion's share of a diversifying addressable market, supporting revenue and market share gains.

Curious what justifies paying up for a housing manufacturer? This narrative leans on modest revenue growth, steady margins, and a richer future earnings multiple. The exact mix might surprise you.

Result: Fair Value of $95.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on housing demand and policy support holding up, while any pickup in material costs or affordability stress could quickly challenge those fair value assumptions.

Find out about the key risks to this Champion Homes narrative.

Another View: Market Multiple Sends a Different Signal

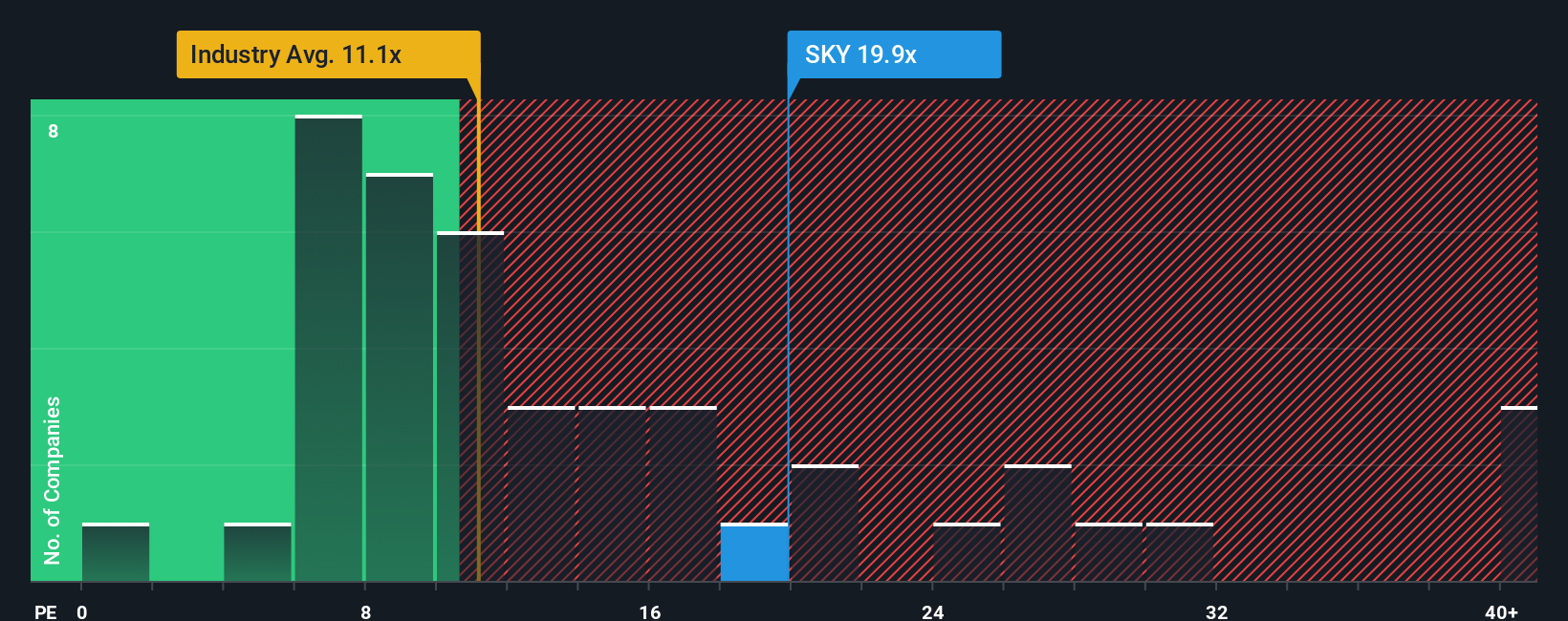

That $95.80 fair value hinges on future earnings and a richer P/E. Right now though, Champion Homes trades on 21.6x earnings, compared with 12.5x for the US Consumer Durables group and a fair ratio of 15.4x. That gap points to valuation risk rather than a clear bargain. Which story do you trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

If you look at these numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a custom narrative in a few minutes by starting with Do it your way.

A great starting point for your Champion Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Champion Homes caught your attention, do not stop there. A few minutes with the right screeners can reveal ideas you will wish you had seen earlier.

- Target potential opportunities by scanning our 53 high quality undervalued stocks that pair quality fundamentals with prices that appear out of step with underlying metrics.

- Prioritise resilience first and review the 86 resilient stocks with low risk scores to see companies that score well on stability and downside protection.

- Identify possible future contenders early by checking the screener containing 24 high quality undiscovered gems that combine solid data with relatively low market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal