Did ePlus’ AI-Focused Expansion and Higher Guidance Just Shift ePlus’ (PLUS) Investment Narrative?

- In early February 2026, ePlus inc. reported higher quarterly and nine-month results, raised its full-year 2026 net sales growth guidance to 20%–22% year over year on a base of US$2.01 billion, declared a US$0.25 quarterly dividend, updated its share repurchase activity, and signaled ongoing interest in acquisitions supported by a new universal shelf registration.

- An interesting angle for investors is how ePlus is pairing strong earnings momentum with plans to expand AI-driven solutions, professional and managed services, and workplace transformation capabilities through both organic investment and potential M&A.

- With these developments and the company’s focus on AI-enabled integrated technology solutions, we’ll examine how this news shapes ePlus’s investment narrative.

Capitalize on the AI infrastructure supercycle with our selection of the 33 best 'picks and shovels' of the AI gold rush converting record-breaking demand into massive cash flow.

What Is ePlus' Investment Narrative?

To own ePlus, you have to believe in its role as an IT partner helping customers stitch together AI, cloud, networking and security into integrated, services-rich solutions. The latest quarter reinforced that story with higher revenue and earnings, while management lifted full-year 2026 net sales growth guidance to 20%–22% on a US$2.01 billion base, declared another US$0.25 dividend, completed a share repurchase tranche, and filed a universal shelf that underpins its acquisition ambitions. Near term, the key catalysts now tilt even more toward execution on AI-driven projects and scaling professional and managed services, as well as how quickly any acquisitions can be integrated. At the same time, the shelf registration and ongoing buybacks sharpen the focus on capital allocation discipline and the risk of overpaying for growth.

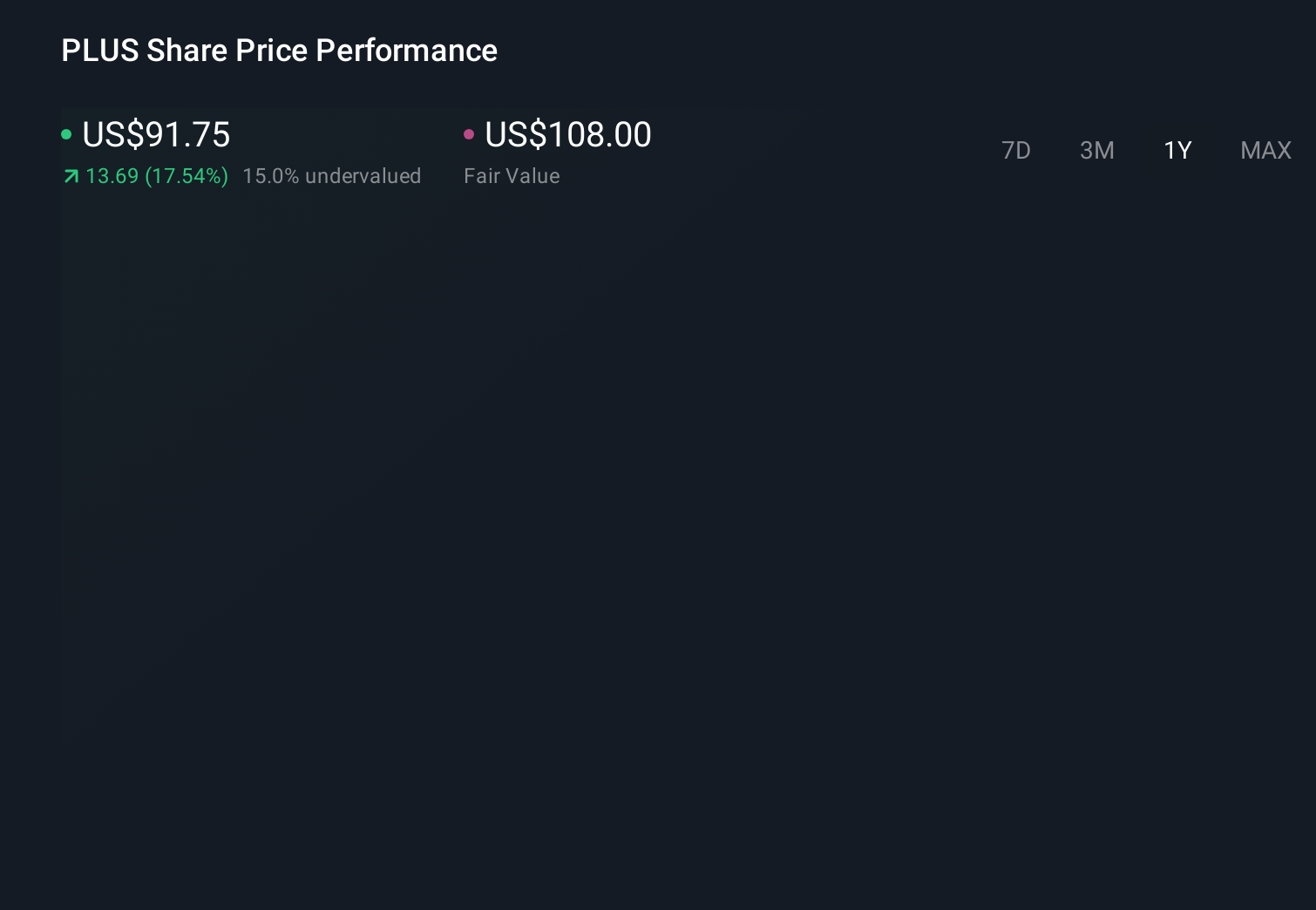

However, investors should also be aware of how future acquisitions might reshape the risk profile. ePlus' shares have been on the rise but are still potentially undervalued by 30%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on ePlus - why the stock might be worth as much as 44% more than the current price!

Build Your Own ePlus Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ePlus research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ePlus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ePlus' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find 53 companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 30 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal