Netflix Warner Bros. Deal Scrutiny Raises Questions On Valuation And Risks

- Netflix (NasdaqGS:NFLX) faces extensive U.S. and European regulatory scrutiny over its proposed US$82.7b acquisition of Warner Bros. Discovery.

- The U.S. Department of Justice has opened an antitrust investigation that now covers both the merger terms and potential anticompetitive behavior.

- Ongoing U.S. Senate hearings and bipartisan political debate are adding pressure and elevating uncertainty around whether the deal will proceed as proposed.

For investors watching Netflix, this proposed tie up with Warner Bros. Discovery touches almost every part of its business model, from content production to distribution and licensing. Netflix is already a large global streaming platform, and combining with a major studio and cable portfolio would further concentrate content libraries, intellectual property, and distribution relationships in one company.

The expanded DOJ probe and active Senate interest mean any path forward is likely to be heavily conditioned by antitrust concerns, potential remedies, or in an extreme case, a challenge to the deal. As you assess Netflix, the key questions now center on how different regulatory outcomes could affect its plans, bargaining power with partners, and competitive position in global streaming and traditional entertainment.

Stay updated on the most important news stories for Netflix by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Netflix.

Is Netflix financially strong enough to weather the next crisis?

Quick Assessment

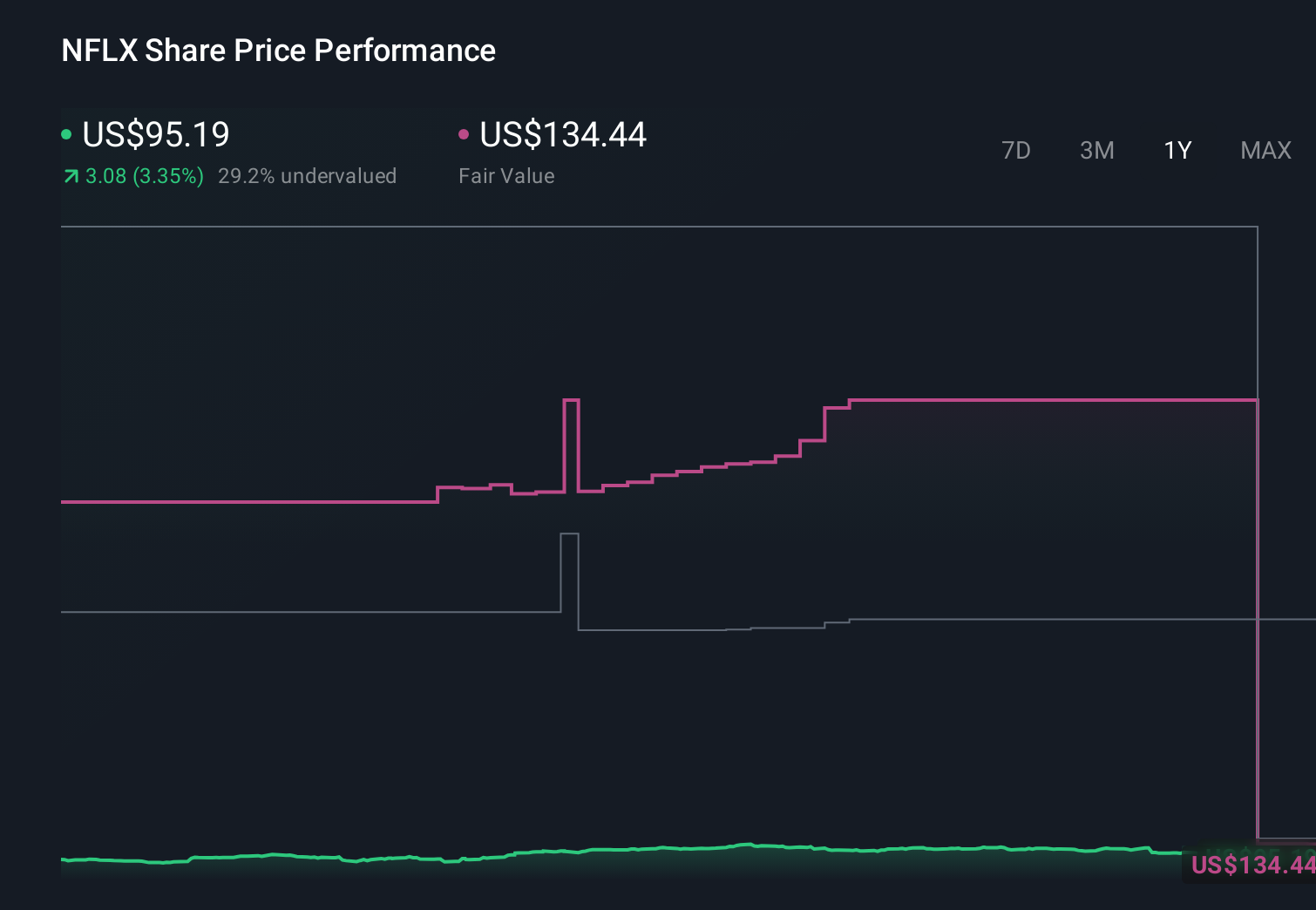

- ✅ Price vs Analyst Target: At US$82.20 versus a consensus target of US$111.84, the price sits about 27% below analyst expectations.

- ⚖️ Simply Wall St Valuation: Shares are trading roughly 4.6% below the Simply Wall St fair value estimate, which is described as close to fair value.

- ❌ Recent Momentum: The 30 day return of about 9.4% decline signals weak short term sentiment as the deal scrutiny unfolds.

Check out Simply Wall St's in depth valuation analysis for Netflix.

Key Considerations

- 📊 The regulatory focus on an US$82.7b transaction could influence Netflix's scale ambitions in content and distribution if conditions or delays arise.

- 📊 Keep an eye on the US$82.20 share price relative to the US$111.84 analyst target, the 31.6x P/E versus the 26.4x industry average, and any updates from DOJ or Senate hearings.

- ⚠️ The most relevant risk is deal uncertainty, where potential concessions, a blocked transaction, or prolonged review could affect costs, integration plans, and management attention.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Netflix analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal