Profit Margin Slide At Insight Enterprises (NSIT) Tests Bullish Valuation Narrative

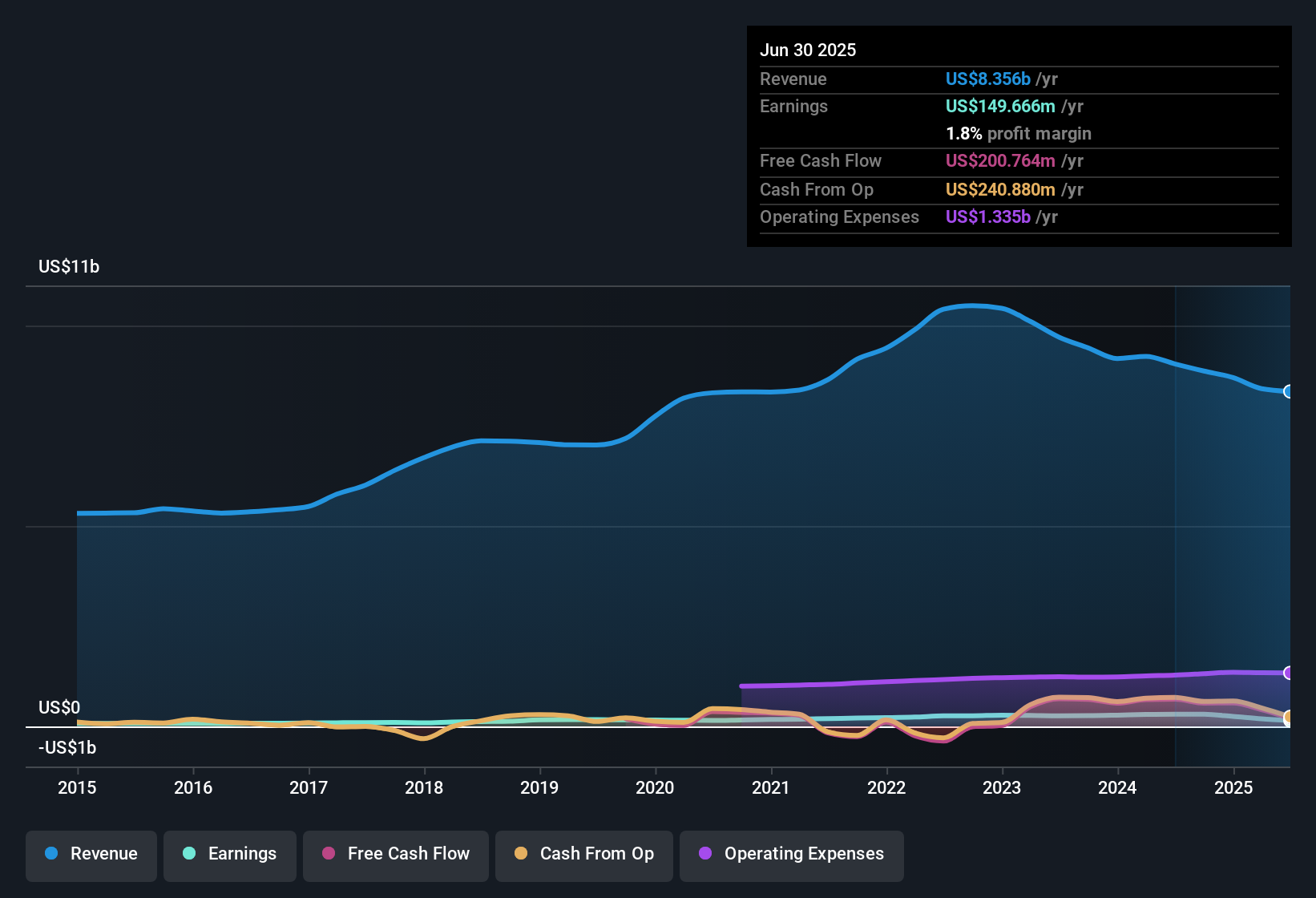

Insight Enterprises (NSIT) closed out FY 2025 with fourth quarter revenue of US$2.0 billion and basic EPS of US$1.68, alongside trailing twelve month revenue of US$8.2 billion and EPS of US$5.00, setting a clear snapshot of its recent earnings power. The company has seen quarterly revenue fluctuate in a tight band between US$2.0 billion and US$2.1 billion across 2025, while basic EPS moved from US$0.24 in Q1 to the US$1.47 to US$1.68 range in the following quarters, giving investors a cleaner read on earnings than the year ago stretch. With trailing net profit margins softer than a year earlier, this set of results puts the spotlight firmly on how sustainably Insight can convert its revenue base into profit.

See our full analysis for Insight Enterprises.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the widely followed growth and risk narratives around Insight Enterprises, and where those stories might need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM margins slip from 2.9% to 1.9%

- On a trailing twelve month view, net profit margin moved from 2.9% to 1.9% on about US$8.2b of revenue, which means the company is now turning a smaller share of each sales dollar into profit than it did a year earlier.

- Bears focus on this margin compression, and the data gives them clear talking points:

- TTM net income fell from US$249.7 million at FY 2024 Q4 to US$157.3 million at FY 2025 Q4, while revenue moved from US$8.7b to roughly US$8.2b, so profits have softened more than sales.

- Within that period, quarterly net income hovered between US$46.9 million and US$58.2 million in most quarters, but the latest TTM margin of 1.9% sits well below the earlier 2.9%, which supports the cautious view that profitability has come under pressure.

Debt coverage flagged as a key risk

- Analysis over the last 12 months highlights a major financial risk, where operating cash flow has not adequately covered debt, so leverage is identified as a meaningful vulnerability alongside the 1.9% net margin.

- Critics highlight this balance sheet point as a central part of the bearish case, and the earnings profile sharpens that concern:

- Across FY 2025, quarterly net income excluding extra items ranged from US$7.5 million in Q1 to US$52.0 million in Q4, so profit generation has been relatively modest compared with the company’s size, which can make servicing debt harder when cash flow is tight.

- The combination of softer margins, modest TTM net income of US$157.3 million, and flagged weak debt coverage underlines why some investors view leverage as a risk that sits alongside the valuation appeal.

Forecast ~30.8% earnings growth meets “cheap” multiples

- Analysts are forecasting earnings to grow around 30.8% per year while revenue is expected to grow about 3% per year, and at the same time the shares trade on a P/E of 17.6x versus peer and industry averages of 19.9x and 26.2x and a DCF fair value of US$109.81 sits above the current US$89.14 share price.

- Supporters lean on this combination as a bullish setup, and the numbers give that argument some weight but also some tension:

- The forecast earnings growth rate of about 30.8% a year against a modest 3% revenue growth expectation suggests a stronger focus on profitability and mix. If achieved, this would contrast with the recent TTM margin slide from 2.9% to 1.9%.

- With the market price roughly 18.8% below the DCF fair value estimate of US$109.81 and below peer and industry P/E averages, the valuation case looks supportive on the figures, while the current 1.9% margin and debt coverage risk are the main numbers that challenge a straightforward bullish read.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Insight Enterprises's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Softer net margins, modest profit generation and flagged weak debt coverage together point to leverage and balance sheet resilience as pressure points in this story.

If that mix of margin pressure and debt risk makes you cautious, it is worth scanning our solid balance sheet and fundamentals stocks screener (45 results) to focus on companies with sturdier financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal