Applied Digital Deepens AI Lease Commitments And Data Center Buildout

- Applied Digital has recently secured multibillion dollar, long term leases for AI data center capacity.

- The company has started construction on a large new data center campus to support expanding AI workloads.

- An additional lease at the new Polaris Forge 2 site with a major hyperscaler or AI cloud provider is described as imminent.

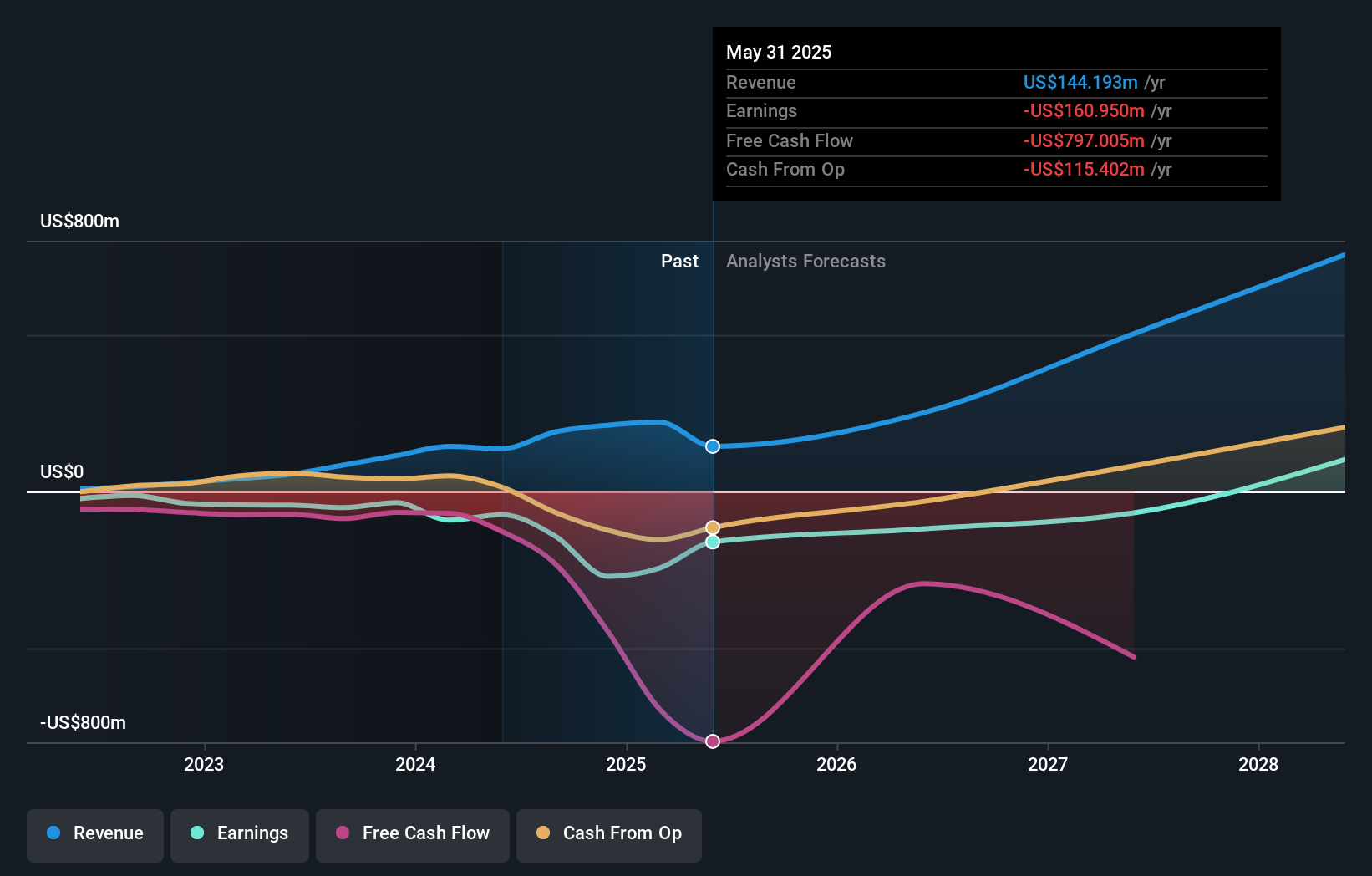

Applied Digital, NasdaqGS:APLD, sits at the center of growing demand for AI ready infrastructure, with its share price at $34.95. The stock has seen a 3.2% return over the past week and 18.2% over the past month, and the very large 1 year and 5 year gains suggest investors have been closely watching its execution in data centers.

The combination of fresh long term leases, new campus construction, and a potential Polaris Forge 2 agreement gives investors more concrete data points to assess future recurring revenue. For anyone tracking AI infrastructure, these updates may support viewing Applied Digital less as a build out story and more as a contracted capacity provider with expanding relationships across major AI customers.

Stay updated on the most important news stories for Applied Digital by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Applied Digital.

How Applied Digital stacks up against its biggest competitors

For Applied Digital, tying up long term AI data center leases and breaking ground on new capacity pushes it further into the same high-capital race that giants like Amazon Web Services, Microsoft Azure, and Google Cloud are running, but with a pure-play focus on leased infrastructure rather than full-service cloud platforms. The $16b of contracted leases across 600 MW, combined with a 430 MW campus under development and a potential hyperscaler deal at Polaris Forge 2, gives investors clearer line of sight on contracted usage for assets that are still being built.

How This Fits The Applied Digital Narrative

These moves line up closely with the existing narrative that Applied Digital is trying to become an AI-focused infrastructure landlord, using long-duration contracts with CoreWeave and other hyperscalers to shift the story from speculative build-out to contracted tenancy. The emphasis on faster build times, power access in North Dakota, and large campus-scale projects also mirrors how bullish narratives frame the company as a specialist alternative to vertically integrated hyperscalers.

Risks And Rewards Investors Are Weighing

- ⚠️ High leverage, with debt reported at US$2.6b by November 2025, increases financing risk if projects slip or funding costs rise.

- ⚠️ Heavy reliance on CoreWeave and a small group of large customers creates concentration risk if any contract terms change or construction deadlines are missed.

- 🎁 Long term lease commitments of about US$16b across multiple campuses provide visibility on potential recurring revenue if projects are delivered as agreed.

- 🎁 The bridge financing and PF2 lease trigger tied to 200 MW suggest management sees a clear path to converting another construction site into a contracted, income-producing asset.

What To Watch Next

Looking ahead, the key things to watch are execution milestones at Polaris Forge and Delta Forge 1, the final terms and size of any Polaris Forge 2 hyperscaler lease, and whether Applied Digital can broaden its customer base beyond CoreWeave while keeping debt in check. If you want to see how different investors are interpreting these moves and the long term story, have a look at the community narratives for Applied Digital on this dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal