Assessing Northwest Natural Holding (NWN) Valuation After Steady Share Gains And Premium P/E Multiple

With no single headline event setting the tone, Northwest Natural Holding (NWN) is drawing attention as investors weigh its recent share performance against fundamentals such as revenue, net income and regulatory utility exposure.

See our latest analysis for Northwest Natural Holding.

Recent trading has been relatively steady, with a 7 day share price return of 3.24% and a 1 year total shareholder return of 25.69%, suggesting momentum that has been gradual rather than abrupt. Overall, the stock’s shorter term share price gains sit alongside solid multi year total shareholder returns, hinting at investors steadily reassessing both income potential and perceived risk around its regulated utility profile.

If this kind of steady utilities name has your attention, it could be worth broadening your search with our screener of 24 power grid technology and infrastructure stocks as another way to spot infrastructure linked opportunities.

With shares up over the past year and revenue of US$1,266.082 million alongside net income of US$100.528 million, the key question is whether Northwest Natural Holding is still trading below its potential or if the market is already pricing in future growth.

Most Popular Narrative: 8.9% Undervalued

With Northwest Natural Holding last closing at $48.07 against a most followed fair value estimate of $52.75, the current share price sits below that narrative view and puts the spotlight on what is driving those assumptions.

Ongoing investments in infrastructure modernization and system upgrades, combined with supportive regulatory outcomes (recent rate increase and higher allowed ROE), may affect net margins, operating efficiency, and future earnings reliability.

Curious what sits behind that view on future earnings power? The narrative leans on compounding revenue, firmer margins and a richer earnings multiple to reach its fair value.

Result: Fair Value of $52.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that earnings power story can be challenged if decarbonization policies dampen gas demand or if regulators limit recovery of ongoing infrastructure spending.

Find out about the key risks to this Northwest Natural Holding narrative.

Another View: Earnings Multiple Paints a Different Picture

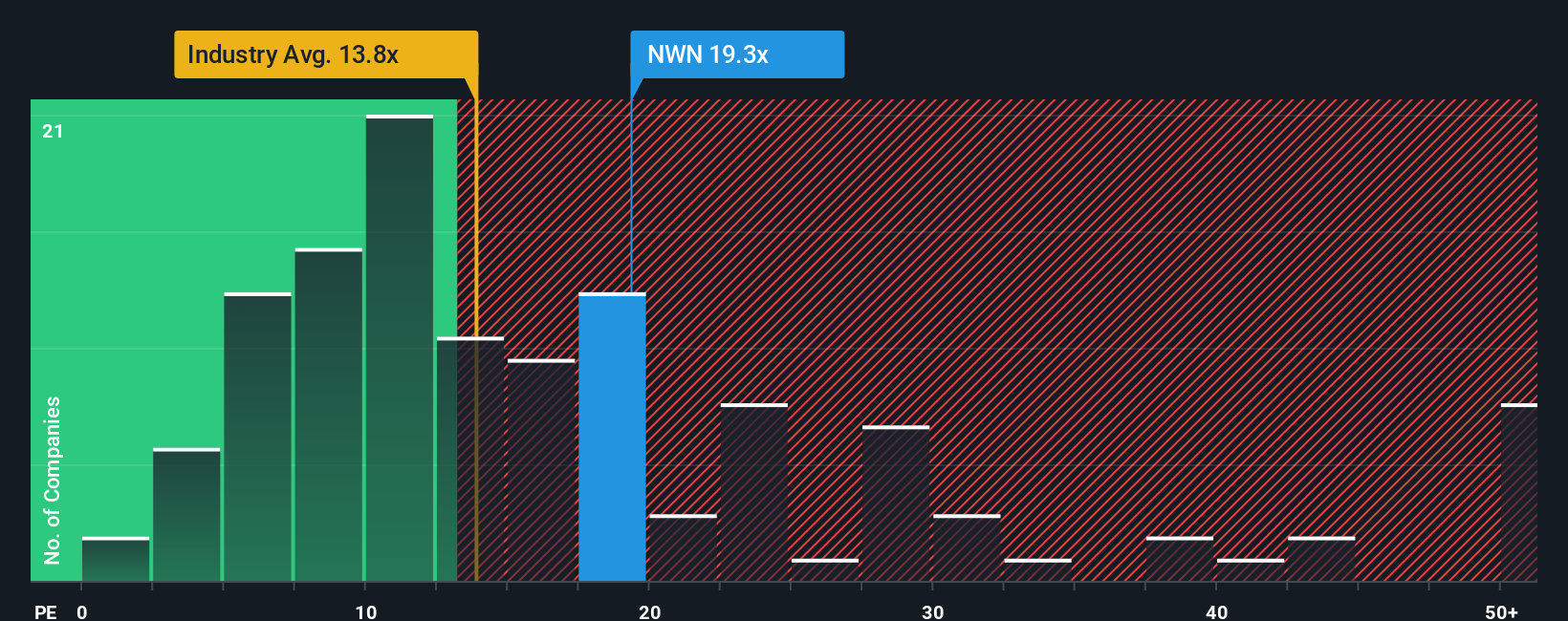

The fair value narrative points to an 8.9% undervaluation, but the current P/E of 19.8x tells a tougher story. That is higher than both the US gas utility peer average of 17.9x and the global gas utilities average of 14.7x, which suggests investors are already paying a premium for Northwest Natural Holding.

With the current P/E also matching the fair ratio of 19.8x, there is less obvious room for the market to re rate the shares higher if those optimistic earnings assumptions do not play out. For you, the key question is whether this premium feels earned or stretched.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northwest Natural Holding Narrative

If you see the numbers differently, or prefer to test the assumptions yourself, you can build your own data-driven view in minutes: Do it your way.

A great starting point for your Northwest Natural Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop at a single utility stock. Use the screener tools to uncover more targeted opportunities.

- Target resilient cash generators by scanning companies with strong fundamentals through our solid balance sheet and fundamentals stocks screener (45 results), and see which names match your quality threshold.

- Hunt for potential value ideas using the 53 high quality undervalued stocks, so you are not relying on a handful of widely followed stocks for future opportunities.

- Strengthen your income watchlist by reviewing our 14 dividend fortresses, and avoid missing companies that currently offer higher yield profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal