Applied Digital Stock: Where It Could Be in 1 Year

Key Points

Applied Digital's strong revenue pipeline and the new data center campus could help it exceed Wall Street's growth expectations.

The stock is expensive right now, but it can justify its valuation given the healthy demand for AI infrastructure.

Applied Digital stock seems poised to jump well above analysts' expectations in the coming year.

Applied Digital (NASDAQ: APLD) is emerging as an important player in the artificial intelligence (AI) infrastructure market, and this explains why investors bought its shares hand over fist in the past year. The share price for this company that designs, builds, and operates dedicated AI data centers shot up a whopping 400% in the past year. This red-hot rally was driven by the lucrative long-term lease contracts that Applied Digital signed with cloud infrastructure providers.

The good news is that analysts expect Applied Digital stock to rise over the next year, too. Let's see how much upside this AI stock might potentially deliver.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images

Applied Digital could easily crush Wall Street's price target

Applied Digital's 12-month median price target of $43.50 suggests potential upside of 18.5% from current levels. All 14 analysts covering Applied Digital rate it as a buy.

That's not surprising, as Applied Digital is poised to win big from the massive spending on AI data centers. The company already signed lease contracts worth $16 billion for 600 megawatts (MW) of AI data center capacity that it is building at two campuses in North Dakota.

Importantly, Applied Digital started recognizing lease revenue from customers, and management anticipates "lease revenues to ramp over the next quarter." That trend should continue for the rest of 2026, as it expects to bring online additional capacity throughout the year. So, it is easy to see why Applied Digital expects "meaningful revenue growth over the coming 18 to 24 months."

What's more, the company recently announced that it broke ground at a 430 MW data center campus in a southern U.S. state. Applied Digital says that it is already in discussions to contract this prospective capacity to an investment-grade hyperscaler. So, Applied Digital is likely to see solid growth beyond 2026.

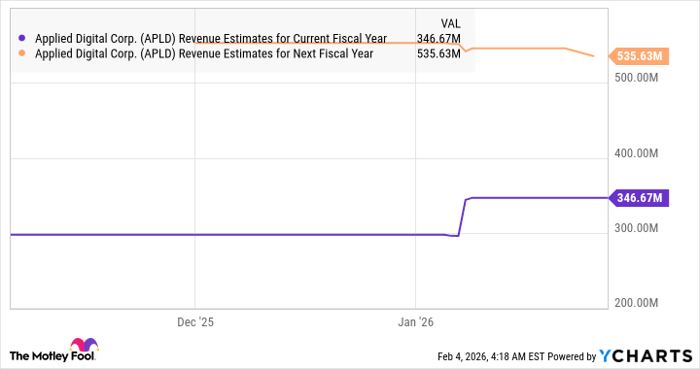

Data by YCharts.

Applied Digital's top line is forecast to jump by 61% in the current fiscal year (which ends on May 31) to $347 million. However, analysts expect a slower top-line increase of 55% next fiscal year. But that's unlikely, since Applied Digital forecasts an acceleration in lease revenue.

Also, the newly announced data center campus discussed above opens the possibility of higher tenant fit-out revenue, which is the money Applied Digital receives for constructing and/or customizing data centers as per tenants' specifications.

Here's how much upside Applied Digital investors can expect

Applied Digital's ability to clock faster growth should pave the way for stronger upside. Assuming its top line jumps by 65% in the next fiscal year, slightly higher than the growth it is expected to deliver in the current one due to the recognition of lease revenue and new tenant fit-out services, its revenue could hit $573 million next year.

The stock trades at 32 times sales right now, which is justified by its terrific revenue pipeline. It can maintain that multiple after a year on the back of its accelerating growth, which would send its market cap to $18.3 billion. That's nearly 80% above the current stock price, suggesting this tech stock could jump impressively.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal