Assessing McKesson (MCK) Valuation After Strong Quarter, Higher Guidance And Business Portfolio Updates

Why McKesson’s latest quarter matters for shareholders

McKesson (MCK) posted double digit revenue and adjusted EPS growth in its latest quarter, raised full year earnings guidance, and updated investors on acquisitions, its European exit, and a future medical surgical IPO.

See our latest analysis for McKesson.

McKesson’s latest earnings beat, higher full year EPS guidance, ongoing share repurchases and an affirmed dividend have coincided with strong momentum, with a 15.1% 30 day share price return and a 59.9% 1 year total shareholder return.

If this healthcare distributor’s run has caught your attention, it could be a good moment to see what else is moving in medical technology and services via our 26 healthcare AI stocks.

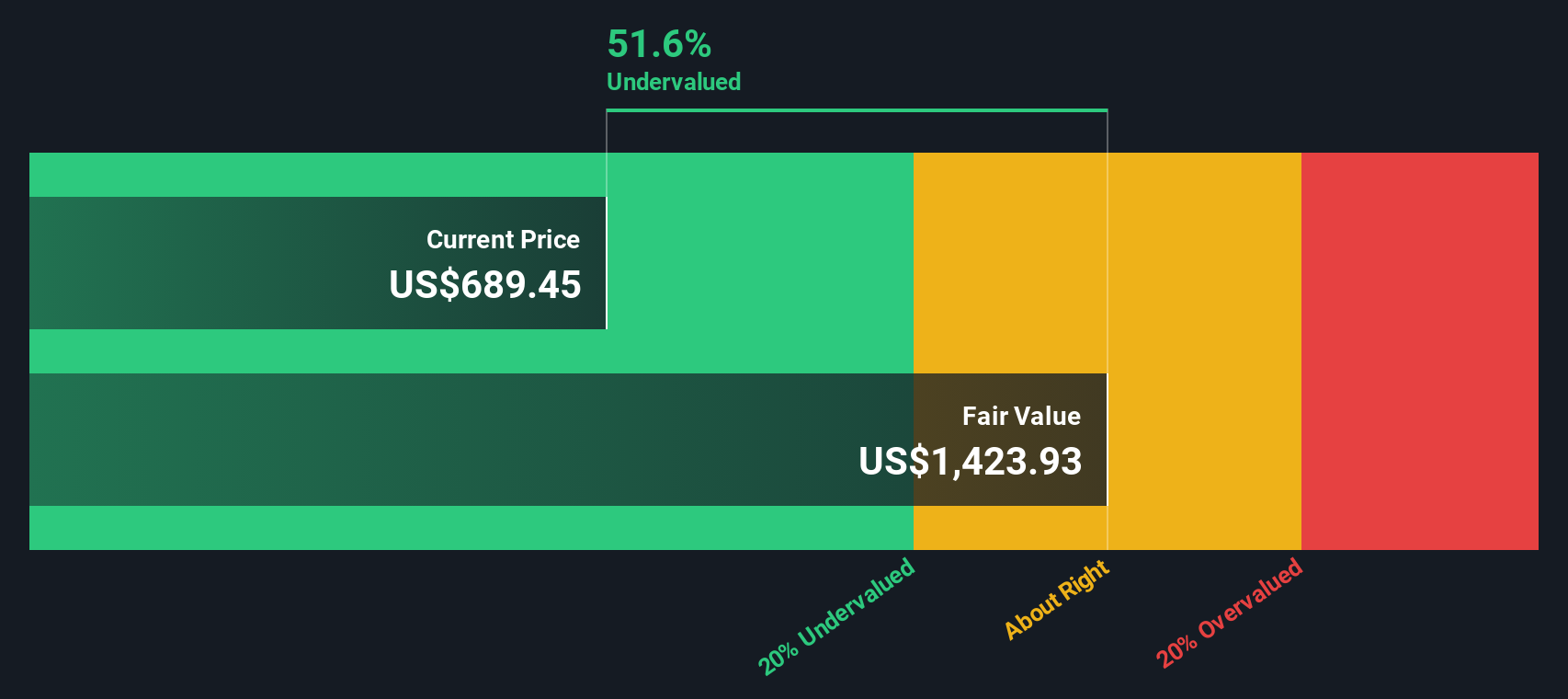

With McKesson trading at $948.68, only about 2% below the average analyst target and flagged with a value score of 4 plus a 35.7% intrinsic discount estimate, you have to ask whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

The most followed narrative puts McKesson’s fair value at $942, slightly below the last close of $948.68, and builds that view around a detailed earnings and margin roadmap.

Increasing adoption of specialty and oncology pharmaceuticals, alongside recent acquisitions (Core Ventures and PRISM Vision) that expand the provider network and service portfolio, are improving revenue mix quality and positioning the company for higher operating margins and earnings growth.

Curious what sits behind that fair value call? The narrative leans on specific revenue growth assumptions, tighter margins, and a future earnings multiple that has to hold up over time.

Result: Fair Value of $942 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still the risk that tighter drug pricing or more aggressive vertical integration by manufacturers and payers could put pressure on McKesson’s margins and revenue base.

Find out about the key risks to this McKesson narrative.

Another take on McKesson’s valuation

The earnings based narrative argues McKesson is about 1% overvalued at $948.68 versus a $942 fair value. Our DCF model points the other way, with an estimate of future cash flow value of $1,475.10, which flags the shares as trading at a 35.7% discount. Which lens do you think fits your expectations better?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own McKesson Narrative

If you are not fully convinced by these views or prefer to test your own assumptions using the same data, you can build a custom McKesson thesis in just a few minutes, starting with Do it your way.

A great starting point for your McKesson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond McKesson?

If you stop with just one company, you could miss stronger fits for your style, so use the screener to quickly surface ideas that match your thinking.

- Target potential mispricings by scanning 53 high quality undervalued stocks that combine solid fundamentals with prices that may not fully reflect their underlying businesses.

- Prioritise resilience by focusing on 86 resilient stocks with low risk scores where balance sheets and risk profiles may better align with a more cautious approach.

- Get ahead of the crowd by checking our screener containing 24 high quality undiscovered gems that the broader market may not be paying close attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal