Triumph Financial Deepens Freight Ties While Tightening Factoring Margins

- Triumph Financial (NYSE:TFIN) has expanded its payments network to include eight of the ten largest U.S. freight logistics firms.

- The company recently added JB Hunt to its roster of logistics partners, broadening its reach in freight payments.

- Alongside the network expansion, Triumph Financial is rolling out automation and workforce reductions in its factoring segment to support margin improvements.

- These moves come as the trucking sector continues to face industry headwinds.

Triumph Financial, through its freight-focused payments and factoring operations, sits close to the daily cash flow needs of trucking companies and logistics providers. With eight of the ten largest U.S. freight logistics firms now on its payments network, including JB Hunt, the company is tying its platform more tightly to large freight volumes. For investors, this speaks directly to how integrated NYSE:TFIN is becoming within core freight workflows.

At the same time, Triumph Financial is pushing automation and adjusting headcount in its factoring business to support margins during a challenging period for the trucking sector. As these changes play out, you may want to watch how volumes, operating efficiency, and partner adoption across the expanded network evolve over coming periods.

Stay updated on the most important news stories for Triumph Financial by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Triumph Financial.

How Triumph Financial stacks up against its biggest competitors

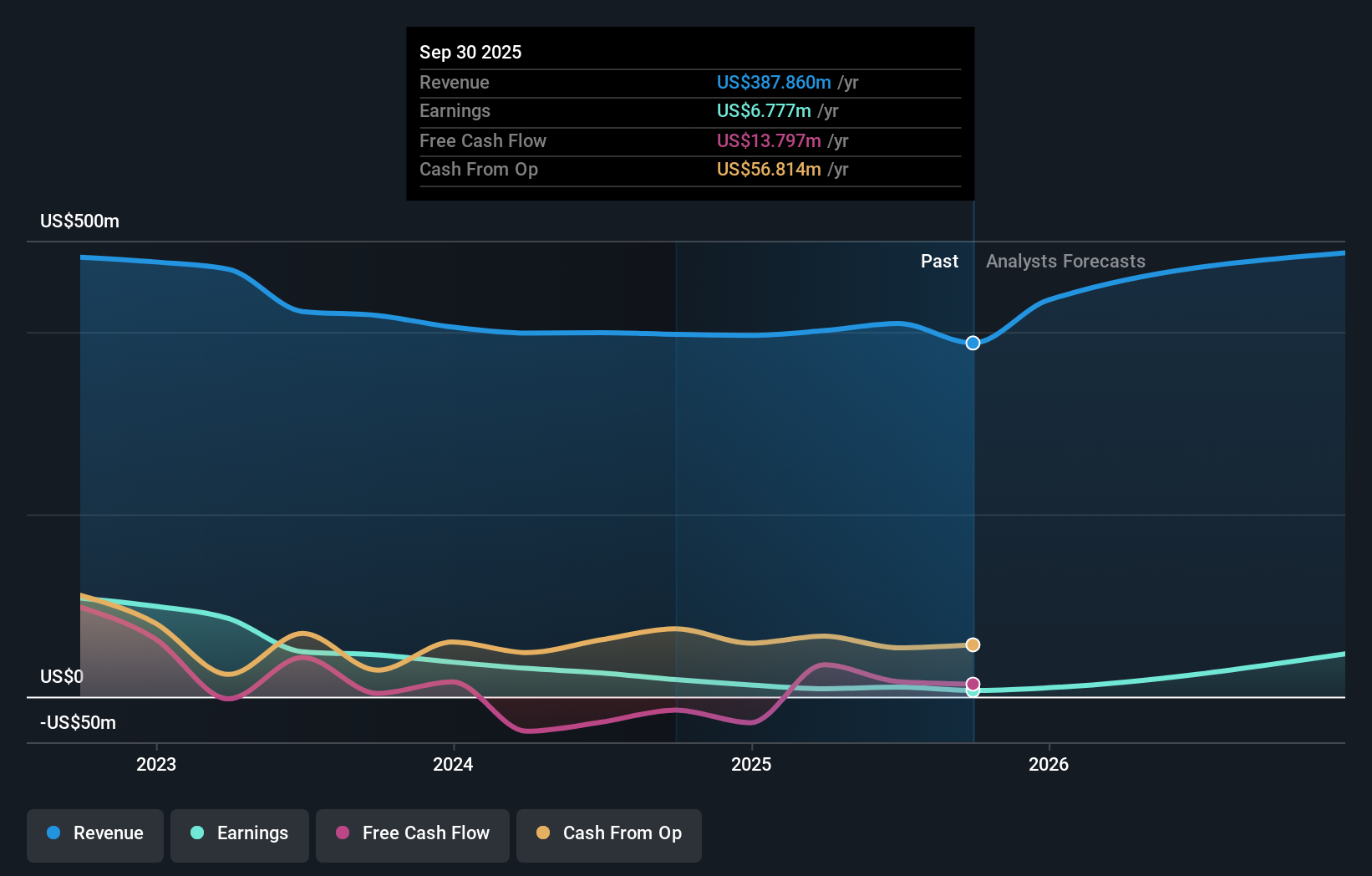

For Triumph Financial, bringing JB Hunt and other large freight brokers onto its payments network strengthens its position as a core transaction hub in U.S. trucking, in a space that also includes players like US Bank Freight Payment and fintech-focused providers such as WEX. Tying more freight volume to TriumphPay while trimming costs in factoring points to a mix of scale and efficiency that aligns with the company’s recent full year results, where net interest income was roughly flat at US$350.59m but net income and earnings per share from continuing operations moved higher year on year.

How This Fits The Triumph Financial Narrative

This news sits neatly with the existing Triumph Financial narrative that centers on data driven freight payments, automation, and higher-margin, fee-based income. The expansion to eight of the ten largest freight logistics firms supports the idea of growing network effects in payments, while the focus on automation and lean operations echoes the narrative’s emphasis on cost discipline and the push toward stronger operating margins in the core payments business.

Risks And Rewards Investors Should Weigh

- Deeper integration with major brokers such as JB Hunt can increase transaction volumes and make the payments platform more valuable to carriers and shippers.

- Margin-focused moves in factoring through automation and workforce changes support the company’s effort to translate revenue into higher profitability.

- Heavy exposure to trucking and freight means results can still be sensitive to freight cycle weakness, even with a larger, more diversified broker network.

- Cost cuts and automation in factoring may carry execution risk if service quality or client relationships are affected during the transition.

What To Watch Next

From here, it is worth keeping an eye on how quickly Triumph converts its broader broker roster into higher payment volumes, stronger EBITDA margins in its payments arm, and steadier earnings alongside sector headwinds that have already weighed on the share price after recent revenue and tangible book value misses. If you want to see how other investors are thinking about these developments and how they tie into Triumph’s longer term freight finance story, take a look at the community narratives for Triumph Financial on this dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal