Assessing State Street’s Valuation After Vision 2030 Progress And Abu Dhabi Expansion News

Why the latest Abu Dhabi move matters for State Street

State Street (STT) has agreed with the Abu Dhabi Investment Office to build a new operating center in Al Ain, adding more than 300 financial services roles and deepening its presence in the UAE.

For you as an investor, this is part of a broader effort that combines international expansion, product growth in areas like private credit ETFs, and management’s longer term Vision 2030 plan for the business.

See our latest analysis for State Street.

At a share price of $132.35, State Street has seen a 2.83% 1 day share price return and an 11.87% 90 day share price return. Its 1 year total shareholder return of 37.08% points to momentum that investors are already rewarding as new ETFs, fee growth and the Abu Dhabi expansion shape expectations around growth and risk.

If this Abu Dhabi expansion has you thinking about other long term stories in financial services, it could be a good time to broaden your search with 22 top founder-led companies.

With State Street trading at $132.35, sitting about 8% below the average analyst target and an estimated 22% below one intrinsic value estimate, you have to ask: is there still upside here, or is future growth already priced in?

Most Popular Narrative: 2% Overvalued

With State Street at $132.35 versus a narrative fair value of about $130, the current price sits slightly above what that widely followed view suggests, which raises the question of what is driving the premium.

The acceleration of passive and ETF investing continues to benefit State Street's leading SPDR ETF franchise, as evidenced by significant inflows, expanding market share in low-cost products, and record trading volumes, which are expected to drive increased recurring management fees and higher operating margins over time.

Read the complete narrative. Read the complete narrative.

Want to see what is baked into that fair value? The narrative leans on steady revenue gains, higher profit margins, and a lower future earnings multiple than many peers. Curious how those pieces fit together into $130 per share?

Result: Fair Value of $130 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on State Street keeping pace with fast-moving fintech platforms and managing fee pressure in ETFs, where lower pricing could squeeze margins.

Find out about the key risks to this State Street narrative.

Another angle on valuation

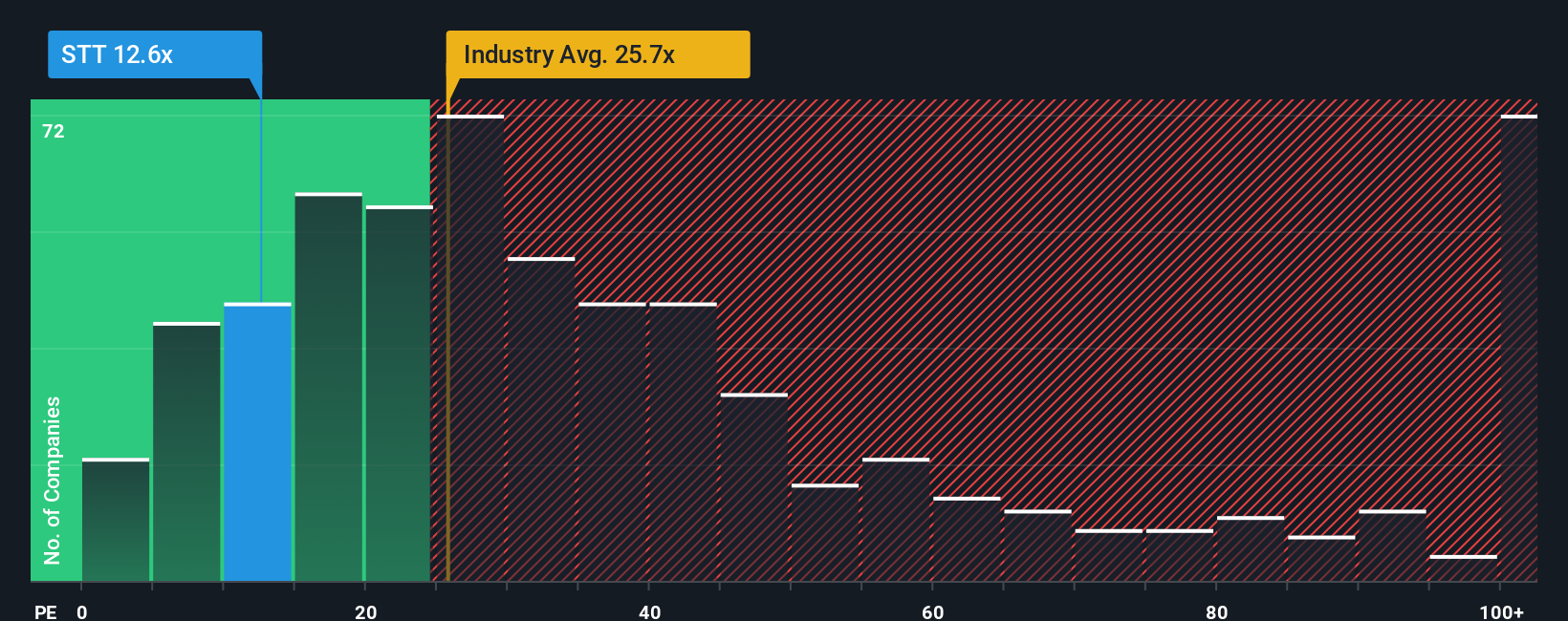

The narrative fair value of about $130 suggests State Street is slightly overvalued at $132.35. Yet on P/E, it looks different. The shares trade on 13.6x earnings, compared with 22.9x for the US Capital Markets industry and a fair ratio of 17.1x. That gap points to possible valuation tension rather than a clear verdict. The key question is which signal to weigh more heavily.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own State Street Narrative

If you see the numbers differently or want to stress test your own view on State Street, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your State Street research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If State Street is on your radar, do not stop there. Use the Simply Wall Street Screener to spot other opportunities before they slip past you.

- Target potential value opportunities by scanning our list of 53 high quality undervalued stocks that currently show strong fundamentals and appealing pricing signals.

- Prioritise resilience by focusing on companies in the 85 resilient stocks with low risk scores that score well on risk factors and financial robustness.

- Stay ahead of the crowd by checking the screener containing 25 high quality undiscovered gems that have quality metrics but are still flying under most investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal