A Look At Lennar (LEN) Valuation As Rent To Own Housing Proposal Draws Investor Attention

Lennar (LEN) is back in the spotlight after reports tied the homebuilder to a proposed rent to own housing initiative that could involve up to one million entry level homes and large private investment.

See our latest analysis for Lennar.

The rent to own proposal and Lennar’s new Dry Canyon community arrive as the 1 month share price return of 8.47% and 7 day gain of 3.72% contrast with a 90 day share price decline of 5.08%. At the same time, the 5 year total shareholder return of 42.12% points to a stronger long run picture than the 1 year total shareholder return decline of 7.72%, suggesting sentiment has recently firmed but remains tested over the past year.

If housing themed headlines have you looking wider than a single builder, this is a good moment to scout 22 top founder-led companies as potential additions to your watchlist.

With Lennar trading around $115.37, modest annual revenue and net income growth, and a value score of 1, the key question is whether current optimism leaves upside on the table or if markets are already pricing in future growth.

Most Popular Narrative: 29% Undervalued

Compared with Lennar’s last close at $115.37, the most followed narrative pegs fair value at $162.49, a sizeable gap that centers on earnings power and margins.

However despite the short-term spike in months' supply, the U.S. still faces a structural housing shortfall of 3 to 5 million units, as estimated by entities like Freddie Mac. This reflects years of underbuilding relative to population growth, particularly in high-demand metro areas, giving affordable home builders like Lennar plenty of room to grow with excellent catalysts such as strong population growth and housing demand in the Sun Belt.

Want to see what kind of revenue climb, profit margins, and future P/E this narrative is baking in? The full write up, built by Zev, connects those housing supply numbers to a detailed earnings path and a profit profile usually linked with higher growth sectors. The assumptions behind that are surprisingly specific, and they are what drives the $162.49 fair value call.

Result: Fair Value of $162.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could be challenged if mortgage rates stay elevated longer than expected or if housing policies and political outcomes differ from what Zev is assuming.

Find out about the key risks to this Lennar narrative.

Another View: Multiples Put The Brakes On

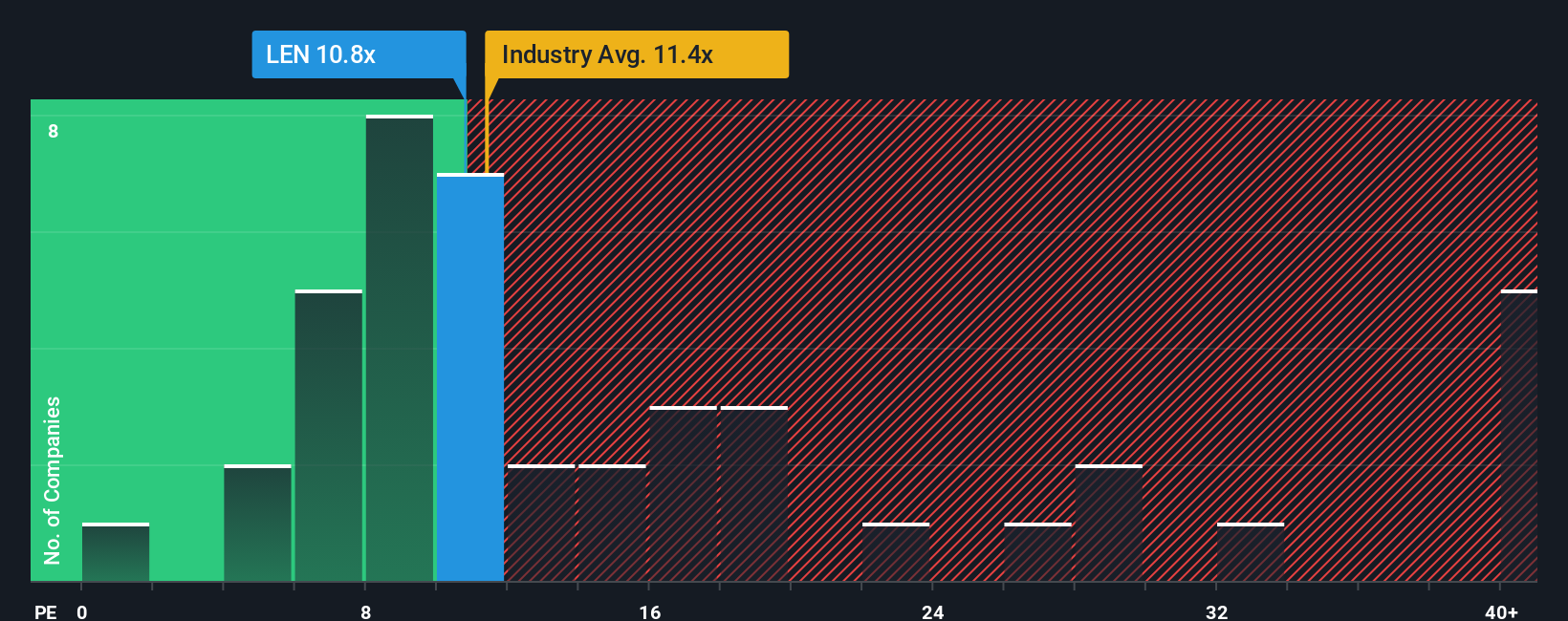

While the most popular narrative sees Lennar as 29% undervalued with a fair value of $162.49, the current P/E of 13.8x tells a cooler story. It sits above both the Consumer Durables industry at 12.5x and the peer average at 13.2x, even though the fair ratio is 17.7x.

That mix of slightly richer pricing than peers, yet still below the fair ratio the market could move toward, creates a more balanced picture with less obvious room for mispricing in either direction. For you, the key question is whether that premium seems justified by the business quality and earnings outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lennar Narrative

If parts of this do not line up with your view, or you would rather weigh the numbers yourself, you can build a tailored Lennar story in just a few minutes, starting with Do it your way.

A great starting point for your Lennar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Lennar has sharpened your interest, do not stop here. The same toolkit can quickly surface other companies that might fit even better with your goals.

- Hunt for quality at a discount by scanning our list of 55 high quality undervalued stocks that pair fundamentals with pricing many investors may be overlooking.

- Lock in income potential by reviewing 15 dividend fortresses that focus on companies offering higher yields with an eye on durability.

- Dial down portfolio stress by checking 81 resilient stocks with low risk scores that aim to keep volatility and red flags in check.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal