AbbVie (ABBV) One Off US$5.0b Loss Tests Bullish High P/E Valuation Narratives

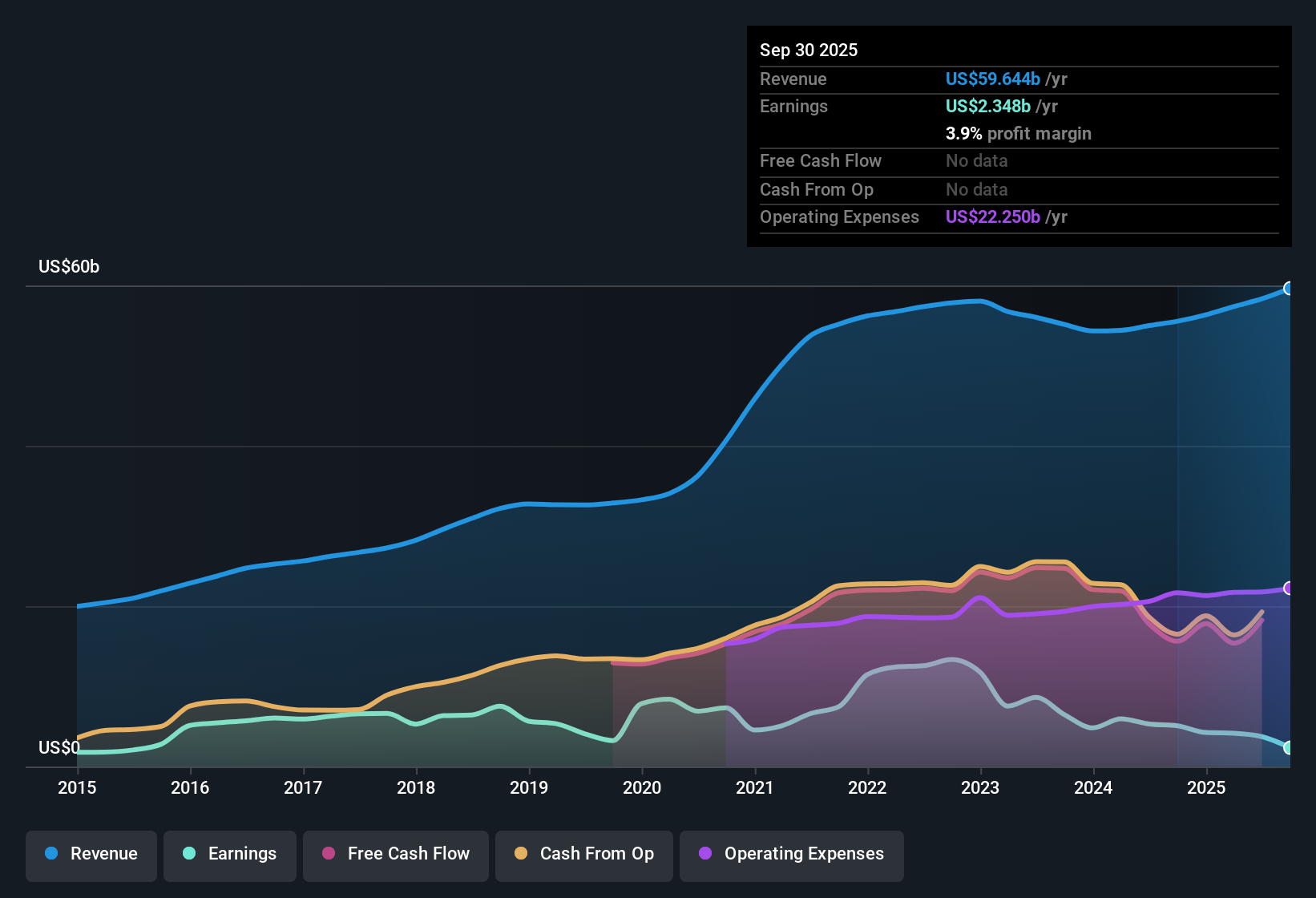

AbbVie (ABBV) has wrapped up FY 2025 with fourth quarter revenue of US$16.6 billion and basic EPS of US$1.02, setting the tone for a year where trailing twelve month revenue reached US$61.2 billion alongside EPS of US$2.38. The company has seen revenue move from US$56.3 billion to US$61.2 billion on a trailing basis, while trailing EPS shifted from US$2.40 to US$2.38, giving investors a clear read on the top line against more compressed profitability. With a trailing net profit margin of 6.9% and a large one off loss weighing on the past year, the story for investors is less about headline growth and more about how durable those margins prove to be.

See our full analysis for AbbVie.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the widely followed narratives around AbbVie's valuation, growth potential and risk profile.

Curious how numbers become stories that shape markets? Explore Community Narratives

US$61.2b in sales, but 6.9% margin keeps profit tight

- On a trailing basis AbbVie generated US$61.2b in revenue with US$4.2b in net income, which works out to a 6.9% net profit margin compared with 7.5% a year earlier in the data.

- What stands out for a bullish view that focuses on AbbVie as a large, diversified pharma group is that this US$61.2b revenue base is spread across multiple areas like immunology, oncology and neuroscience. However, the 6.9% margin and five year earnings decline of 16.3% a year mean the size of the business has not automatically translated into stronger profitability.

- Bulls often highlight breadth of the drug portfolio as a stabilizer, but the margin slip from 7.5% to 6.9% shows that even with scale, profit can still be pressured by factors like pricing and costs.

- Supporters may also point to the company’s role in high value disease areas, while the earnings decline rate in the data keeps the spotlight on how efficiently that portfolio converts into bottom line results.

One off US$5.0b loss and a high 91.6x P/E

- The trailing 12 month figures include a US$5.0b one off loss and, on top of that, the shares are priced at a 91.6x P/E versus 24.4x for peers and 19.7x for the US biotechs industry in the dataset.

- Critics who take a more bearish stance focus on this combination of a large one time loss and a very high P/E, and the data gives them several concrete pressure points to refer to.

- They can highlight that earnings over the last five years declined at 16.3% a year while the dividend yield of 3.16% is flagged as not well covered by current earnings, which keeps questions around payout sustainability on the table.

- They can also point to the elevated leverage noted in the risk summary, arguing that high valuation multiples and thinner coverage for dividends leave less room for comfort if profitability stays close to the current 6.9% margin.

DCF fair value at US$374.18 vs US$219.02 price

- The analysis data shows a DCF fair value of US$374.18 per share compared with a current share price of US$219.02, indicating the price sits about 41.5% below that DCF estimate while revenue is forecast to grow 6.2% a year and earnings 23.6% a year in the dataset.

- Supporters with a bullish tilt lean heavily on this gap between the DCF fair value and the current price, and the growth forecasts in the data give them more to work with even after the recent hit to profitability.

- They can argue that if earnings do grow at around 23.6% a year on top of 6.2% revenue growth, the current 6.9% net margin and compressed EPS of US$2.38 over the last twelve months could improve off a reset base that was pulled down by the US$5.0b one off loss.

- They may also point out that the DCF fair value of US$374.18 already factors in those forecast growth rates, so the current US$219.02 price in the data leaves room for sentiment to adjust if reported results begin to more closely track those expectations.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AbbVie's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

AbbVie is working with a tight 6.9% net margin, a US$5.0b one off loss, a 91.6x P/E and an earnings decline in the data.

If those pressure points make you cautious about paying up for this kind of risk and earnings profile, you might want to compare it with 81 resilient stocks with low risk scores that focus on more resilient balance sheets and steadier fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal