A Look At Cadence Design Systems (CDNS) Valuation After The Recent Software Sector Sell Off

Cadence Design Systems (CDNS) has drawn fresh investor attention after a broad software sector sell off, where its shares dropped alongside peers as markets reassessed how AI is reshaping competitive positioning.

See our latest analysis for Cadence Design Systems.

That sector-wide reset has left Cadence with a 7 day share price return of 10.75% and a 30 day share price return of 14.14%. The 1 year total shareholder return of 10.82% contrasts with a 3 year total shareholder return of 45.03% and a 5 year total shareholder return of 87.64%, which suggests that recent momentum has cooled compared with its longer run record.

If AI infrastructure is where your attention is right now, it could be worth scanning our list of 33 AI infrastructure stocks as a way to spot other potential ideas in this space.

After a sharp pullback, Cadence now trades at US$270.14 with mixed signals from brokers and an intrinsic value estimate that sits close to the current price. So is this weakness a genuine opening, or is the market already baking in future growth?

Most Popular Narrative: 29.7% Undervalued

The most followed narrative pegs Cadence Design Systems' fair value at $384.20, well above the last close of $270.14. This sets up a clear valuation gap for investors to evaluate.

The expanding partnership with major industry players like NVIDIA and Intel, including initiatives such as 3D-IC and data center digital twins, positions Cadence for future competitive advantages and new revenue streams.

Cadence's ongoing share buyback program, using at least 50% of their annual free cash flow, is expected to enhance earnings per share (EPS) by reducing the share count over time.

Want to see what sits behind that higher fair value and the confidence in long term earnings power? The narrative leans heavily on compounding revenue growth, rising margins and a future earnings multiple that assumes Cadence keeps its edge in high performance chip design. Curious which specific growth, profitability and valuation assumptions have been stitched together to justify that price?

Result: Fair Value of $384.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if geopolitical tensions affect Cadence’s exposure to China or if key AI partnerships and acquisitions do not deliver as expected.

Find out about the key risks to this Cadence Design Systems narrative.

Another View: Earnings Multiple Tells A Different Story

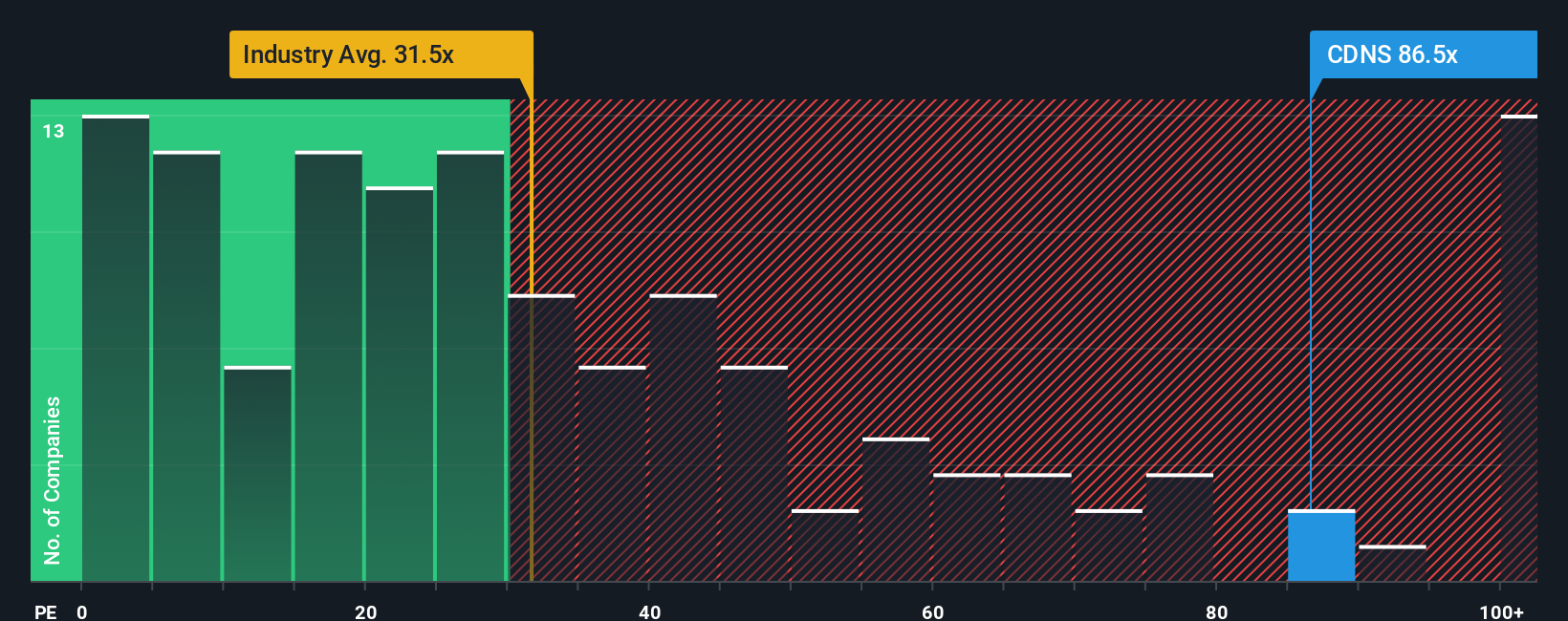

While the popular narrative sees Cadence as 29.7% undervalued, the current P/E of 69.3x paints a tougher picture. That is far above the US Software industry at 25.7x, peers at 46.2x and a fair ratio of 35.9x. This points to meaningful valuation risk if sentiment cools.

Numbers like that can be hard to square with any thesis. It is worth asking which you trust more: the upbeat growth narrative or a market multiple that already prices in a lot of good news. See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Design Systems Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom Cadence story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cadence Design Systems.

Ready to hunt for your next opportunity?

If Cadence has sharpened your thinking, do not stop here. Put that momentum to work by lining up fresh ideas that match your goals today.

- Target value first by reviewing companies our screener flags as 55 high quality undervalued stocks, where quality and price may be better aligned with what you want to pay.

- Prioritize resilience by scanning our 81 resilient stocks with low risk scores, built to highlight businesses with characteristics that may help reduce portfolio volatility.

- Get ahead of the crowd by checking our screener containing 25 high quality undiscovered gems, focused on companies that have strong fundamentals yet are still flying under many investors' radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal