After Leaping 27% Lumentum Holdings Inc. (NASDAQ:LITE) Shares Are Not Flying Under The Radar

Lumentum Holdings Inc. (NASDAQ:LITE) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days were the cherry on top of the stock's 444% gain in the last year, which is nothing short of spectacular.

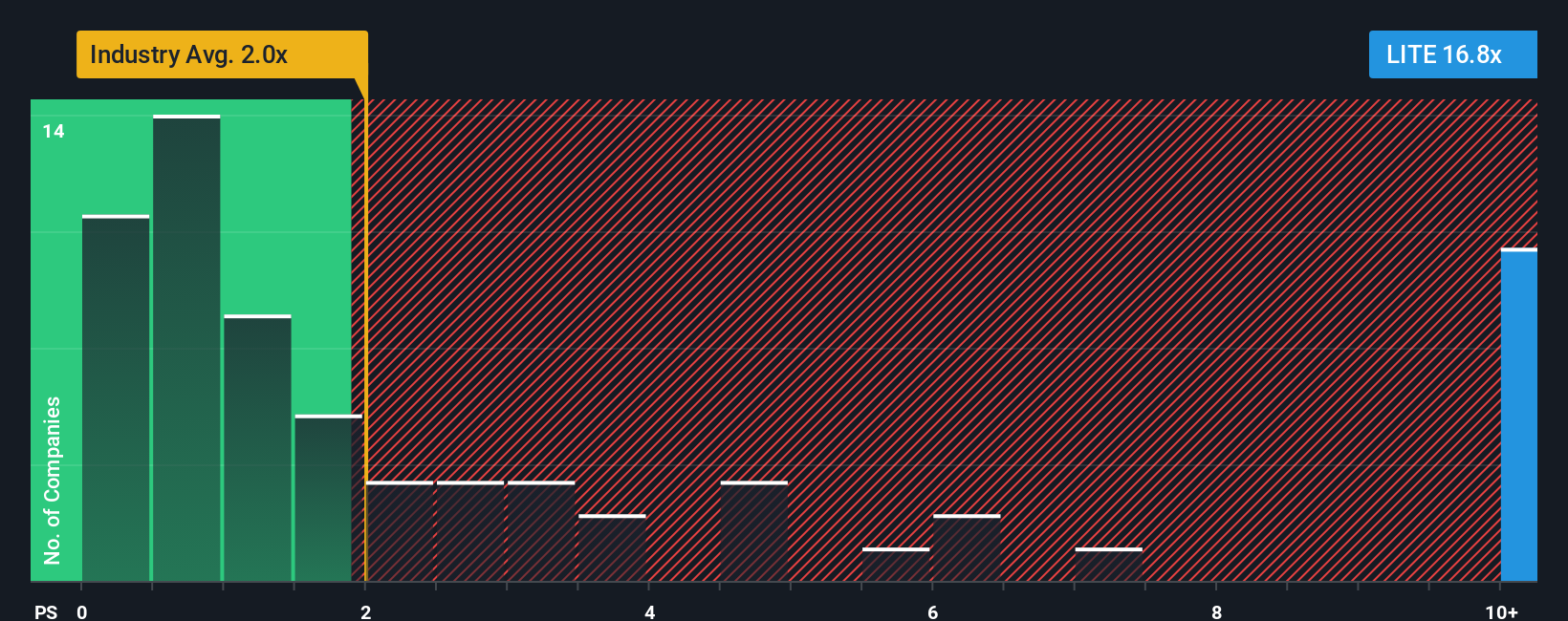

After such a large jump in price, given around half the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Lumentum Holdings as a stock to avoid entirely with its 17.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Lumentum Holdings

How Lumentum Holdings Has Been Performing

Lumentum Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Lumentum Holdings will help you uncover what's on the horizon.How Is Lumentum Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Lumentum Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. As a result, it also grew revenue by 15% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 76% during the coming year according to the analysts following the company. That's shaping up to be materially higher than the 18% growth forecast for the broader industry.

In light of this, it's understandable that Lumentum Holdings' P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to Lumentum Holdings' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Lumentum Holdings maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Communications industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 4 warning signs for Lumentum Holdings you should be aware of, and 1 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal