Assessing Advanced Energy Industries (AEIS) Valuation After Strong Recent Share Price Momentum

Advanced Energy Industries: Event Context and Recent Share Performance

Advanced Energy Industries (AEIS) has been drawing investor interest recently, supported by its role in precision power solutions for semiconductor and industrial applications, and a share price that closed at US$257.64.

The stock shows a 1 day return of 1.2%, with a 7 day decline of 4.3%, and gains of 12.2% over the past month and 18.9% over the past 3 months, highlighting mixed short term momentum.

See our latest analysis for Advanced Energy Industries.

That recent 1 month share price return of 12.2% and 3 month share price return of 18.9%, alongside a 1 year total shareholder return of 128.4%, suggests momentum has been firming over both shorter and longer periods.

If AEIS has caught your eye, this could be a good moment to see what else is moving in related areas. You can start with our screener of 33 AI infrastructure stocks.

With the shares at US$257.64, a 1 year total return above 100%, and the price now close to the US$263 analyst target, the key question is simple: is there still a potential entry point here, or is the market already pricing in future growth?

Most Popular Narrative: 2% Undervalued

Advanced Energy Industries' most followed narrative sets a fair value of $263, slightly above the last close at $257.64, which puts the current price almost in line with those assumptions.

Recent research points to a more constructive setup for Advanced Energy Industries, with several price target increases and at least one rating upgrade helping to reset expectations for revenue, margins, and P/E assumptions linked to semiconductor and datacenter exposure.

Curious what justifies that higher fair value mark so close to today’s price? The narrative leans on faster earnings expansion, richer margins, and a valuation multiple usually reserved for market leaders. The full story ties those pieces together in a way the current share price alone does not show.

Result: Fair Value of $263 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still meaningful execution risk here, particularly if hyperscale or semiconductor spending slows or if tariff pressures keep chipping away at margins.

Find out about the key risks to this Advanced Energy Industries narrative.

Another View: Earnings Multiple Paints a Tougher Picture

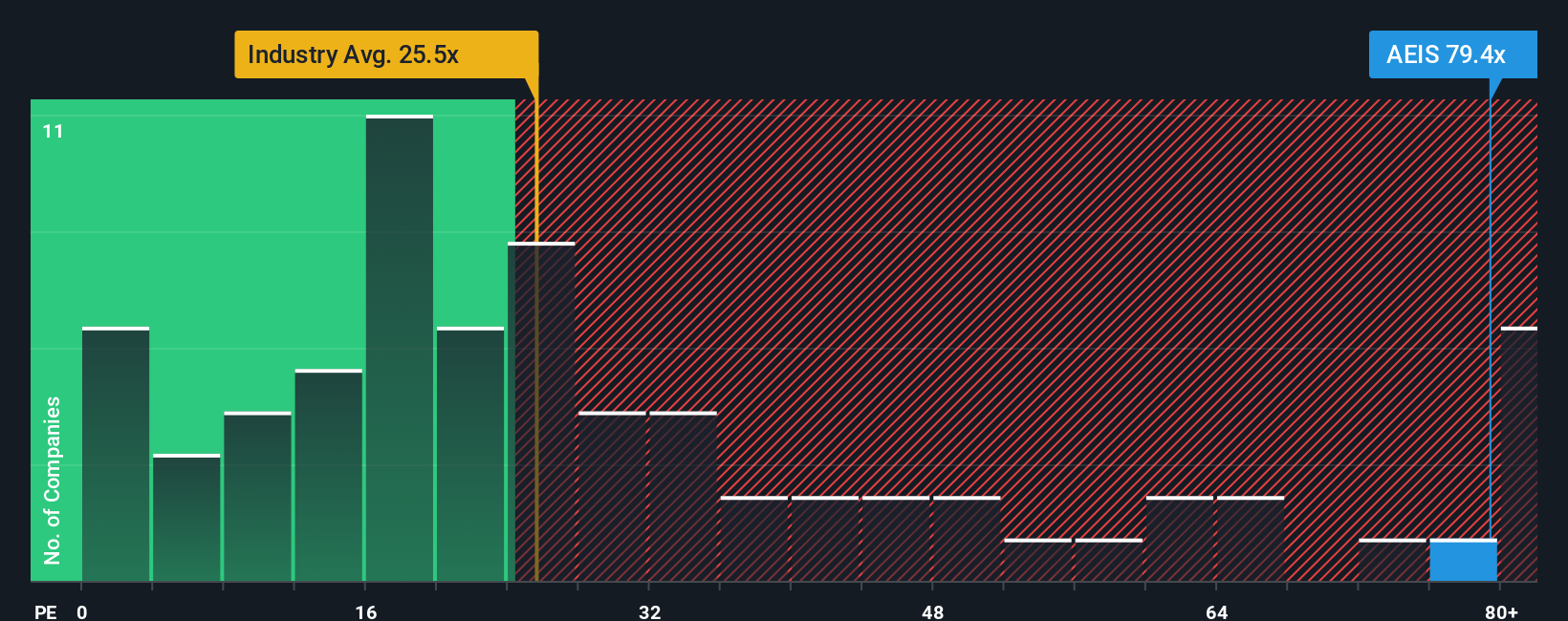

That 2% undervaluation story sits uncomfortably next to AEIS trading on a P/E of 66.7x. Peers average 23.7x, the US Electronic industry sits at 27.1x, and the fair ratio is 42.1x. This hints at valuation risk if sentiment cools. Which picture do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Energy Industries Narrative

If you look at these numbers and reach a different conclusion, or prefer to trust your own work, you can build a fresh narrative in a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Energy Industries.

Looking for more investment ideas?

If AEIS sits on your watchlist, do not stop there; broaden your opportunity set now and let the numbers point you toward your next move.

- Scan for value opportunities by checking companies our screener flags as 55 high quality undervalued stocks with solid fundamentals backing up their current pricing.

- Focus on consistency and resilience by targeting businesses highlighted in our 81 resilient stocks with low risk scores that score well on stability and risk metrics.

- Spot tomorrow's potential standouts early by reviewing the screener containing 25 high quality undiscovered gems that the market may not be paying close attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal