Toll Brothers (TOL) Valuation Check After New Luxury Community Launches Across Key US Markets

Toll Brothers (TOL) has been busy, rolling out and planning new luxury communities across Florida, California, Nevada, Georgia, Pennsylvania, Michigan, New York, Texas, and more. This burst of development helps frame how investors might think about the stock today.

See our latest analysis for Toll Brothers.

The recent string of community launches across Florida, California, Nevada, Georgia, Pennsylvania, Michigan, New York, Texas, and New Jersey has come alongside a 30 day share price return of 10.66% and a 1 year total shareholder return of 14.23%. The 3 year total shareholder return of 165.34% points to strong longer term momentum off a higher base.

If you are looking beyond homebuilders for what is gaining attention right now, this could be a good moment to see what stands out in our screener of 22 top founder-led companies.

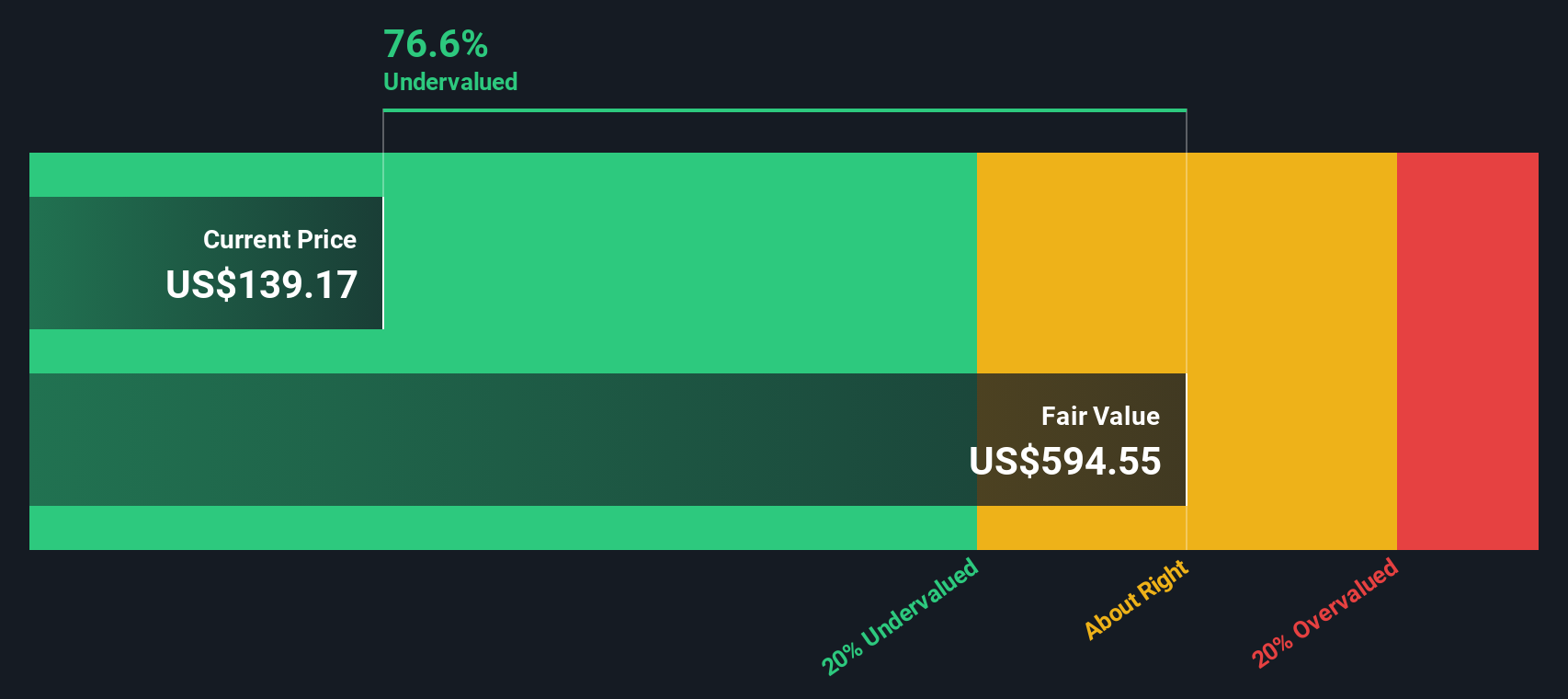

With Toll Brothers trading at US$150.60 versus an average analyst price target of US$154.13 and an intrinsic value estimate that sits above the current price, you have to ask whether there is still a margin of safety here or if the market is already pricing in future growth.

Most Popular Narrative: 2.3% Undervalued

With Toll Brothers last closing at $150.60 against a most followed fair value estimate of about $154.13, the current share price sits just below that narrative line in the sand, which puts more focus on the assumptions behind it than on a big valuation gap.

Demographic tailwinds from affluent Millennials and Gen Z entering peak homebuying years, combined with persistent housing shortages, are creating pent up demand for larger, luxury homes, a core Toll Brothers offering that supports sustained high average selling prices, revenue growth, and pricing power.

Want to see what this narrative is really baking in? The story leans on steady revenue growth, firm margins, and a future earnings multiple that steps down from today. Curious how those pieces fit together into that fair value line?

Result: Fair Value of $154.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if reliance on speculative builds and rising incentives starts to bite into margins and weaken demand for Toll Brothers’ luxury focus.

Find out about the key risks to this Toll Brothers narrative.

Another Angle On Value

That 2.3% “undervalued” narrative is based on future earnings and a fair value line of $154.13, but our SWS DCF model actually points the other way, with an estimate of $131.20 that implies Toll Brothers is trading above its future cash flow value.

This clash between an earnings based fair value and a cash flow based fair value raises a simple question for you: which story do you trust more, the cash the business is modeled to generate, or the earnings and multiples analysts are comfortable underwriting today?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toll Brothers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toll Brothers Narrative

If this version of the story does not quite fit how you see Toll Brothers, you can review the numbers yourself and form your own view in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Toll Brothers.

Looking for more investment ideas?

If you are weighing up what to do next after looking at Toll Brothers, it is worth lining up a few more candidates before you make a move.

- Target reliable income by scanning our list of 15 dividend fortresses, which focuses on sustained payouts rather than short lived yield spikes.

- Hunt for value by running through 55 high quality undervalued stocks, where pricing and fundamentals are filtered to spotlight potential mispriced opportunities.

- Prioritise resilience by checking 81 resilient stocks with low risk scores, designed to surface companies with lower risk scores that may help steady an otherwise volatile portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal